by Stephen Lingard, CFA Senior Vice President, Portfolio Manager, Franklin Templeton Multi-Asset Solutions

After more than a year of tense talks, Canada, Mexico and the United States have replaced the North American Free Trade Agreement (NAFTA). Franklin Templeton Multi-Asset Solutions’ Stephen Lingard gives his take on the new trilateral trade pact and explains why it could benefit select Canadian companies.

On 30 September 2018, Canada and Mexico reached a last-minute deal with the United States to replace the 1994 North American Free Trade Agreement (NAFTA).

We think the new United States-Mexico-Canada Agreement (USMCA) averts the worst fears of a breakdown in trade relations between the three countries and potential disruption to regional supply chains. As we mentioned in a previous article, the protracted renegotiation process posed threats to the North American auto market in particular.

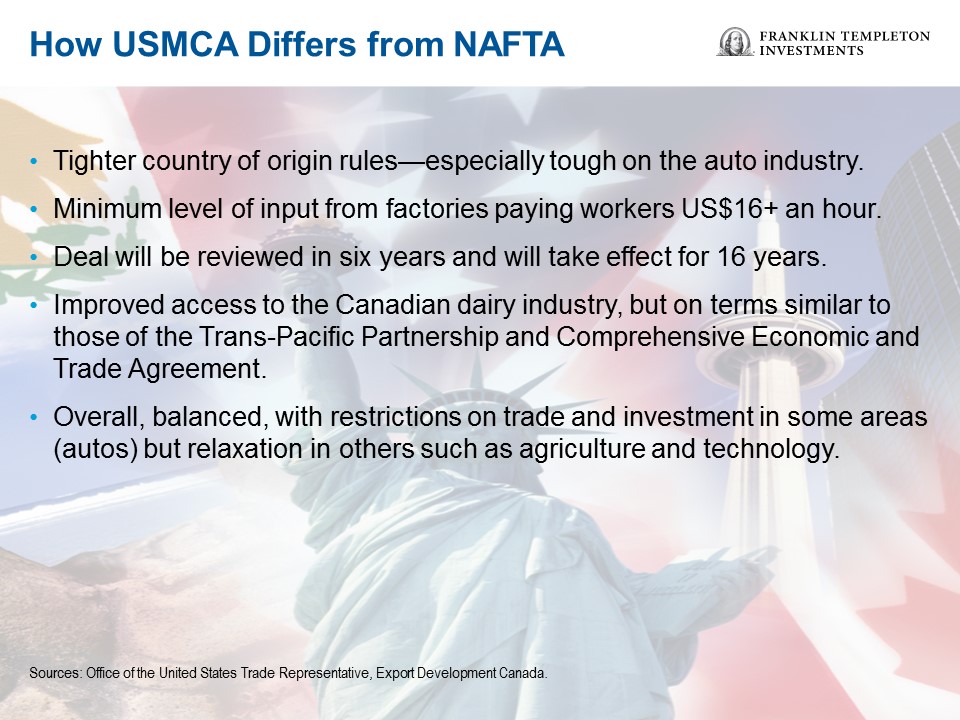

The chart below shows some of the main differences we see between NAFTA and USMCA.

In our view, the new North American trade deal is neither especially good nor bad for Canada and Mexico. But the fact that it clears away some of the uncertainties is positive, in our eyes. This new deal may support capital expenditure and remove a headwind from future growth.

However, the path to this agreement included threats, tariffs and sanctions, which are not generally part of the normal course of negotiations.

Where was the collaboration within established institutions? The lasting damage to trust and mutual respect have created a challenging environment. We think this will heighten concern in Canada and Mexico about being so dependent on one trading partner. And it may push those countries to start looking at trading opportunities further afield.

Who won in the stand-off? Canada initially stepped back from the negotiations. After the United States agreed to a deal with Mexico, Canada came back to the table. But would a US-Mexico bilateral deal have ever passed in US Congress? The depth of the integration of the United States and Canada supply chains seems to have been enough to persuade the United States to make critical concessions at the last minute.

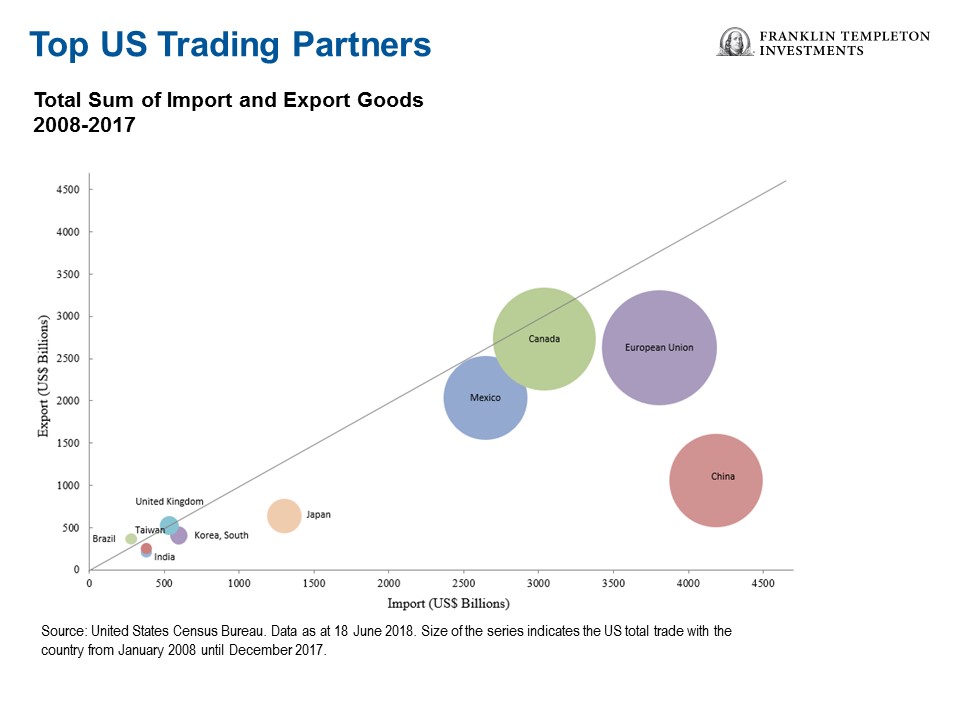

Or was it just that the United States decided to narrow the trade war, and fight on one front (at a time)? Initiating talks with other long-term allies such as Japan and the European Union suggests that the United States is summoning all its energy for the bigger fight, with China. As the chart below shows, these countries and the European Union have been the top US trading partners over the past 10 years.

Investment Implications

We think the conclusion of trade negotiations is a positive for Canada as it removes a cloud hanging over the economy and adds to other shorter-term tailwinds supporting cyclical activity. However, some deceleration in the pace of Canada’s gross domestic product growth is still anticipated in 2019.

For global portfolios, we maintain slightly cautious towards Canadian bonds.

The uncertainty around trade had previously been cited by the Bank of Canada. With that uncertainty removed, we expect that it will continue to raise interest rates.

We see select opportunities in Canadian stocks, with financials likely benefitting from a rising interest-rate environment and the energy sector benefitting from higher crude oil prices.

The Canadian dollar might benefit from these trends as well.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline.

Copyright © Franklin Templeton Multi-Asset Solutions