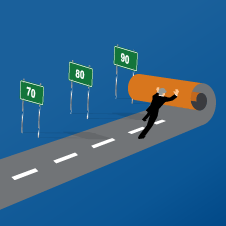

When I was in high school, I worked as a lifeguard. I loved the job, but I was always aware of the enormous responsibility that came with it. I found the key to success was to anticipate trouble before it happened – to watch swimmers for any early signs of distress before they ever came close to drowning. Today, I see similarities between lifeguards and policy-makers such as the U.S. Federal Reserve (Fed), which must try to anticipate economic downturns before they start. For the past several weeks, I have written in my blog that signs of a global slowdown are starting to appear. The good news is that policy-makers appear to be reacting to those early signs – which I believe could help spur a “Santa Pause” rally for markets.

The Fed takes a more dovish tone

First came the November 28 speech by Fed Chair Jay Powell at the Economics Club of New York. The S&P 500 Index and the Dow Jones Industrial Average rallied because he took a far more dovish tone than he did just a month ago; in fact, his words were a powerful “about-face” from his comments early in October. In those earlier comments, he said the Fed was “a long way from neutral,” and, not surprisingly, these two indices fell on those remarks. Last week he said he believes rates are “just below” neutral, which sent them upward.

Some have criticized the market reaction, pointing out that Powell was just being “factual” by stating that current rates are just below the low end of the neutral range. However, that’s not what he said in October. What he did last week was to essentially support and underscore Fed Vice Chair Richard Clarida’s recent comments, in which Clarida stated that rates are close to neutral. In Powell’s speech, he explained that “our gradual pace of raising interest rates has been an exercise in balancing risks.” Powell’s words generally support the dovish comments heard from several Federal Open Market Committee (FOMC) participants over the past few weeks.

Then came the release of the minutes from the November meeting of the FOMC, which is the policy-making arm of the Fed. While the FOMC still has a positive view of the economy, it is beginning to worry about tariffs and debt. The FOMC believes it will be appropriate, if current conditions persist, to remove the language from its post-meeting statement that suggests further rate hikes are appropriate. Many FOMC participants agreed that “monetary policy was not on a pre-set course” and that “the stance of policy should be importantly guided by incoming data,” reiterating Clarida’s previous assurances that the Fed remains data dependent. This past weekend, Dallas Fed President Richard Kaplan was very clear in his assessment that global growth is softening, and that there are signs of weakness appearing in sectors sensitive to higher interest rates. His message was clear: The Fed should not be on a pre-set course for rate hikes and should instead be patient and cautious.

In other words, the Fed is a vigilant lifeguard sitting on the edge of its chair, watching for signs of trouble and willing to alter its actions to prevent problems.

Outside of the Fed, reactions to the data are varied

It’s not just the Fed that seems to be reacting to signs of an economic downturn. It seems that U.S. President Donald Trump’s administration is also willing to at least temporarily alter its trade policy in light of recent economic data that is weaker. Admittedly, I was very worried about the meeting between Trump and Chinese President Xi Jinping on the sidelines of the G20 meeting. That was especially so once I heard that Pete Navarro, the Director of Trade and Industrial Policy at the White House, would be attending the dinner. Navarro has written numerous books that are very critical of China, and bringing him to U.S.-Sino trade talks, in my view, was like bringing your mother-in-law to marriage counselling — there is unlikely to be an amicable outcome. However, the U.S. delegation must have been spooked by recent developments – particularly General Motors’ announcement that it would be closing plants – because they agreed to a moratorium on tariff increases in exchange for an agreement by China to buy some additional goods from the U.S. as well as an agreement by China to reduce auto tariffs on U.S. imports, according to the U.S.

In my view, this is terrific news for the stock market, which may celebrate for days. However, I would not assume that we won’t see an escalation in tensions in the future. The trade wars are on “pause,” but they don’t seem to be over just yet. But hopefully this is a sign that the U.S. will be taking into account economic data as it formulates its trade policies and conducts its negotiations going forward. In addition, as I suspected would happen, we are seeing a greater likelihood that Congress will seek to curtail Trump’s trade authority, most notably by Republican Senator Charles Grassley of Iowa. In a recent interview with U.S. news and information website Axios, Grassley said he would take a favourable view of legislation limiting the administration’s power to impose tariffs to protect national security (known as Section 232 authority).

Not all policy-makers have been as sensitive to weakening data. One institution that doesn’t seem too interested in reacting to recent data is the Bank of Korea. The Monetary Policy Committee voted last week to raise rates by 0.25 percentage points, following its 0.25 percentage-point rate hike a year ago. Korean export levels have begun to stagnate, and the employment situation has been lacklustre, with the likelihood of further weakening when a minimum wage increase is implemented next year. Perhaps the Bank of Korea will become more sensitive if data deteriorates enough. I think we are likely to see a rate cut in the next six months.

What could this mean for stocks?

In short, while I am not as sure that year-end spending will necessarily drive a Santa Claus rally for markets this year, I do expect a “Santa Pause” rally. Comments from Powell and other FOMC participants, along with the minutes from the FOMC meeting, suggest the Fed could hit the “pause” button for rate hikes at some point next year. This pushed stocks higher last week and may continue to propel markets higher going forward. And the U.S.-Sino agreement to hit the “pause” button on their trade dispute is already showing signs of propelling markets higher. This could be a good December for risk assets globally after all, given that the two key risks threatening markets seem to be in abeyance – at least temporarily.

What’s ahead for the week

As we look ahead, there are several things to watch:

1. Possible U.S. government shutdown. We are within a few days of a possible partial government shutdown in the U.S., and I believe there is still a strong possibility that it could occur. Given that it would be only a partial shutdown, I don’t believe it would have much impact, if any, on markets – especially given that the Fed pause and the tariff pause are creating double tailwinds for risk assets. However, investors will likely want to follow the situation closely.

2. OPEC meeting. Oil prices are up already on news of the U.S.-China trade truce, and are likely to go up further if OPEC announces production cuts at its upcoming meeting this week. Making the meeting more interesting is that Qatar is withdrawing from OPEC. The reasons are multifold: Qatar wants to focus on natural gas – perhaps a hint of times to come as reliance falls on crude oil as an energy source – but it also is reacting to the political and economic boycott of the country by Saudi Arabia and several of its allies. While Qatar’s departure from OPEC may be a lot easier to orchestrate than Brexit, it also carries with it significant ramifications given its role as a diplomatic and thoughtful OPEC member.

3. The U.S. employment situation report. This coming Friday, the November Employment Situation Report for the U.S. will be released. We will want to pay very close attention to the average hourly earnings number given what it may tell us about inflation. Wage growth in the October jobs report rose over 3% for the first time in years,† and I think we could see similar wage growth this month. Looking back at the beginning of this year, I believe that the January employment report’s average hourly earnings number that was released in February contributed to that month’s sell-off; similarly, the October jobs report’s average hourly earnings number that was released in November contributed to that month’s sell-off. I must underscore that Fed officials have made it clear that the Fed is data-dependent – which is not the same thing as being dovish. The Fed seems dovish because most recent data has been on the weak side. However, if data gets stronger (and a few very recent data points are pointing in that direction) or data indicates inflation is rising, then the Fed will need to become more hawkish in its pace of tightening. So, while markets rejoiced last week because it looked like the Fed may take its foot off the accelerator in 2019, that foot can get back on the accelerator rather quickly depending on data – such as average hourly earnings.

4. Brexit. The next two weeks will be critical as the U.K. prepares for a vote by Parliament on December 11 regarding Prime Minister Theresa May’s Brexit plan. Pressure is coming from all sides, as many members of her party have voiced opposition to the plan because they believe the U.K. should have a better Brexit deal than the one May has proposed. And then there are those in the U.K., including former Prime Minister Tony Blair, who would prefer to stay in the European Union and are advocating for another Brexit referendum vote. After all, May was forced to concede that Brexit in any form would initially leave Britain worse off than if it had remained in the EU. And so, the stakes are high. The Bank of England recently warned that a “no-deal” Brexit would result in the largest drop in national income since World War II, with particular vulnerability for home prices. If the parliament vote on May’s proposal fails, I would expect a second vote with a greater likelihood of passing. If a second vote fails, then there is a good likelihood that May’s government could collapse, in which case another Brexit referendum becomes more likely.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog