by Karen Schenone, CFA, Blackrock

Defined-maturity bond ETFs can vastly simplify the task of laddering high-yield bonds. Karen explains.

Bond laddering is a popular strategy among investors seeking steady returns and income, particularly when interest rate conditions are uncertain. As I’ve written about elsewhere, laddering is the practice of buying bonds that mature in consecutive calendar years, and then reinvesting the proceeds from maturing principal into new bonds that extend the ladder out another year.

Defined-maturity bond exchange traded funds (ETFs), such as iShares iBonds® ETFs, make building bond ladders more efficient by combining the control of investing in individual bonds with the convenience and diversification of an ETF. For example, an investor could build a five-year ladder by purchasing five defined-maturity ETFs, thereby gaining exposure to hundreds of underlying bonds with known maturity dates, monthly income stream potential, and an overall experience that’s vastly simpler than do-it-yourself.

Reaching higher

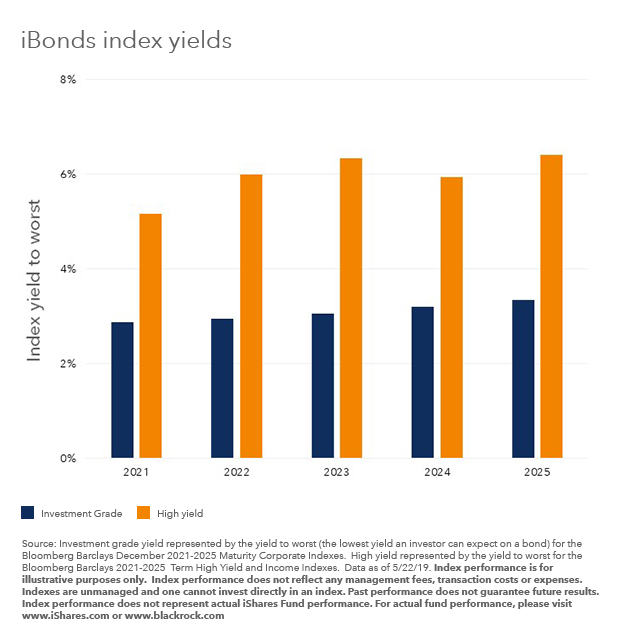

Most investors choose to ladder municipal and investment-grade corporate bonds, but some might want more income than these bonds currently yield, as shown in the chart here.

There are some important differences between investment-grade and high-yield bonds to note, however. For one, security selection becomes even more important for a high-yield bond ladder, since these bonds have higher credit or default risk than investment-grade securities. Also, more than 80%1 of the high-yield bond market is callable, meaning the money can be returned early by the issuer. If a bond gets called early, investors will have to reinvest the money in another bond, potentially at a different interest rate; that uncertainty can make it difficult to maintain a steady cash flow and specific maturities as they move “up the ladder.”

That’s where defined-maturity bond ETFs can be a game changer.

How high-yield iBonds ETFs work

The iShares iBonds 2021-2025 Term High Yield and Income ETFs invest primarily in high-yield corporate bonds. The funds have several important features:

- They have the flexibility to include BBB-rated bonds if certain market conditions are met. Because these investment-grade bonds are much less likely to get called, adding them would help the fund to mature at a set date, should the high yield bonds get called.

- To help cushion the funds against defaults, bonds are removed when the dollar price of the bonds falls below $60, or into distressed territory. (Remember, bonds are $100 at par.)

Add it all up and investors have a vehicle to build ladders with greater income potential, diversification and the simplicity of an ETF.

Karen Schenone, CFA, is a Fixed Income Product Strategist within BlackRock’s Global Fixed Income Group and a regular contributor to The Blog.

Source:

1. Source: Bloomberg Barclays, based on the Bloomberg Barclays US High Yield Bond Index as of 4/30/19

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

When comparing stocks or bonds and iShares Funds, it should be remembered that management fees associated with fund investments, like iShares Funds, are not borne by investors in individual stocks or bonds. Buying and selling shares of iShares Funds will result in brokerage commissions.

The iShares® iBonds® ETFs (“Funds”) will terminate on or about March 31 or December 15 of the year in each Fund’s name. An investment in the Fund(s) is not guaranteed, and an investor may experience losses, including near or at the termination date. Unlike a direct investment in a bond that has a level coupon payment and a fixed payment at maturity, the Fund(s) will make distributions of income that vary over time. In the final months of each Fund’s operation, as the bonds it holds mature, its portfolio will transition to cash and cash-like instruments. As a result, its yield will tend to move toward prevailing money market rates, and may be lower than the yields of the bonds previously held by the Fund and lower than prevailing yields in the bond market. As the Fund approaches its termination date, its holdings of money market or similar funds may increase, causing the Fund to incur the fees and expenses of these funds.

Following the Fund’s termination date, the Fund will distribute substantially all of its net assets, after deduction of any liabilities, to then-current investors without further notice and will no longer be listed or traded. The Funds’ distributions and liquidation proceeds are not predictable at the time of investment and the Funds do not seek to return any predetermined amount.

The rate of Fund distribution payments may adversely affect the tax characterization of an investor’s returns from an investment in the Fund relative to a direct investment in bonds. If the amount an investor receives as liquidation proceeds upon the Fund’s termination is higher or lower than the investor’s cost basis, the investor may experience a gain or loss for tax purposes.

Diversification and asset allocation may not protect against market risk or loss of principal.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Barclays or Bloomberg Finance L.P., nor do these companies make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with the companies listed above.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of May 2018 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners.

ICRMH0619U-858242-1/1