SIACharts Relative Strength Spotlight: Avoiding Portfolio Destruction

Home Capital Group (TSX: HGC.TO)

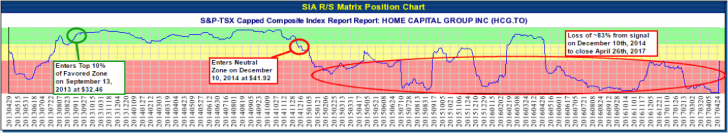

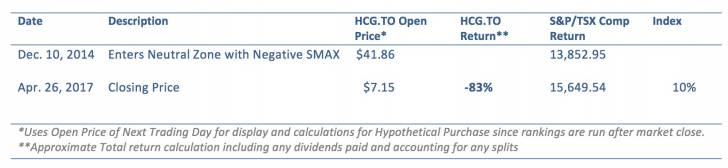

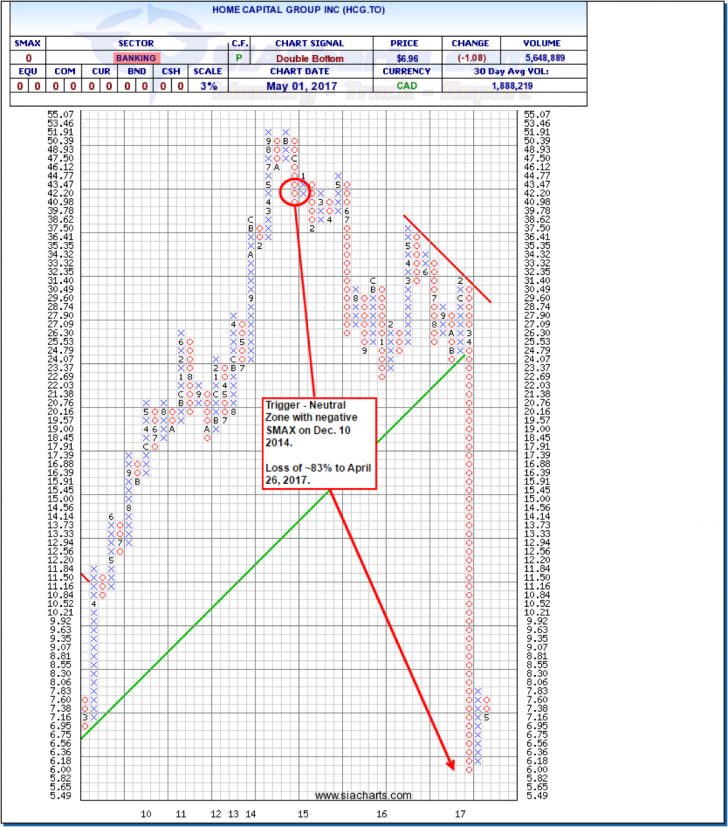

Analysis: Home Capital Group (HCG.TO) entered the top 10% of the Favored zone of the SIA S&P/TSX Composite Index Report on September 13, 2013, closing at $32.46. On December 10, 2014, HCG.TO entered the Neutral Zone with a negative SMAX. The total return over this time was ~23%. We also witnessed a quick entry into the Favored zone in February of 2016, but if purchased during this time would have resulted in a flat trade.

In the SIACharts Relative Strength Spotlight: Avoiding Portfolio Destruction, our focus turns to avoiding significant losses in the Yellow and Red Zones. If you were to liquate HCG.TO when triggered on December 10, 2014, a loss of 83% would have been avoided to the low in late April 2017. Remaining in an objective and disciplined strategy, it is possible to avoid any subjective bias holding positions that are exhibiting relative weakness and higher risk. One of the benefits of using SIA Relative Strength Analysis is that it takes the guess work out of when to exit a weak or weakening position. Even if you didn’t exit the position upon the first trigger, you still had ample time to do so in the last 2 and ½ years. This discipline differs significantly from a fundamental or often-speculative, subjective approach of many market participants or analysts. Take this article published just days before the recent collapse on April 24, 2017, by the Motley Fool for example. Or perhaps this article found in the Globe and Mail in Dec. of 2016, describing HGC.TO as “an attractive buy idea that deserves a place in every diversified Canadian equity portfolio.” It is this type of subjective analysis that can lead to Portfolio Destruction without the prior tools to avoid these errors.

About HCG.TO: Home Capital Group Inc., through its subsidiary, Home Trust Company, provides deposits, mortgage lending, retail credit, and credit card issuing services in Canada. It offers various deposit products, such as savings account demand products; and single-family residential and insured residential lending, as well as residential and non-residential commercial mortgage lending services.

Source: www.SIACharts.com, for illustration purposes only