Ten Years On: Is the World Economy Getting Back to “Normal”? - Context

by Fixed Income AllianceBernstein

A decade ago, we got the first warnings that the US subprime crisis would go global. Since then, monetary policy has pushed deep into unconventional territory. How will it respond as the backdrop begins to look more “normal”?

On August 9, 2007, the European Central Bank (ECB) made a massive €95 billion overnight liquidity injection into the euro-area banking system in response to problems at French bank BNP Paribas. Although some tremors had preceded this move, it was the first indication that the US subprime crisis was taking on a global dimension. It was also the first significant central bank intervention in what would soon become the global financial crisis (GFC).

In the subsequent 10 years, much of our understanding of the way economies work has been turned on its head. The global economy experienced its worst recession since the 1930s and we learned that not all institutions are “too big to fail.” Central banks, meanwhile, inflated their balance sheets to levels normally seen only during wartime and pushed interest rates into negative territory. All of this was unimaginable a decade ago.

A Broader Research Scope Needed

We’ve learned some important lessons over this period—and our research reflects them. We’ve broadened our approach away from a narrow focus on business-cycle developments. Instead, we think a more balanced approach is necessary, one which also considers the financial cycle and structural factors likely to influence economies and asset prices over longer horizons. In short, the GFC has changed the way we look at the world.

Yet, just as it was wrong to downplay the importance of the financial cycle and structural factors 10 years ago, it’s important not to ignore the business cycle today.

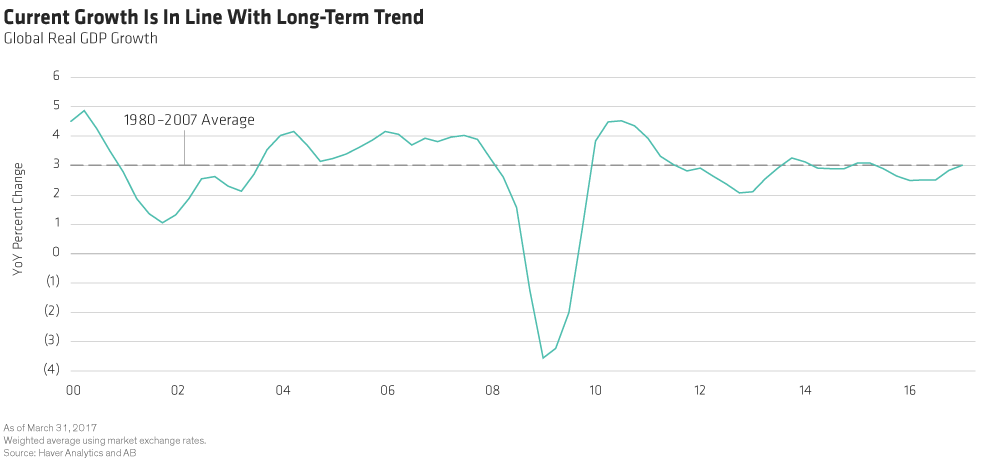

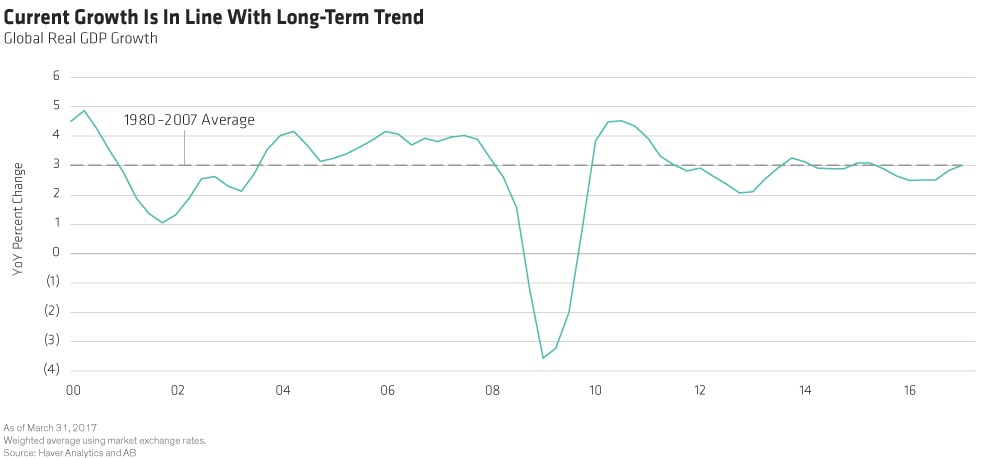

So how does the world look 10 years on? Based on our estimates, the global economy grew at an annual rate of 3.0% in the first quarter this year, roughly 1% below the pace of the immediate precrisis period. But the latter was achieved at the peak of a debt-fueled asset-price boom. In the quarter century prior to the crisis, by contrast, the global economy grew at 3.0% per annum—in line with its current growth rate (Display).

We can make similar observations about other indicators. In developed economies, for example, the unemployment rate is close to cyclical lows reached in 2007, the money supply is rising nicely and so are asset prices (too nicely for some!). In many respects, therefore, the global economy is starting to look a bit more “normal.”

Is Inflation Really an Exception to “Normal?”

There’s an exception, of course, and that’s inflation. Or is it an exception?

During the precrisis period, global headline inflation was boosted by rapid increases in oil and commodity prices driven by rapid industrialization in emerging economies, especially China. But core inflation rarely approached 2% during this period (Display). This suggests that many of the forces holding inflation down might be structural in nature, like demographics or technology.

But while the global cyclical backdrop may be approaching some semblance of normality, this is clearly not the case for monetary policy—particularly in developed markets. Central bank balance sheets are still bloated and short-term interest rates remain negative in Europe and Japan. In short, monetary policy is still fighting a deflation demon which may well have left the room.

Two Schools of Thought

There are two competing theories at work here. The first assumes that the global backdrop only looks a bit more “normal” because monetary policy is so accommodative. The second theory claims that unconventional monetary policies have outlived their usefulness and urgently need to be recalibrated. With the world still awash with debt, we have some sympathy with the first theory. Policymakers, though, would like to believe the second.

In recent weeks, central banks in several developed economies have shifted their rhetoric in a more hawkish (or less dovish) direction. We think they’re responding to the normalization of the global cyclical backdrop and the realization that low inflation might be structural—and therefore beyond the influence of conventional monetary policy.

As long as the cyclical backdrop remains benign, we expect central banks to explore the tension between the two theories outlined above by gradually withdrawing monetary accommodation. Elevated debt and weak nominal growth put limits on how far this process can go, but it certainly points to a less bond-friendly environment. And given the potential for policy missteps along the way, it’s also a recipe for increased volatility.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Copyright © AllianceBernstein