by William Smead, Smead Capital Management

As value stock picking managers, we assume we will be operating in a bifurcated equity environment. We think the bifurcation will be between sectors of the stock market which appear over-capitalized due to “rear-view mirror” success and those which look undervalued when considering the present value of their future income stream. The combination of numerous forces, both positive and negative, will most likely create this bifurcation.

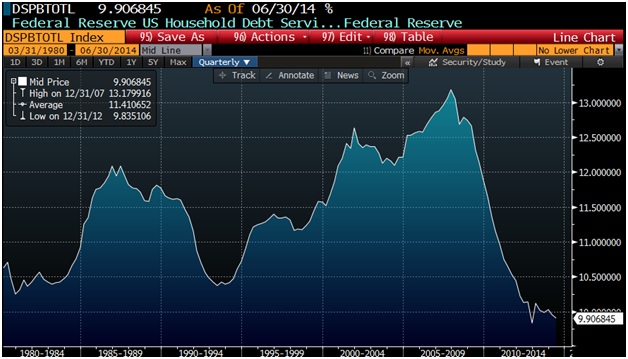

The strongest of the positive forces we see are historically-low interest rates, a continuing bear market in commodities like oil, the most favorable household debt service ratio (HSDR) of the last 35 years and a huge population group between the ages of 22 and 32 years old.

The strongest of the negative forces in our eyes are the strong U.S. dollar, slowing growth in China, the long-term bear market in commodities like oil and the over-capitalization of small-cap stocks/private equity/alternatives investments, which dominate many of the largest institutional and high-net-worth individual portfolios.

Positive Bifurcation: Dramatically Better U.S. Economy

We believe the biggest change in the U.S. investment markets in the next year could be the coming rampage to buy houses among first-time homebuyers. Homes are historically affordable, interest rates are the lowest and best in my lifetime, and an avalanche of echo-boomer buyers are likely to assault this market. Here is what Warren Buffett told a Fortune Magazine Conference on October 7, 2014:

“You would think that people would be lining up now to get mortgages to buy a home,” Buffett said today at a conference hosted by Fortune magazine in Laguna Niguel, California. “It’s a good way to go short the dollar, short interest rates. It is a no-brainer. But so far home construction pickup has been slower than I had anticipated.”

This has not happened yet, and because it hasn’t happened, few stock picking organizations are willing to be lonely in their stock selections in order to benefit from a potential onslaught of home buying. Much like investing in oil stocks at their bottom in 1999-2003, there just aren’t many companies which are publicly-traded and fit our eight criteria for stock selection. You want to talk about lonely, residential real estate only contributed 3% of U.S. GDP so far in 2014.

In 1960 there were 160 million people counted in the U.S. census. The worst single year of housing starts in the following decade was one million starts. We have 315 million people in the U.S. today and we are starting fewer than one million this year. In our portfolio, Berkshire Hathaway (BRK.B), NVR (NVR), Home Depot (HD), HR Block (HRB), Comcast (CMCSK) and the major banks Bank of America (BAC), Wells Fargo (WFC), and JP Morgan (JPM) are companies we expect will benefit greatly from a massive pickup in home building in the U.S.

BRK.B does everything from residential real estate brokerage to carpets to paint. NVR is the nation’s fifth-largest homebuilder and gets 80% of their sales in the starter home category. Home Depot’s participation is fairly obvious and builds on terrific performance even before the first-time buyers show up. HRB prepares tax returns for many blue-collar workers whose employment and wages would be positively affected by housing. When folks form a household of their own, they are much more likely to pay for monthly internet access and watch more TV via Comcast. This is especially true for parents of a couple of toddlers, who are running around the house in the evening. The majority of the mortgage loans are likely to be provided by the three largest lenders BAC, WFC and JPM. Buffett went on to explain why he is still optimistic this will happen:

“Household formation falls off dramatically in a recession, at least initially,” he said. “But that doesn’t last long. Hormones kick in and in-laws get tiresome, too.”

Our economic recovery has been so anemic from 2009 to today that it has had the same impact on home buyers as a recession. Anecdotally, look around you. Today’s children are being born to couples who no-doubt will want their kids playing in their own yard soon enough.

Gasoline futures have fallen over 90 cents from June 20, 2014 to October 17, 2014. This is a massive tax cut to the average household in the U.S. and a creator of psychological confidence. We have held on to our over-weighted position in consumer discretionary companies despite the respite they have taken during the last year. If you put an extra $100 per month into the wallet of the average consumer, it could positively affect purchases at eBay (EBAY), Disney (DIS), Nordstrom (JWN) and Cabela’s (CAB). This is not the only reason to be excited about the U.S. consumer. American consumers are operating the farthest inside their means in 35 years, and if their confidence gets boosted by home building and lower gasoline prices, we think you could see a meaningful pickup in consumer confidence and related activity. See the chart below:

We likely won’t be interested in reducing our over-weighted position in what we call our “addicted-customer-base” consumer discretionary companies until household debt service returns to 11.5-12% of household gross income. This level served as a warning over the last 35 years. We are a long way from there as recent government statistics show U.S. household savings reached 5.6% of gross income over the summer of 2014, even as the U.S. economy improved. The low for the savings rate was 2.2% in the third quarter of 2005.

Negative Bifurcation: Out with the Globally Synchronized Trade

A strong U.S. dollar, a recession in China and a bear market in commodities led by oil are the exact opposite of what happened from 2000-2010. What did well in that stretch were U.S. small-cap stocks, commodities, emerging market equities, U.S.-based multinational companies connected to emerging markets, and alternative investments.

We believe we are in a seven to ten-year bear market in commodities driven at the margin by an over-supply of and weakening demand for oil and gas. Americans have taught themselves to use less gasoline and the Chinese economy is being forced away from its commodity-heavy reliance on fixed-asset investments. This movement comes while China is making another effort to avoid a bust like we had in the U.S. in 2007-09. Energy is 35% of most commodity indexes and an important expense in the creation of most of the other commodities.

The S&P 500 Index is loaded with companies which did well from 2000-2010 and are likely to be directly affected by these negative forces. We suggest they be avoided and we are avoiding them in our portfolio. At the end of a cycle, indexes have a tendency to be over-weighted in what did well the prior ten years, because they are “market-cap” weighted. We like to look at charts of the winners and losers since Japan began to weaken their currency versus the U.S. dollar in October of 2012. Commodities have had a very hard time since then as have emerging market equities. We believe it is a good picture of the next five to ten years for determining winners and losers because it won’t just be the Yen which could go down a great deal among currencies, if the U.S. economy performs much better than most experts forecast.

Our portfolio currently owns no energy, basic materials and heavy industrial stocks. We are also under-weight consumer staples, which along with energy, basic material and heavy industrial stocks get a big part of their revenue and saw a big part of their past ten-year growth come from China-led emerging markets.

In conclusion, we are expecting an opportunity for Main Street to beat Wall Street, for domestically-oriented companies to beat ones with large foreign revenue, and for U.S. domestically-oriented large-caps to outperform both large peers and small-caps overall. This is the bifurcation we envision over the next five years.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management