by Doug Drabik, Fixed Income, Raymond James

This week, Barron’s has an article titled, Stocks Off to Best Start in 28 Years. The European stock market, despite questionable economic conditions, is off to one of its better starts in years. CNBC reports that Chinese stocks are “jumping” amid hopes of a Sino-US trade deal. All of this is great news for investors and the growth prospects of their portfolios.

Emotions run high during good times. The hard part is to stay in control with arguably one of the most important disciplines of investing: appropriate asset allocation.

Euphoric behavior can push investors into bad habits just as catastrophic market events can alter investor patience. Unpredictable investment behavior can lead to buying and selling at some of the worst times. Neither extreme is likely healthy for long term investors. Defining optimal asset allocations cannot be standardized. Different ages, accumulated wealth, income potential, family situations, spending habits, liquidity needs, risk tolerance, etc. all contribute to formulating the allocations ideal for each individual investor. Wavering from the optimal allocations can impede long term results.

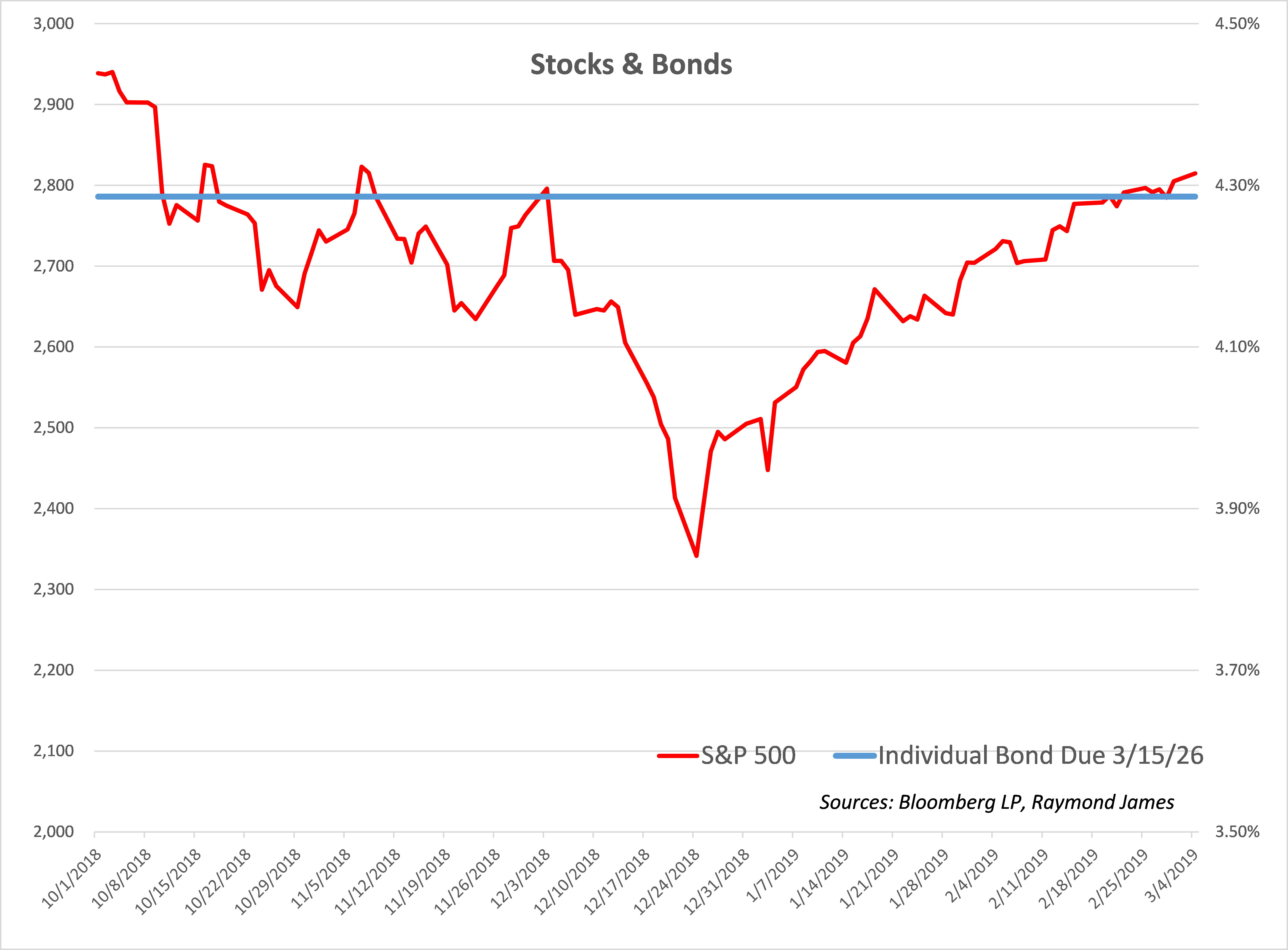

The start of this year has been good for equity holdings; however, remember that just 3 months ago, stocks had one of the worst Decembers in decades. The point is not to panic in dips but not to risk fixed income allocations during rallies. The graph might be worth 1,000 words. At the start of the last quarter of 2018, you could purchase a corporate bond with a 4.29% yield. As depicted, stocks bounced up and down falling dramatically by year’s end only to climb steadily since.

How was the corporate bond’s income and cash flow affected over this time frame? Not at all! The bond was bought with a 4.29% yield and continues pay 4.29%. Did stocks move up and down? Yes. Did the price of this corporate bond fluctuate? Yes. However, for buy-and-hold individual bond investors, income and cash flow are locked from the purchase date to the redemption date.

Asset allocation works as time permits the equity allocation to serve its purpose and grow. At the same time, bond allocations allow income to be consistent and predictable as long as they are held to maturity. The appropriate asset allocation works. Don’t get caught up in the market’s seesaw.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James