Can Managed Futures Manage Rising Rates?

by Corey Hoffstein, Newfound Research

Summary

- Rising interest rates are on the horizon … somewhere

- Yield curve dynamics – including the absolute level of rates, their direction of change, and the slope of the yield curve – all play an important role in the returns for managed futures

- The cost of carry in shorting fixed-income futures means that commodity trading advisors (CTAs) may fail to profit in rising rate environments

- Without positions in fixed-income, CTA returns may become more highly correlated with equities, challenging their position as an “alternative” and their diversification benefits

Rising rates are somewhere out there on the horizon. Where, nobody quite knows. Did this week’s devaluation of the yuan push out the timeline? If lower export prices from China cause disinflation-on-the-way-to-deflation for the US, then the answer is a solid maybe.

How, exactly, a rising rate scenario will play out is unknown. Will rates “normalize” quickly? Will it be a prolonged, slow rate hike cycle?

Perhaps most importantly: how can we mitigate portfolio losses from losses in fixed income caused by rising rates?

There are several potential ways we could mitigate losses:

- Avoid fixed income all together

- Pick our spots on the yield curve and credit spectrum

- Find a way to profit from rising rates, hedging out losses in long bond positions

When it comes to profiting from trends in any direction, we might think of CTAs and global macro managers pursuing trend following strategies. Employing both long and short positions in global futures contracts – covering equity indices, commodities, interest rates, and currencies – they can profit in nearly any environment.

Nearly any.

The problem is that rising rates are a unique sort of environment that even CTAs might not be able to profit from.

Let’s explore why.

When a CTA takes a long position in fixed income, they can profit in two ways: (1) betting correctly on the direction of rates, or (2) roll yield.

While (1) is the heart of trend-following, (2) plays a considerably influential role in fixed income futures returns.

So what is roll yield?

Roll yield occurs when the holder of a futures contract “rolls” their position forward on a quarterly basis to stay in the most liquid contract. For example, someone currently holding the September 2015 10-Year T-Note Futures contract may roll into the December 2015 as the September maturity approaches.

Now, because the holder of a fixed income futures contract does not receive any yield, a potential arbitrage opportunity can arise.

An investor could theoretically short 10-year note futures, borrow the money to buy a 10-year note, collect the yield from the note, pay the short-term interest on the borrowed money, and deliver the note against the short futures position at maturity.

In this scenario, the spread between the 10-year note’s yield and the short-term interest from borrowing is our arbitrage.

To prevent this, fixed income futures contracts further out typically trade at a discount to those nearer to maturity. How much is the discount? The spread between the 10-year note’s yield and the cost of financing.

So if we tried the arbitrage we’d end up net neutral or potentially net negative after trading costs because the negative roll yield would cancel out with the spread we earned on our 10-year note minus the cost of financing.

As long as the yield from the note is greater than the cost of financing (i.e. 10-year rates > repo rates), investors that are long futures contracts benefit from this roll yield.

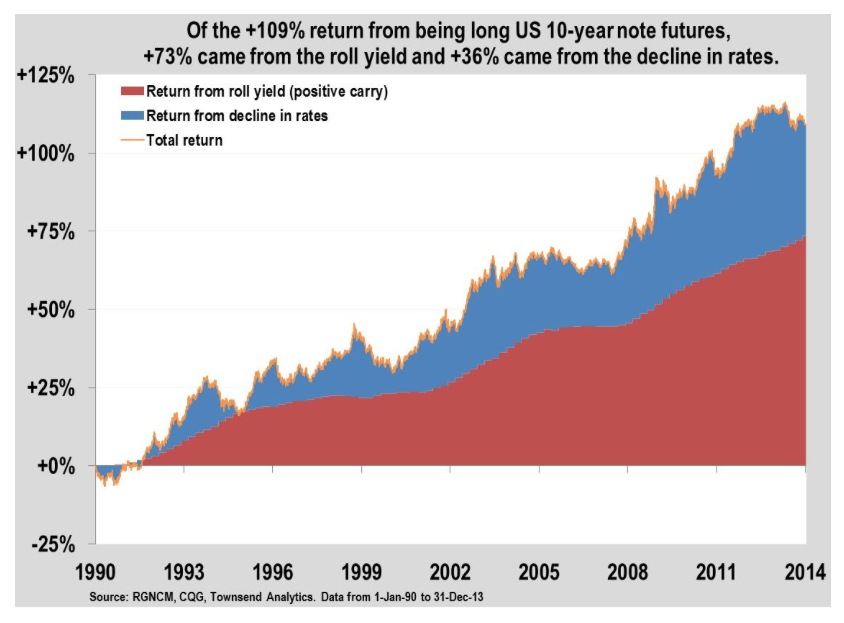

How beneficial was this roll yield in the past? A research paper from Roy Niederhoffer and Coen Weddenpohl estimates close to 2/3rds of a “buy and hold” strategy in fixed income futures comes from this roll yield.

Which is terrible, terrible news for those looking to short these contracts. In fact, this is bad news for anyone looking to short fixed income generally since we have to pay, instead of receive, the income: be it in the actual coupon or in futures roll yield. And that can get quite expensive.

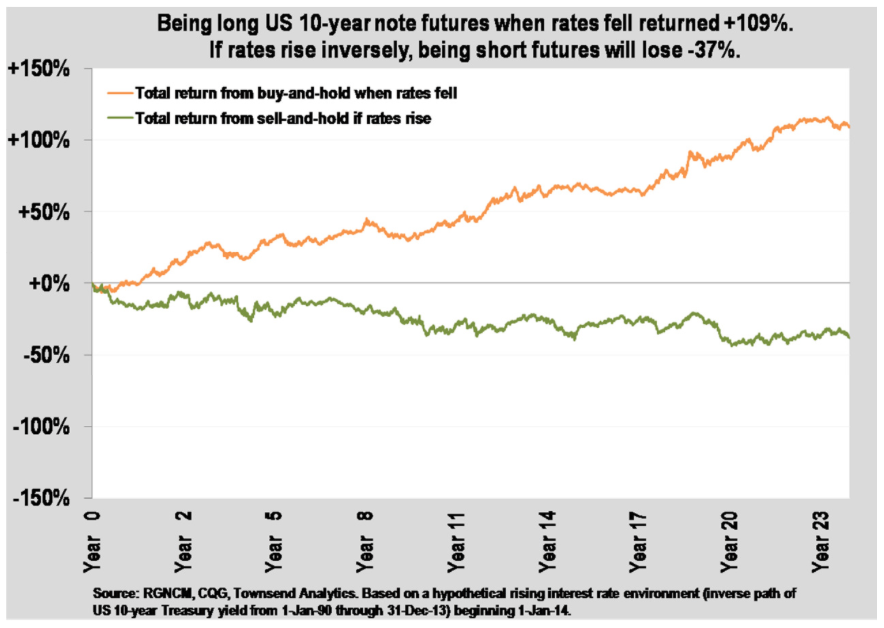

In the same paper, Niederhoffer and Weddenpohl show that even if rates took the exact reverse path – climbing over the next 25 years – a “short and hold” position would still be unprofitable because of this negative roll yield effect.

So in the case of rising rates, sell-and-hold is not the opposite of buy-and-hold.

This is exactly why we’ve said in the past that tactical fixed income is so different than tactical equity. The income component makes up a significant piece of total return and cannot be ignored.

It may get worse. In a rising rate environment, CTAs are stuck between a rock and a hard place: losing money on the direction of rates if they are long and losing money on roll-yield if they are short. So they may just sit on the sidelines.

Being out of fixed income means that they won’t benefit from any flight-to-quality that may occur during an equity crash.

In other words, in a rising rate environment, with reduced positions in fixed income futures, the correlation between CTAs and equity indices may actually increase.

Now we do not necessarily believe that rates will rise in the exact inverse manner of the descending path they took over the prior 30 years – but we believe this analysis highlights an important point: profiting in a rising rate environment is difficult.

At Newfound, we believe in a more rotational approach to managing rising rate risk. Instead of shorting – which can be extremely costly – or sitting on the sidelines – which has a high opportunity cost – we believe in relying on momentum to help us identify areas of strength that can allow us to benefit from yield tailwinds while seeking to minimize the price impact of rising rates.

If you’d like to learn more, please read our white paper Why Tactical Fixed Income Is Different.

Copyright © Newfound Research