by Don Vialoux, EquityClock.com

Upcoming US Events for Today:

- Quadruple Witching

Upcoming International Events for Today:

- Canadian Consumer Price index for August will be released at 8:30am EST. The market expects a year-over-year increase of 1.3%, consistent with the previous report. Core CPI is expected to show an increase of 1.6% versus 1.7% previous.

The Markets

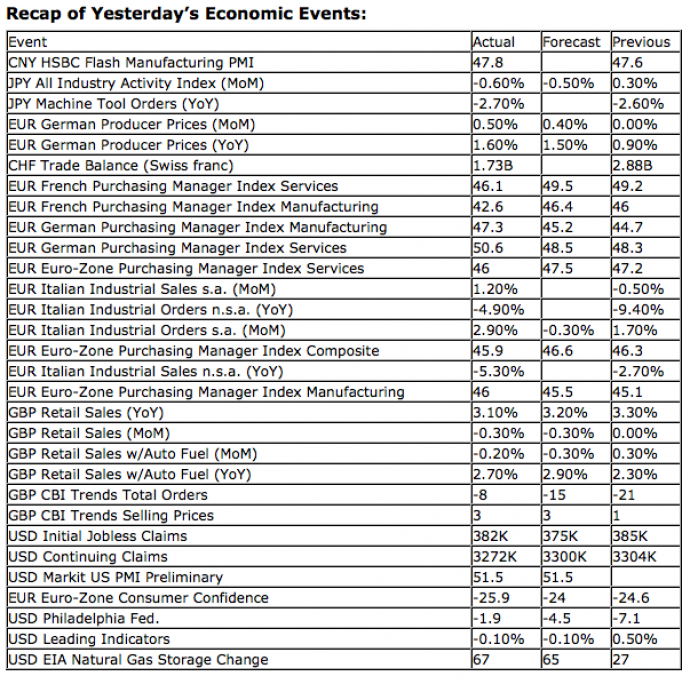

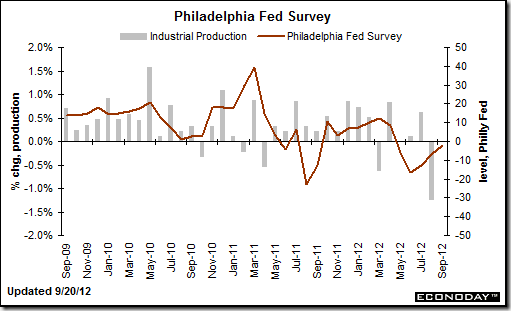

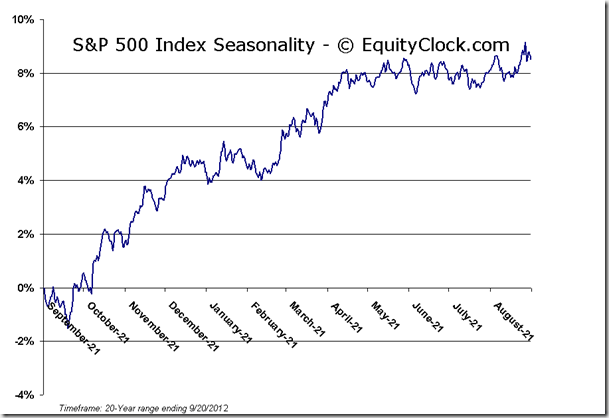

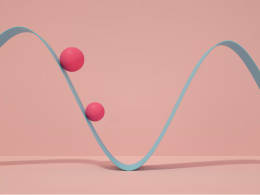

Markets ended around the flatline on Thursday as manufacturing numbers from Europe and China weighed on investor confidence. Manufacturing PMI data in China and Europe remains below 50, a level that marks the dividing line between expansion and contraction. US manufacturing data did not fare much better with the Philadelphia Fed Index remaining below zero at –1.9, although an improvement from the last report at –7.1. October typically marks an important low on a seasonal basis for manufacturing. Improvement in manufacturing data between October through to June is typical, influencing strength in the economy and equity markets in the process.

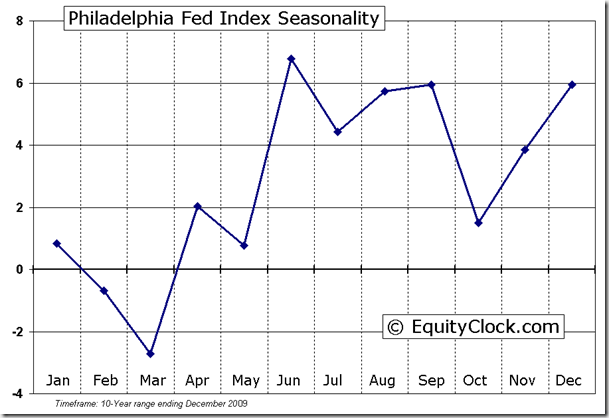

Gold has received a bit of attention of over the last couple of days as a significant technical event leads to speculation of further gains ahead. The price of bullion has produced a Golden Cross, whereby the 50-day moving average crosses above the 200-day, suggesting improving intermediate-term strength. But aside from this upbeat technical achievement, the price of the metal has met up with trend-line resistance around the 1780 level. The level of resistance stretches back to highs last seen around this time last year and provides indication of reluctance to buy the precious metal at levels near $1800 an ounce. The price of gold is significantly overbought and sufficiently stretched away from significant moving averages, such as the 50-day, that the probability of a pullback over the short-term is high. Seasonal tendencies for Gold temporarily turn negative in the month of October before resuming an upward trend into the end of the year.

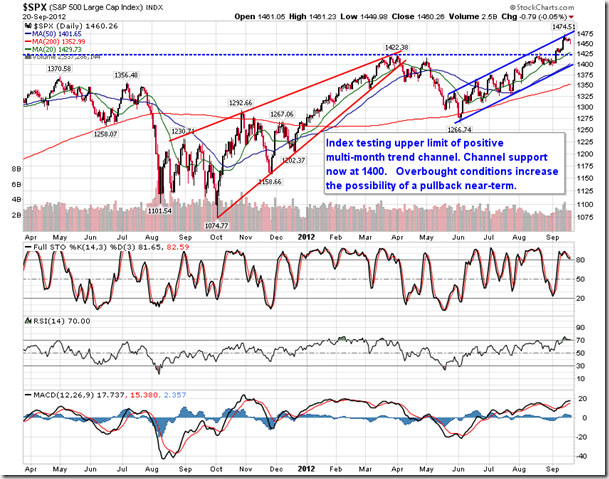

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.85. Today is Quadruple Witching, the day on which contracts for stock index futures, stock index options, stock options and single stock futures all expire. Trading activity during the week to follow September expiration is known to have a negative bias with 16 of the last 21 periods showing a negative outcome for the Dow Jones Industrial Average.

Chart Courtesy of StockCharts.com

Chart Courtesy StockCharts.com

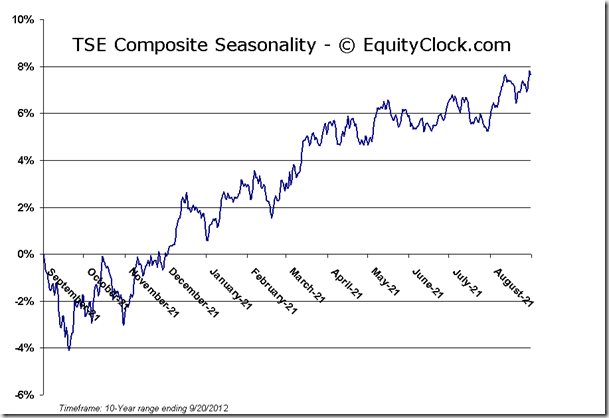

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.64 (up 0.16%)

- Closing NAV/Unit: $12.67 (up 0.18%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 4.02% | 26.7% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Copyright © EquityClock.com