Tech Talk: Short Term Technical Recovery for N.A. Equities

May 11th 2016

by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday May 11th

U.S. equity index futures were lower this morning. S&P 500 futures were down 3 points in pre-opening trade.

Most of the early weakness can be attributed to weakness by Walt Disney after the company reported less than cons

Pre-opening Comments for Wednesday May 11th

U.S. equity index futures were lower this morning. S&P 500 futures were down 3 points in pre-opening trade.

Most of the early weakness can be attributed to weakness by Walt Disney after the company reported less than consensus fiscal second quarter earnings. Disney fell $5.55 to $101.05

Staples dropped $1.55 to $8.81and Office Depot fell $2.03 to $4.06 after they called off their proposed merger due to anti-trust concerns.

Macy’s dropped $2.67 to $34.32 after releasing negative guidance for the year.

Alaska Air added $0.46 to $69.79 on news that the stock will be added to the S&P 500 Index on the close on Thursday, replacing SanDisk.

Toyota Motor is expected to open lower after releasing negative guidance for the year.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/05/10/stock-market-outlook-for-may-11-2016/

Note seasonality charts on the NASDAQ Biotech Index and Wholesale Inventories.

ensus fiscal second quarter earnings. Disney fell $5.55 to $101.05

Staples dropped $1.55 to $8.81and Office Depot fell $2.03 to $4.06 after they called off their proposed merger due to anti-trust concerns.

Macy’s dropped $2.67 to $34.32 after releasing negative guidance for the year.

Alaska Air added $0.46 to $69.79 on news that the stock will be added to the S&P 500 Index on the close on Thursday, replacing SanDisk.

Toyota Motor is expected to open lower after releasing negative guidance for the year.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/05/10/stock-market-outlook-for-may-11-2016/

Note seasonality charts on the NASDAQ Biotech Index and Wholesale Inventories.

Daily Observations

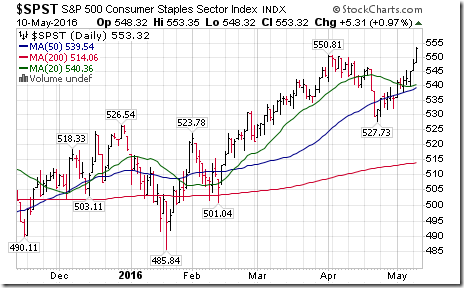

Finally, a short term momentum recovery by North American equity markets following a brutal two week slump! Consumer related stocks led the advance with the S&P Consumer Staples Index and S&P Consumer Discretionary Index breaking to new recent highs.

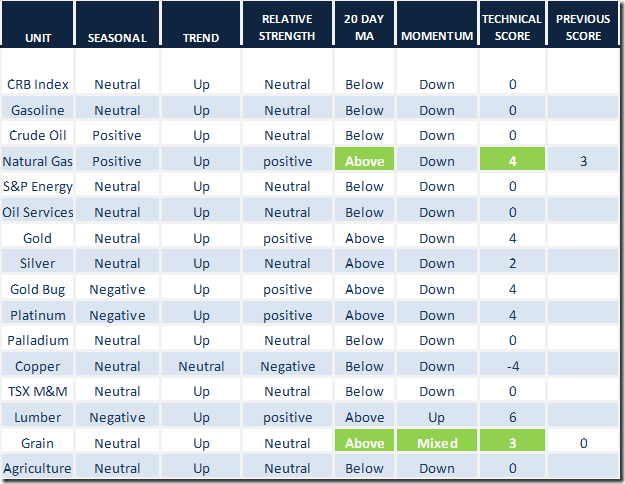

Commodity prices continued to underperform significantly due to short term strength in the U.S. Dollar Index. An interesting exception was lumber with a break to a 14 month high.

StockTwits Released Yesterday

Ratio of stocks to bonds presently favours the fixed income asset class.

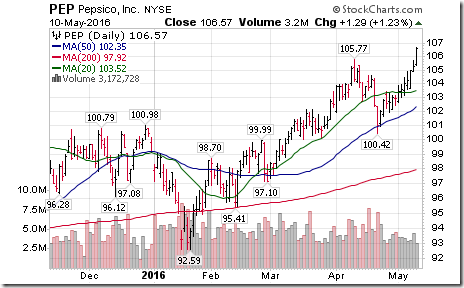

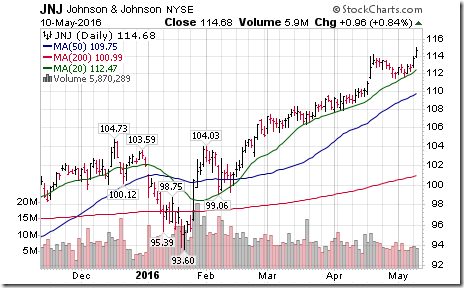

Technical action by S&P 500 stocks to 10:15: Bullish. Breakouts: $HD,$CPB,$DPS,$MO, $PEP,$SJM, $AVB, $CB,$JNJ, $ESS

Editor’s Note: After 10:15, technical action by S&P 500 stocks remained bullish. Breakouts included Discovery Communications and Agilent Technologies

Nice breakout by S&P Consumer Staples Index and related ETFs above 550.81 to reach an all-time high! $XLP

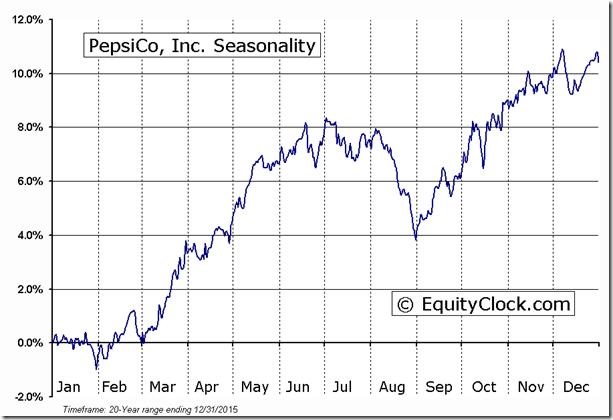

S&P Consumer Staples stocks breaking resistance and extending intermediate uptrend included $CPB, $DPS, $MO and $PEP.

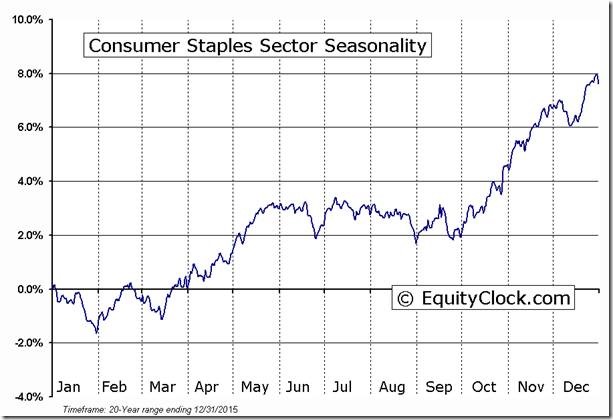

‘Tis the season for Consumer Staples stocks to move higher in a real and relative basis until the end of May.

Nice breakout by $JNJ, a DJIA stock, above $114.19 to an all-time high extending an intermediate uptrend.

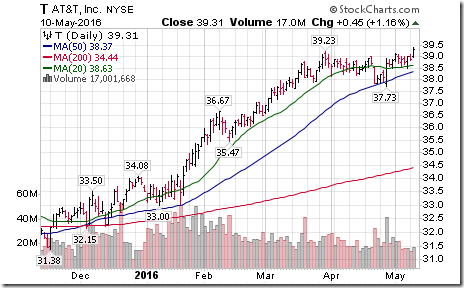

Nice breakout by $T above $39.23 to an all-time high extending an intermediate uptrend.

Nice breakout by $HD, a DJIA stock, above $137.00 to an all-time high extending an intermediate uptrend.

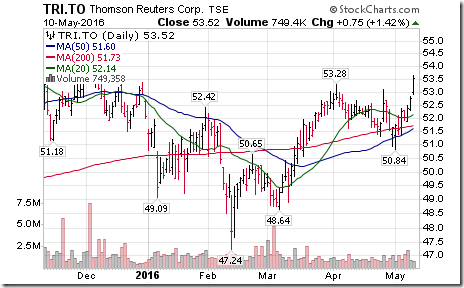

Nice breakout by $TRI.CA Thomson Reuters above $53.28 to extend an intermediate uptrend.

Interesting short term double bottom pattern completed by $AGU.CA on a move above $111.99!

Editor’s Note: A nice breakout at a time when the stock shows strong on-balance volume. Someone has been accumulating this stock during the past 9 months. Also, the stock was helped yesterday by a strong move in gain prices.

S&P Consumer Discretionary Index moved above 638.94 to a 6 month high extending an intermediate uptrend.

Trader’s Corner

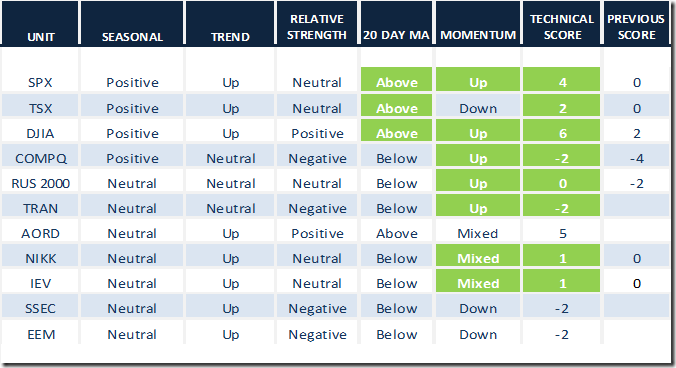

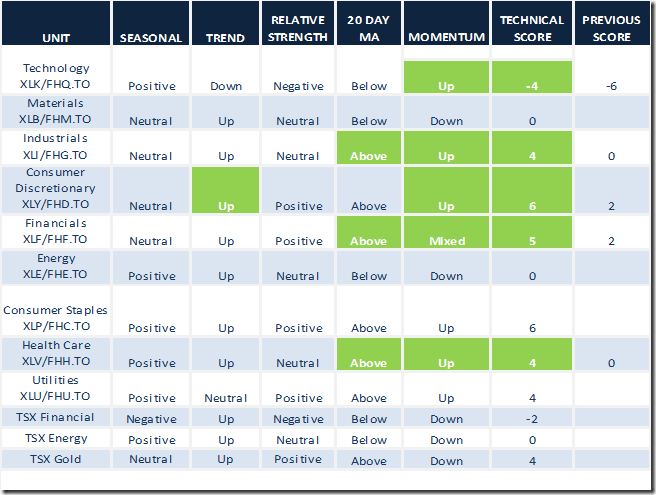

Technical scores for equity indices and sectors improved significantly mainly due to a change in momentum from down to up on a recovery from short term oversold levels.

Daily Seasonal/Technical Equity Trends for May 10th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Commodities Trends for May 10th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March May 10th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples (both broke to new recent highs yesterday):

S&P 500 Momentum Barometer

The Barometer recovered 9.40 to 71.60 yesterday. The Barometer remains intermediate overbought and trending down.

TSX Composite Momentum Barometer

The Barometer recovered 3.16 to 63.68 yesterday. The Barometer remains intermediate overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/a865912ebb45088a98033d9520584316.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/4296633ba2594346955e4dee14786d75.png)