by Vadim Zlotnikov, AllianceBernstein

Is innovation dead or are we on the cusp of new technological revolutions? Without resolving this epic debate, we believe that market conditions today are conducive to investing in companies with disruptive potential, but it takes a sober approach to find big dreams that can deliver big returns.

For investors, innovation is important because it often drives productivity improvements and higher profit margins. From 2000 to 2008, US productivity declined sharply. Yet even then, there was evidence that innovation created value. According to one academic study, innovation-focused countries that issued high numbers of patents and spent aggressively on research and development (R&D) between 2006 and 2008 boosted productivity in 2009.1

In recent years, productivity has broadly improved. Meanwhile, there is now a wide dispersion of long-term earnings growth forecasts. We interpret this as a sign that analysts think earnings of a few, select companies are poised for a prolonged departure from historical levels. In other words, analysts believe there are big dreams in the market that could trigger disruption and boost profitability.

When Dreams Become Nightmares

Market dreams don’t always have happy endings. During the Nifty Fifty years in the 1960s and 1970s, it was widely believed that the largest companies would grow forever. More recently, visions of another 20 years of explosive emerging-market and commodities growth were quite common.

So is there really a point to investing in dreams? We think so—but beware of fantasies. Even though the tech bubble has made people wary of the “next big thing,” we think there are still disruptive technologies out there that can generate productivity gains when they reach the market.

Personalization Revolution Is Developing

Information technology is a case in point. According to a study by Bernstein’s semiconductor team, Moore’s Law—which stipulates that the processing power of silicon chips doubles every two years or so—is set to continue for the next 20–30 years.

Beyond semiconductors, a recent McKinsey study has identified several areas that could disrupt our current world order over the next decade, from self-driving vehicles to robotics and cloud technology.2 We see a common thread to the current wave of innovation: customization and personalization of products and services. Whether it’s a tailored medical treatment based on your genetic makeup or a personalized online shopping experience, new technology is increasingly finding ways to tap into individual needs and preferences. But where should investors begin?

R&D Patterns Are Insightful

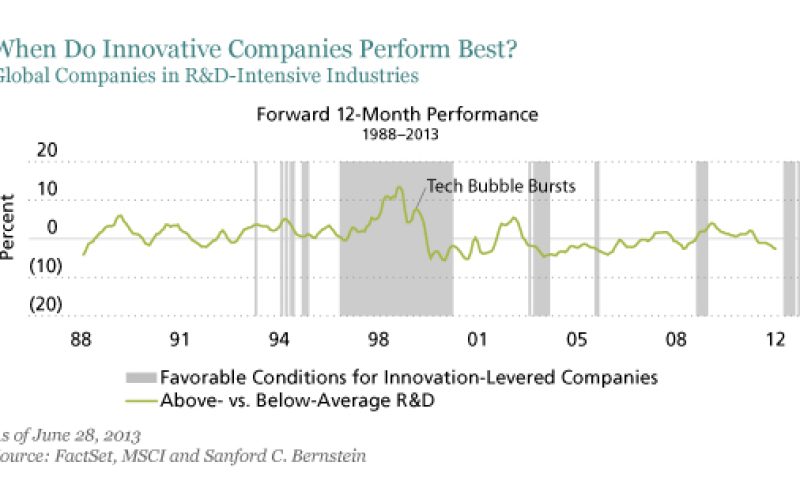

Start by looking at R&D patterns. About 40% of industries are R&D intensive, devoting more than 2% of sales to R&D. And companies that invest in R&D more than their industry average tend to deliver greater profit growth and better returns, according to our research (Display).

The problem is that the benefits of above-average R&D spending tend to be highly episodic (Display). For example, after the tech bubble, stocks of companies with higher-than-average R&D spending underperformed dramatically.

The good news is that we can also identify periods in which big R&D spenders did well. In those periods, three key conditions prevailed: first, R&D-to-sales ratios were increasing sharply. Second, estimated long-term growth rates were rising significantly. And third, the spread between high and moderate long-term growth rates was wide—meaning there were dreams to be captured. Today, all three conditions exist, so it’s probably a good time to invest in innovation.

Identifying Industries and Companies

Our research suggests that increasing R&D-to-sales ratios for a given industry tends to lead to favorable performance. The challenge is to find industries where innovation is most likely to be rewarded, but are not crowded because of a high proportion of favorable analyst ratings.

At the individual company level, a combination of a premium price/book valuation, rising return on equity and increasing R&D-to-sales is often a good sign of an R&D-intensive stock with promising return potential. So on average, it is better to look for companies willing to commit R&D resources in fast-growing market areas, rather than to look for a single “game-changing” company in a mature sector.

1. B.H. Hall, Innovation and Productivity (National Bureau of Economic Research, June 2011).

2. McKinsey Global Institute, Disruptive Technologies: Advances That Will Transform Life, Business and the Global Economy (May 2013).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist for AllianceBernstein.

Copyright © AllianceBernstein