by James Picerno, Capital Spectator

How’s your globally diversified strategy faring these days? Having a tough time? You’re not alone–the headwinds are fierce. For the first time in recent memory, the overwhelming majority of the major asset classes are in the red on a trailing one-year basis. As a result, broadly defined asset allocation strategies are suffering, at least relative to the stellar numbers in recent years.

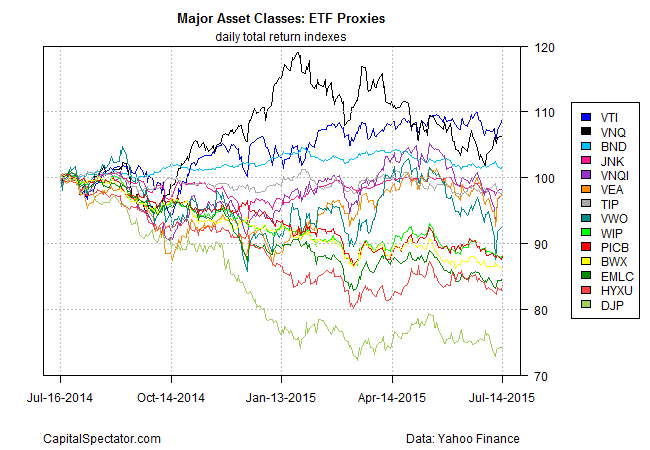

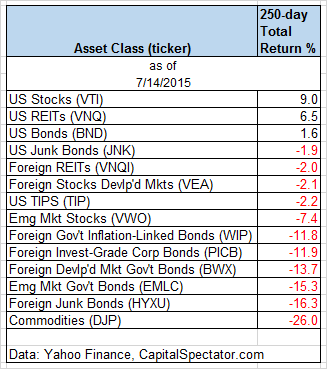

Using a set of ETF proxies for the trailing 250-day (1 year) total return, only US stocks, US REITs (real estate investment trusts), and US bonds (broadly defined) are posting gains among the major asset classes. By contrast, the other 11 asset classes are in varying states of loss over that period.

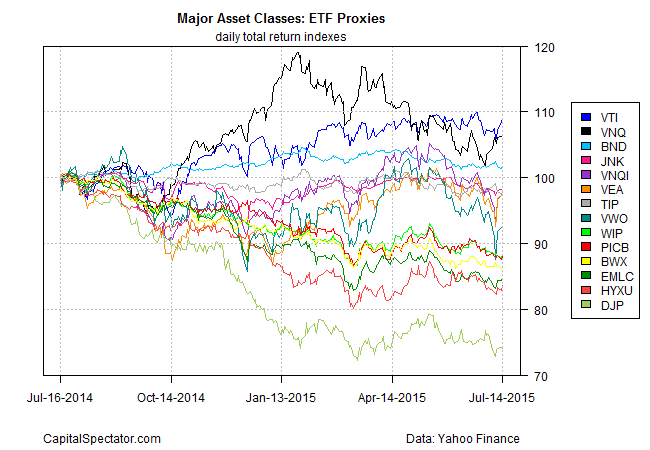

Here’s another view by indexing all the ETFs to 100 as of July 16, 2014… ouch!

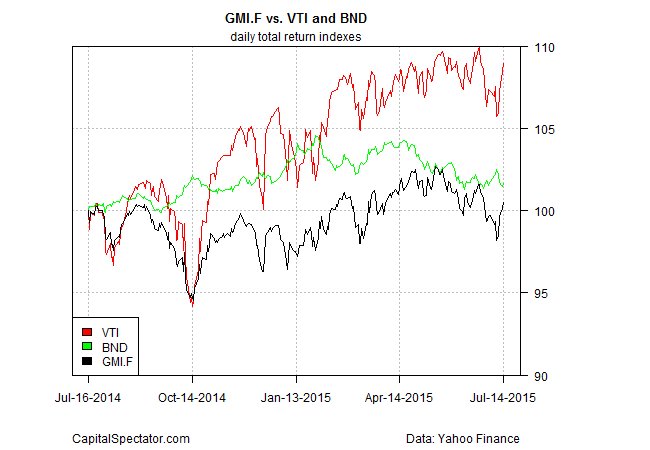

Given the current environment, it’s no surprise that a broadly defined asset class strategy has stumbled lately. For instance, consider an ETF-based version of an unmanaged, market-value-weighted mix of all the major asset classes — the Global Market Index Fund, or GMI.F, which holds all the ETFs in the table above. Here’s how GMI.F stacks up for the past 250 trading days through yesterday (July 14, 2015). This investable strategy is ahead by less than 1% over that span — below the performance for US stocks (VTI) and US bonds (BND).

Is GMI’s diminished performance surprising? Maybe, but only if you weren’t paying attention. Risk premia projections for GMI have been relatively soft for some time (see this month’s update, for instance) — after several years of hefty gains for GMI and equivalent strategies. The lesson, of course, is that mean reversion is alive and well when it comes to market (and portfolio strategy) returns.

Copyright © Capital Spectator