by Scott Brown, Ph.D, Raymond James

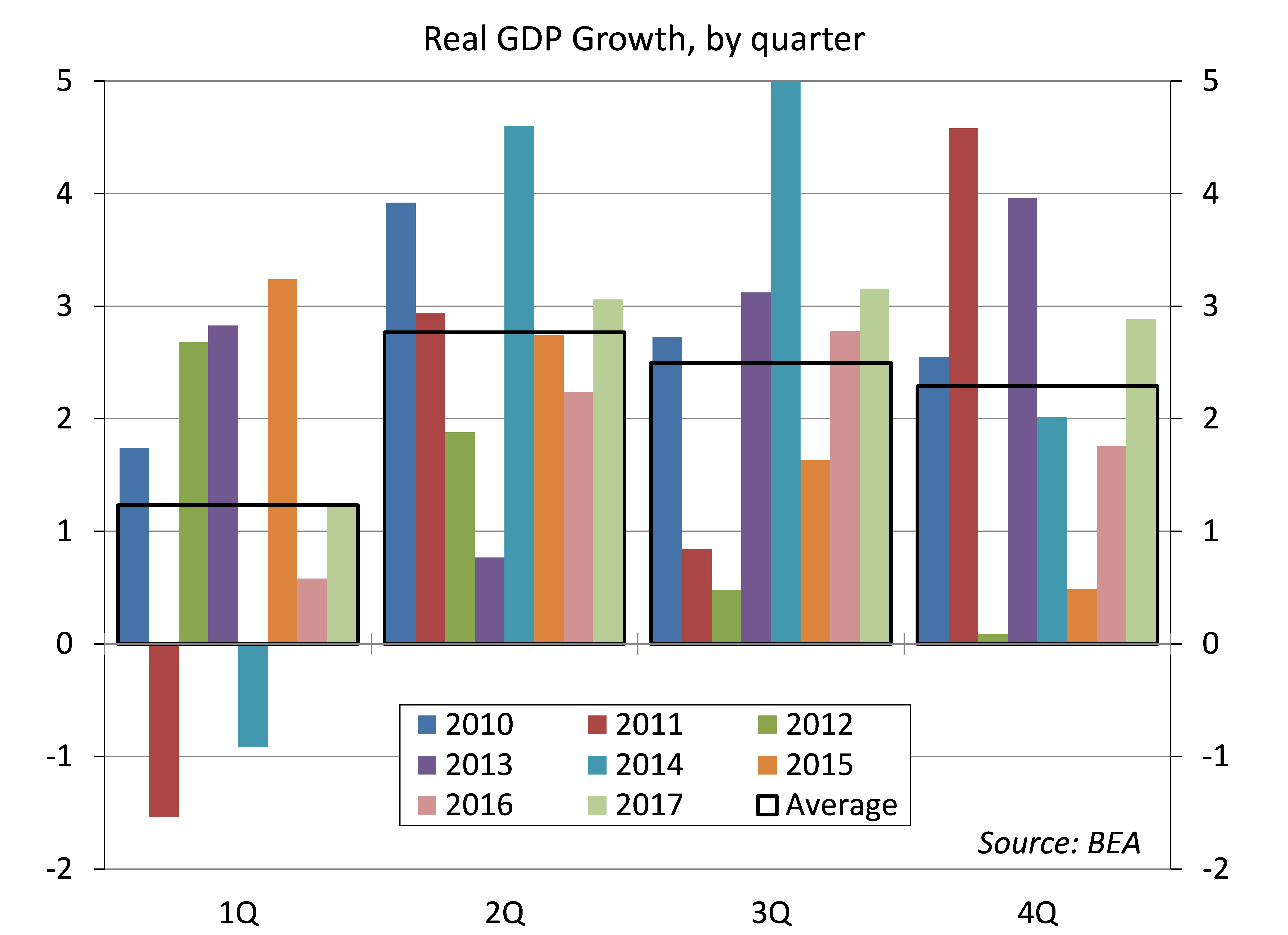

The Bureau of Economic Analysis will report the advance estimate of 1Q18 GDP growth on April 27. These figures will be revised, but the underlying story is not expected to change much. Growth was likely moderate, not horrible, but far short of the lofty expectations that some had put forth at the start of the quarter. Nobody appears too worried about that. Fed officials saw signs of first quarter softness as “transitory.” Stock market volatility and tariffs are also viewed as no big deal. Policy decisions will remain data dependent and monetary policy is not on a preset path, but 25 basis points per quarter is the most likely scenario and it’s up to the upcoming information to dissuade the Fed from acting.

Inflation-adjusted consumer spending rose at a 4.0 annual rate in 4Q17 – strong, but partly reflecting a rebound from the third quarter’s hurricanes. Still, it’s not unusual to see a more modest gain (seen at about a 1% annual rate) following such strength. Shipments of capital goods have continued to improve, but the pace slowed considerably from 4Q17 (where growth also reflected a rebound from hurricane effects). Weather was likely a factor in some areas in 1Q18. In addition, GDP figures have exhibited residual seasonality. Specifically, first quarter growth has generally been lower than the rest of the year. This could reflect permanent changes to seasonal patterns following the financial crisis, but that would disappear over time (as the seasonal adjustment pattern adapts). Note that the 1Q18 weakness is not observed in the key components of GDP (consumer spending, business fixed investment).

GDP growth figures are often uneven across quarters. Fed officials know this and continue to expect a pickup in growth in the near term, reflecting the impact of fiscal stimulus (the Tax Cut and Jobs Act and the recent government spending agreement) and a strong global economy.

Still, the impact of fiscal stimulus isn’t clear. Cash on balance sheets and lower borrowing costs hadn’t lit much of a fire under capital investment, so why would a reduction in corporate tax rates? At the same time, business sentiment has been strong, and that may help. However, the consumer is the driving force of the economy. There was some reduction in individual taxes, but not for everybody, and generally not enough for the typical worker to notice. While there have been announcements of one-time bonuses and salary increases, some critics have denounced that as mere PR (as some bonus intentions had been announced ahead of the TCJA passage). Moreover, wage increases have generally remained moderate in recent months.

Growth is likely to be limited by constraints in the job market. The Fed’s recent Beige Book noted firms’ “continued difficulty finding qualified candidates across a broad array of industries and skill levels.” Labor shortages were most often cited in high-skill positions, including engineering, information technology, and health care, as well as in construction and transportation.

Fed officials recognize that there are risks of raising rates too rapidly or too slowly. Tightening too aggressively risks undermining the expansion. While wage pressures don’t appear to be a problem, the Fed believes that left unchecked, the economy will soon exceed its potential (if it hasn’t already), leading to a difficult correction later on. Hence, a policy of gradual rate hikes is seen as appropriate, balancing these risks.

Last week, the White House indicated that President Trump intends to nominate Richard Clarida (a professor at Columbia and an advisor to PIMCO) to be Fed Vice Chair, and Michelle Bowman (a Kansas Bank Regulator) to be a Fed governor. Neither nomination was a surprise. Clarida brings critical monetary policy expertise to the Fed’s Board of Governors, while Bowman will fill a slot representing community bankers. Neither should face any difficulty in being approved in the Senate. Meanwhile, Marvin Goodfriend, who had a terrible hearing (he was wrong on monetary policy throughout the recovery and shows no signs of having learned anything by that), has seen his nomination stall. His Senate approval would be a close vote (Rand Paul doesn’t like him and John McCain is sidelined), but he might pass if the three nominations are voted on together. Personnel changes (especially Randall Quarles appointment as Vice Chair of Supervision) have already had an impact on the Fed’s regulatory outlook, but monetary policy isn’t likely to be much different. The makeup of the Federal Open Market Committee is a little more hawkish this year, but the FOMC’s basic approach to monetary policy is essentially the same as it was under Yellen, anchored by the central bank’s excellent staff. Looking ahead, the Fed’s decisions are expected to focus more on the balancing of risks of a policy error.

*****

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report's conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Copyright © Raymond James