by Steven Vanelli, CFA, Knowledge Leaders Capital

With some exceptions, smaller-cap stocks in the US tend to pay higher taxes than their larger-cap peers. As such, speculation that corporate tax rates may be cut has stoked the performance of US small caps recently. In addition to the concern that tax reform and/or tax cuts may get stalled, there are three other factors that we think investors should consider when evaluating small caps in the US.

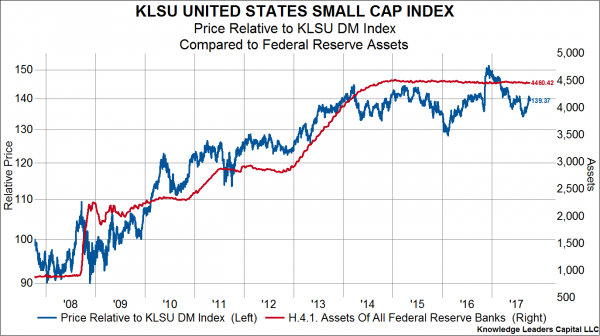

First, the relative performance of US small caps, compared to the developed world has been highly correlated to changes in the size of the Fed’s balance sheet. More so than large cap stocks, the relative performance of small caps has tracked successive rounds of QE quite closely. As can be seen in the chart below, where we compare the relative performance of US small caps to our KLSU Developed Market Index, small caps have been in a sideways channel since the end of QE3. The concern here, of course, is that as the Fed moves to shrink its balance sheet, the relative performance of liquidity-sensitive small caps may suffer.

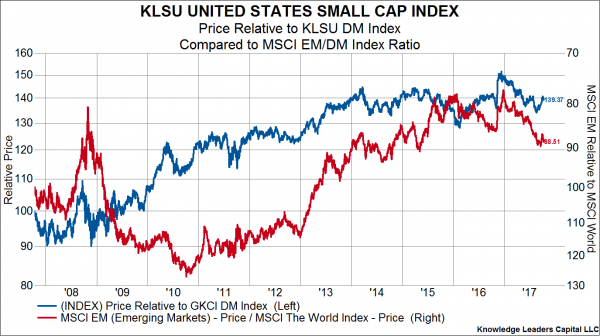

Second, generally US small caps outperform the developed global equity markets when the developed markets are outperforming the emerging markets. In the chart below, the red line, fixed to the right axis and inverted, is the relative performance of the MSCI Emerging Markets Index compared to the MSCI World Index. If EMs continue to outperform DMs, breaking out of the 2014 resistance, this may telegraph more weakness ahead for US small caps.

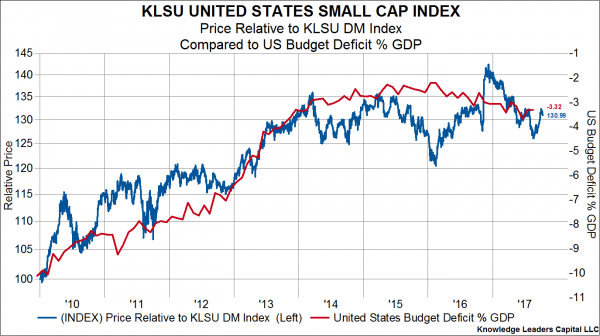

Lastly, since 2009 US small cap stocks have exhibited a close relationship with the US budget deficit as a percent of GDP. While the budget deficit shrank from over 10% of GDP in 2009 to less than 3% of GDP by 2014, US small caps outperformed global developed equities by 35%. They are dead flat since. As the budget is slowly widening out again, it appears small cap relative performance is rolling over with it. Ironically, should the US pass a tax cut that widens the deficit, this may be a greater negative for small caps than any positive effects of lower tax rates.

Copyright © Knowledge Leaders Capital