Key Points

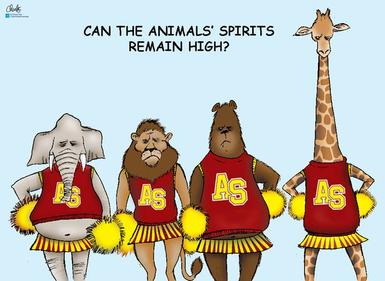

- Corporate and consumer “animal spirits” may come under pressure from trade uncertainty, tightening financial conditions, slowing earnings growth as the impact of tax cuts fades, and financial market volatility.

- The tight labor market has put increased pressure on wage growth, which could compress corporate profit margins and lead to higher interest rates. Additional U.S. dollar strength and continued market volatility could further strain financial conditions.

- Economic data in “level” terms remain healthy, but 2019 will increasingly see “rate of change” deterioration. Remember my well-worn adage: “When it comes to the relationship between economic fundamentals and stock prices, better or worse matters more than good or bad.”

Animal spirits sustainable?

U.S. economic growth was strong in 2018, but some of the forces behind that strength were either short-term or likely to fade going forward. We expect U.S. economic growth to slow in 2019, with the risk of a recession rising. Trade friction, which remains an uncertainty heading into 2019, could be an important indicator of the length of runway between now and the next recession.

There has been a relatively unprecedented gap between consistently better-than-expected “soft” economic data (survey- and confidence-based) and worse-than-expected “hard” economic data (quantifiable metrics). Soft data have been supported by persistently strong business and consumer confidence, but a risk heading into 2019 is that animal spirits could fade.

Liquidity tide is heading out

Market volatility is a 2018 theme that is likely to persist in 2019. After a decade of unprecedented liquidity provision courtesy of the Federal Reserve, liquidity is draining out of the system as the Fed and other central banks move toward tighter monetary policy.

Earnings growth likely will decelerate sharply in 2019, as year-over-year comparisons become more challenging in light of the tax-cut-related boost to earnings in 2018. Continued U.S. dollar strength and the impact of trade tariffs could be additional headwinds for earnings, even though stock valuations have become more reasonable.

Investor sentiment is likely to swing in a wider range in 2019 assuming volatility persists, although the bouts of excessive optimism seen in 2018 likely will fade.

Takeaways

- Discipline around diversification and rebalancing will be important in 2019. Recession risk is rising, and stocks historically have posted their weakest performance during the six months leading up to recessions.

- Stocks’ historically strong post-midterm-election performance trend is a tailwind, but trade uncertainty and/or the political landscape could serve as offsetting headwinds.

- “Rolling” or “stealth” bear markets—in which certain stocks or market sectors fall into bear territory, even if the overall market isn’t—may continue in 2019 as sectors and asset classes continue to reprice for receding global liquidity.

Copyright © Charles Schwab & Company