by Blaine Rollins, CFA, 361 Capital

The U.S. economy continues to fire higher as evidenced by last week’s strong list of economic data. Throw on top of the potential for a trillion dollars of infrastructure spending, a trillion dollars of cash repatriation from overseas, several hundred billion in corporate and personal income tax savings, and whatever other savings that can be gained from reduced government regulation, and you have the makings for a growth acceleration to rival the new Model S P100D. (Zero to 60 mph in 2.4 seconds.) So, there should be absolutely no wonder why Treasury yields are ripping higher and pulling the U.S. dollar with it. The markets are now positioning for a 100%—certain FOMC hate hike in December and should get ready for a few more in 2017 as the government, consumers and corporations get busily spending.

The biggest question in most minds is whether any fiscal conservative in Congress will stand up and question how much is being spent. I think that it would be difficult for any member of Congress to question those swing state voters who want jobs created now. So, watch the RRR line up and pass everything today and figure out how to pay for it tomorrow. Barron’s had a good idea to push out the Fed’s maturities to 100 years which is a great idea given this new fiscal environment that we are in. Interest rates are going higher for now; might as well lock in for the long term even though it will cost you more in the short term.

I see some portfolio managers and strategists that want to fight this tape and bet against a Trump presidency and all this spending. I think that this would be a risky strategy. Especially when you know that the spending, repatriation and tax cuts will happen without much of a fight. Also, the Trump jawboning is beginning to work its way into the C-suite when you hear that Apple is now asking its suppliers to come up with iPhone U.S. manufacturing plans and Ford is changing its mind on the manufacturing location for one of its car models. Again, you may not be happy with the election results from 2 weeks ago, but you can’t bet against what is likely on the table and this current market momentum. Think about your investment portfolio first and consider what Tom Hanks said over the weekend: “This is the United States of America. We’ll go on. There’s great like-minded people out there who are Americans first and Republicans or Democrats second… I hope the President-elect does such a great job that I vote for his re-election in four years.” Now if only the market bulls could convince Kellyanne to cancel the Trump twitter account.

Steve Bannon has the ear of the President-elect. This will have a direct effect on your portfolio…

“Like [Andrew] Jackson’s populism, we’re going to build an entirely new political movement,” he says. “It’s everything related to jobs. The conservatives are going to go crazy. I’m the guy pushing a trillion-dollar infrastructure plan. With negative interest rates throughout the world, it’s the greatest opportunity to rebuild everything. Ship yards, iron works, get them all jacked up. We’re just going to throw it up against the wall and see if it sticks. It will be as exciting as the 1930s, greater than the Reagan revolution — conservatives, plus populists, in an economic nationalist movement.”

Hopefully you have already read Ray Dalio’s change in thoughts last week. If you want to hunt for the largest seller of Bonds in the world, I’d start by looking at Bridgewater…

“…whereas the previous period was characterized by 1) increasing globalization, free trade, and global connectedness, 2) relatively innocuous fiscal policies, and 3) sluggish domestic growth, low inflation, and falling bond yields, the new period is more likely to be characterized by 1) decreasing globalization, free trade, and global connectedness, 2) aggressively stimulative fiscal policies, and 3) increased US growth, higher inflation, and rising bond yields. Of course, there will be other big shifts as well, such as pertaining to business profitability, environmental protection, foreign policies/alliances, etc. Once again, we won’t go into the whole litany of them, as they’re well known. However, the main point we’re trying to convey is that there is a good chance that we are at one of those major reversals that last a decade (like the 1970-71 shift from the 1960s period of non-inflationary growth to the 1970s decade of stagflation, or the 1980s shift to disinflationary strong growth). To be clear, we are not saying that the future will be like any of these mentioned prior periods; we are just saying that there’s a good chance that the economy/market will shift from what we have gotten used to and what we will experience over the next many years will be very different from that.

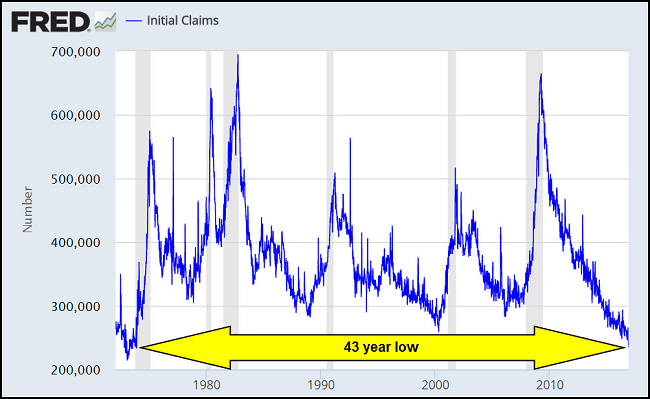

The economic data was great last week. Look at this long-term chart of Jobless Claims…

This morning, we learned that initial unemployment claims fell to 235,000 last week (seasonally adjusted). That’s the lowest since November 24, 1973 when it hit 233,000. Of course, the country’s population is more than 50% larger than it was 43 years ago. (CrossingWallStreet)

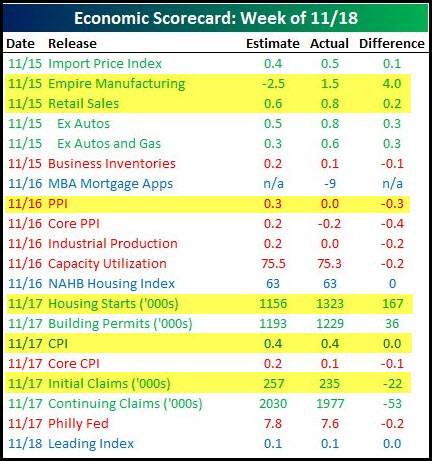

Bespoke does a great job each week of listing the economic data. I highlighted the most important upsides to take further note of…

(@bespokeinvest)

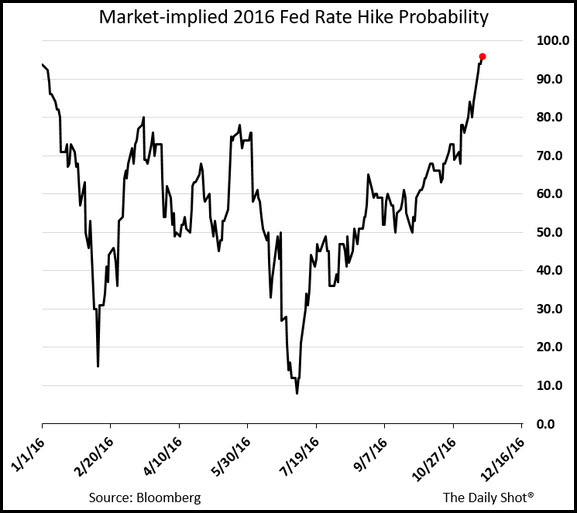

A December rate hike probability now equals that of Alabama making the BCS playoff…

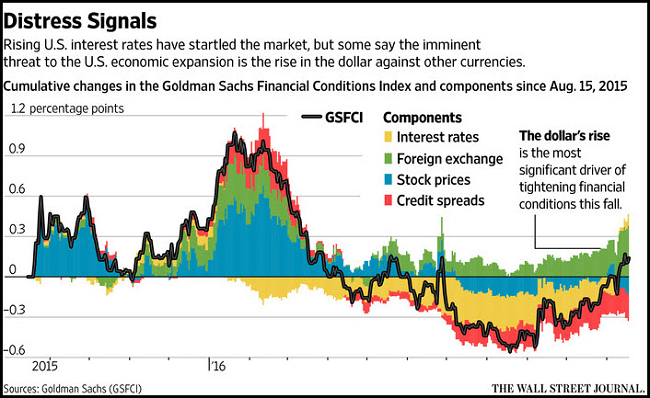

The U.S. dollar has now paced the S&P 500 to new highs. Which is unusual, but so are the recent election results…

Of course, a suddenly stronger U.S. dollar will make for some late nights in the CFO’s office as it erases multinational corporate earnings…

In an earnings call Wednesday, Cisco Systems Inc. said it has seen weakened demand from customers abroad, in part because of “incredible currency headwinds.” Chief Executive Chuck Robbins said some of Cisco’s customers have delayed capital spending “until they had better clarity around the currency situation.”

Beverage maker Coca-Cola Co. forecasts that currency swings will cut as much as 9% from its pretax profit this year.

(WSJ)

A strong U.S. dollar is now the biggest headwind to the U.S. economy according to the GSFC index…

It will be up to a healthy credit environment and stock market to balance away the pain from forex and rising interest rates.

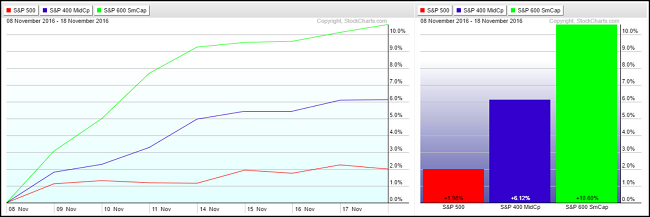

Looking at the market returns by capitalization show that the best place to be since the election has been in Small Cap stocks…

Remember, small caps are in a better position to: 1) be protected from a rising U.S. dollar, 2) benefit more from U.S. spending, 3) benefit more from a reduction in corporate tax rates, and 4) the sector has a higher concentration of financial stocks which have done better as interest rates have risen.

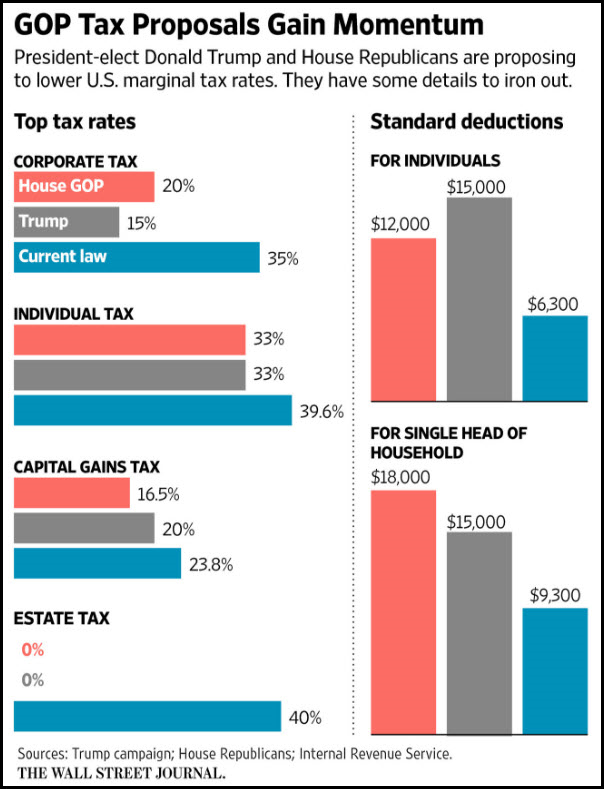

If you have tax losses, take them now. Wait to take gains or sell your company in 2017 and beyond when tax rates are lower…

(WSJ)

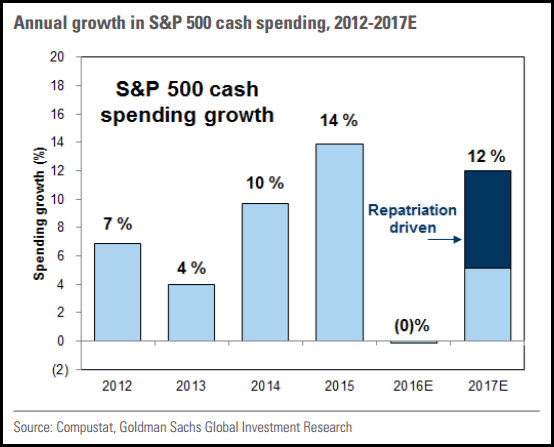

Goldman sees corporate cannons as being reloaded into 2017…

S&P 500 firms will increase total cash use by 12% in 2017. We forecast S&P 500 firms will spend $2.6 trillion next year, allocating 52% to investing for growth (capex, R&D, and M&A) and 48% to returning cash to shareholders (buybacks and dividends). Cash balances currently stand at historical highs, totaling $1.6 trillion (ex-Financials) or 12% of assets compared with a long-term average of 7%. (Goldman Sachs)

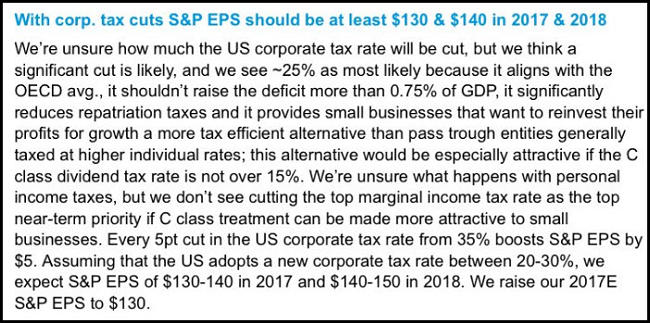

And DeutscheBank sees those cannons blowing a hole in their S&P 500 targets…2500 by 2018 (+15%)…

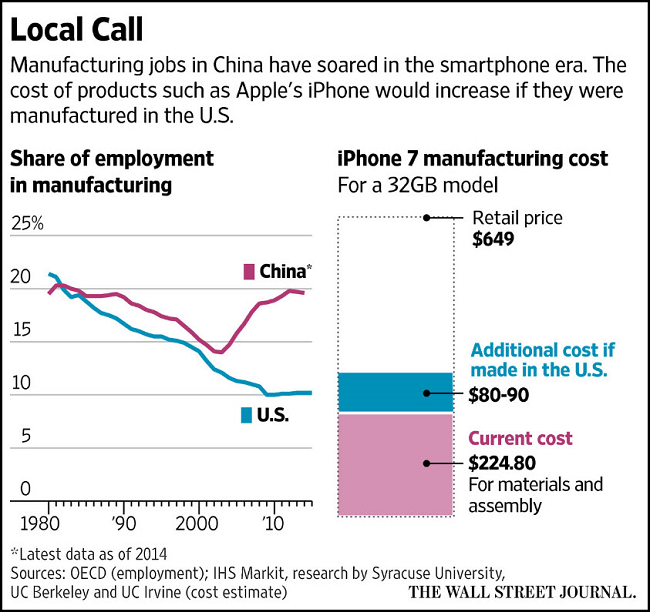

Apple has started to look at shifting iPhone production into the U.S…

Away from the recent strengthening in the dollar, it is estimated that the cost of a new iPhone could rise by about 15%.

(WSJ)

This is incredible. Can we consult with this team for future U.S. infrastructure spending (including a few potholes on my daily commute)?

A section of road in the centre of the Japanese city of Fukuoka has reopened just days after a sinkhole opened up outside a busy railway station and threatened to topple nearby buildings.

In a typical demonstration of Japanese workmanship and efficiency, workers toiled around the clocks and had practically filled in the section of road in just two days, according to local media.

Finally, the best read of the week: A great follow up by John Carreyrou on his investigation of Theranos…

After working at Theranos Inc. for eight months, Tyler Shultz decided he had seen enough. On April 11, 2014, he emailed company founder Elizabeth Holmes to complain that Theranos had doctored research and ignored failed quality-control checks.

The reply was withering. Ms. Holmes forwarded the email to Theranos President Sunny Balwani, who belittled Mr. Shultz’s grasp of basic mathematics and his knowledge of laboratory science, and then took a swipe at his relationship with George Shultz, the former secretary of state and a Theranos director.

“The only reason I have taken so much time away from work to address this personally is because you are Mr. Shultz’s grandson,” wrote Mr. Balwani to his employee in an email, a copy of which was reviewed by The Wall Street Journal.

(WSJ)

Copyright © 361 Capital