by Bryce Coward, CFA, Gavekal Capital

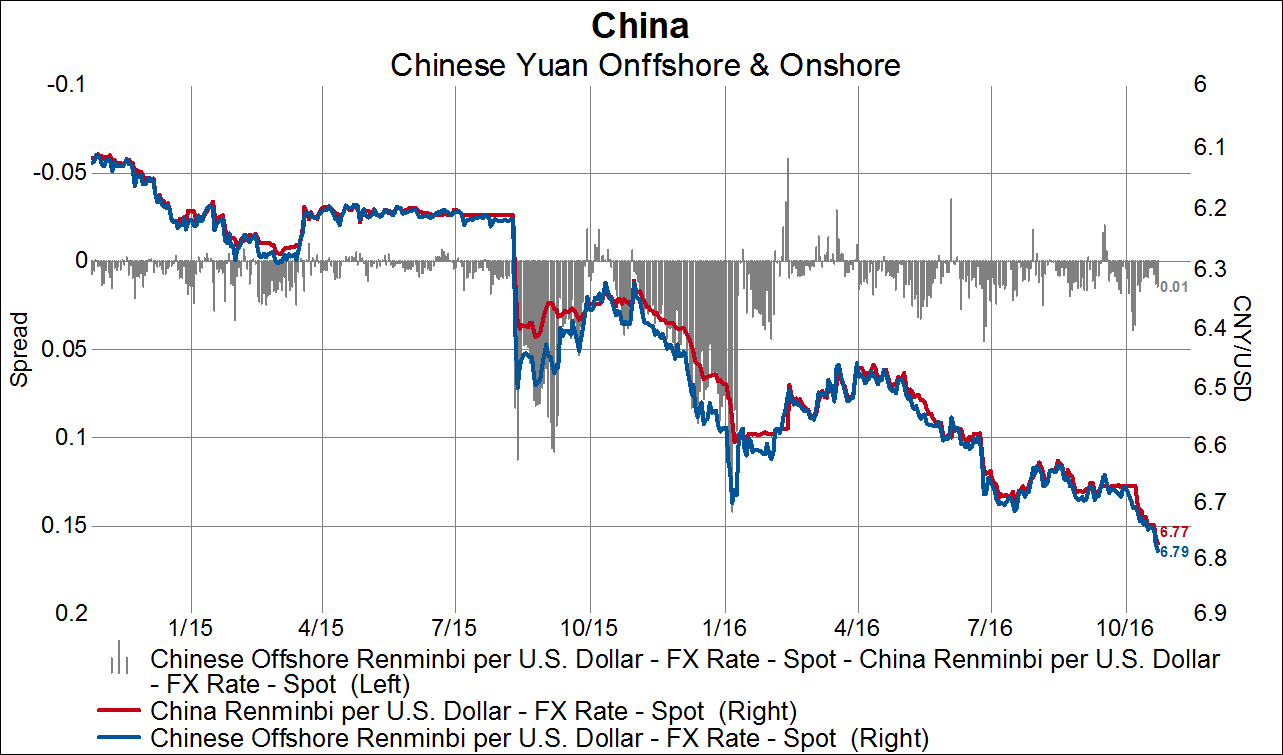

Over the last several weeks Eric has been exploring the implications of a further decline in the yuan here and here, and the falling yuan was also a big part of our recent quarterly. A falling yuan is associated with a dampening of economic activity outside of China and heightened downside volatility in the markets as the beggar thy neighbor policy feeds through the transmission mechanisms to benefit China at the expense of its trading partners. Yet, in recent weeks the yuan has decisively continued its slide and no one has seemed to notice or care. Indeed, China itself appears to be supporting the downside breakout through its manipulation – or lack thereof – of the Hong Kong traded CNH hibor rates. What do we mean by that? The direction of the yuan is somewhat determined by the spread between the offshore trade yuan (CNH) and the onshore traded yuan (CNY). The mostly freely traded CNH gives market participants queues as to the directional movements of the onshore rate and a negative spread between the two spot rates (CNH trading lower than CNY) implies depreciation pressure on CNY. As the grey bars in chart two below show, the offshore rate has been trading at a discount to the onshore rate pretty much all the time since mid-2015, except when the yuan periodically stabilizes.

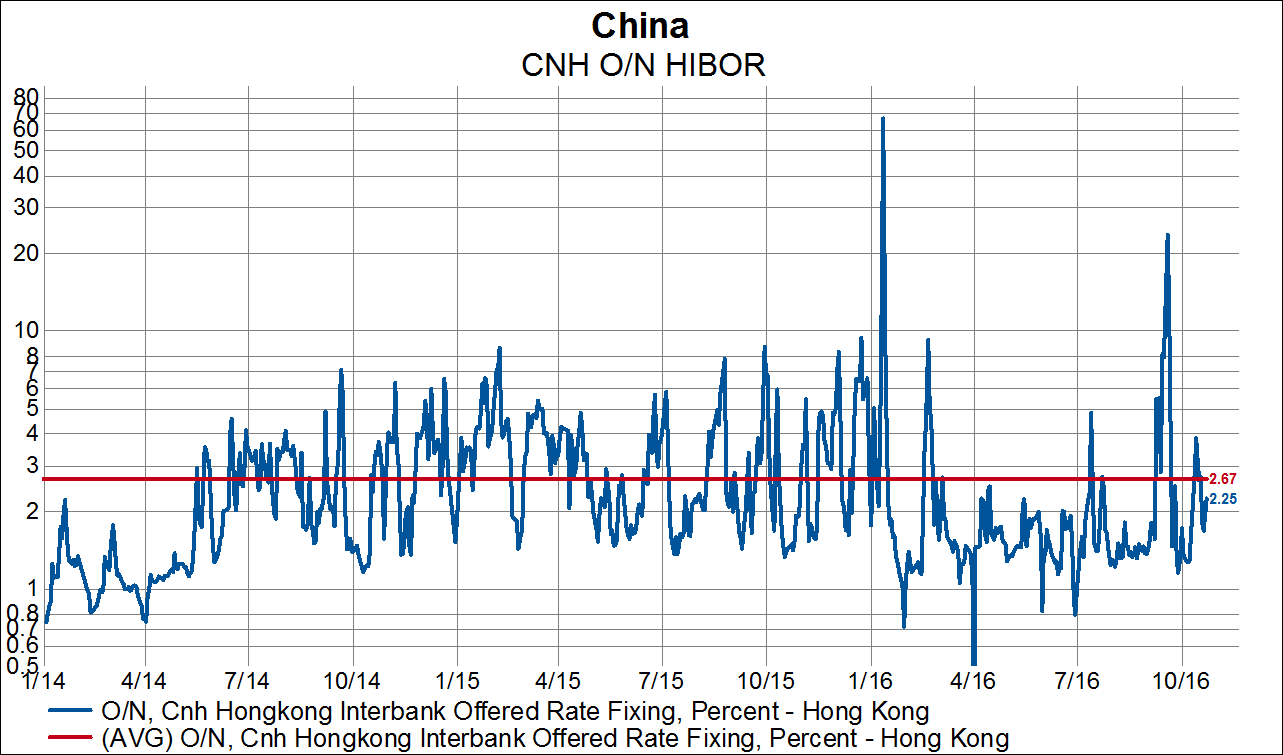

So what can China do about the CNH-CNY spread to influence the CNY spot price? To answer that question we have to back up and first recognize that the spot CNH is partially a function of the interest rate holders of CNH receive. A higher interest rate paid on CNH deposits will create demand for CNH, all else equal. So China, through state-directed edict, has the ability to influence the interest rate paid on CNH deposits by having Chinese banks raise or lower the interbank overnight lending rate, CNH hibor. Again, a higher CNH hibor rate should translate into a firmer yuan and vice versa.

So where are we today? As chart three below shows, overnight CNH hibor rates are below average. When China really wants to stop the CNY from falling it will manufacture extremely elevated overnight lending rates, as we saw in September and January of this year. Below average over night lending rates imply that China is perfectly happy with the directional move lower in the yuan, and by extension the economic benefits that accrue to it relative to its trading partners.

Copyright © Gavekal Capital