Will Energy Bonds Hold Up in a Volatile Oil Market? - Context

by Fixed Income AllianceBernstein

A dramatic fall in oil prices, followed by a sell-off in high-yield energy bonds—is it time to worry about oil and gas companies again? Quite the contrary. The North American issuers that make up most of the world’s high-yield energy market are in a better position today than they have been in years.

Investors with sweaty palms may be forgiven, however. The price of West Texas Intermediate (WTI) oil fell 16% over the past month, to $62 a barrel. The last energy crisis began in October 2014 with a 14% decline in oil prices in one month.

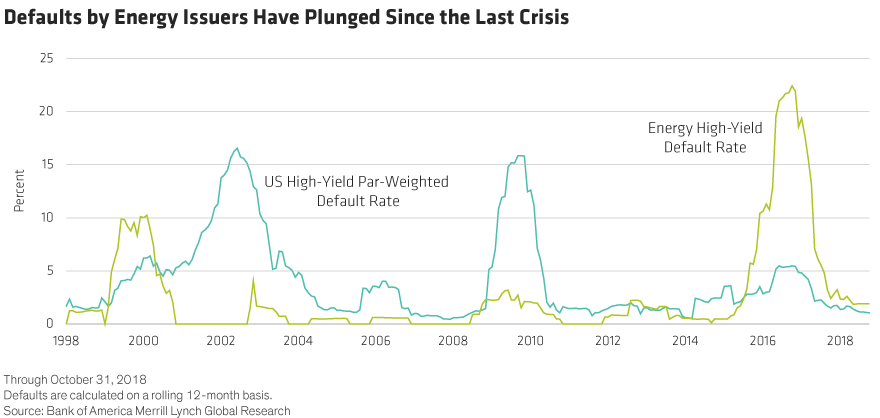

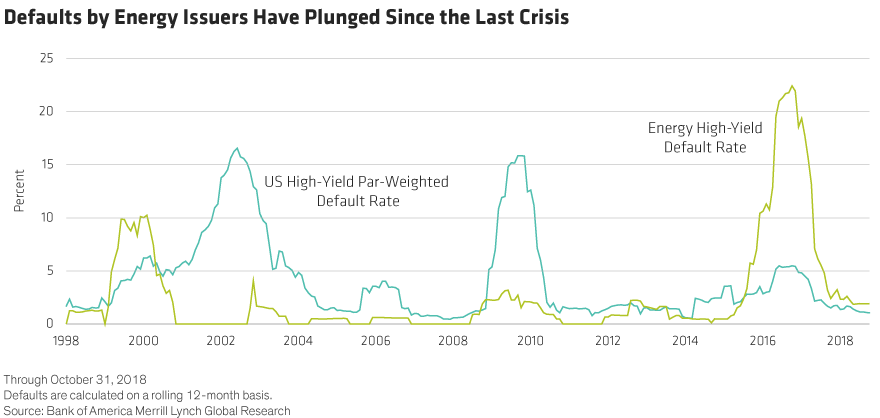

That crisis lasted two years. More than 100 energy companies went bankrupt, according to Haynes and Boone. And the share of borrowers that had missed a payment in the previous 12 months ballooned from 0.5% to 22% two years later in 2016 (Display 1).

But there are two reasons why investors should take a deep breath. First, the forces driving oil prices south this time are different than in 2014, and arguably less foreboding. More importantly, the fundamental quality of high-yield issuers has improved significantly, making the recent drop in oil prices less troubling.

Debt? Down. Profits? Up.

Just as a forest fire prunes the weakest trees and gives the sturdiest ones room to flourish, so the last energy crisis left only the strongest high-yield issuers standing. It’s also added stronger companies into the mix.

Sixty-nine bonds from 16 investment-grade issuers dropped into the high-yield category between October 2014 and the end of 2016. These “fallen angel” issuers now account for nearly a quarter of the high-yield energy sector. The good news there is that they have more diversified and higher-quality assets, more experienced management teams and lower production costs than many of their peers.

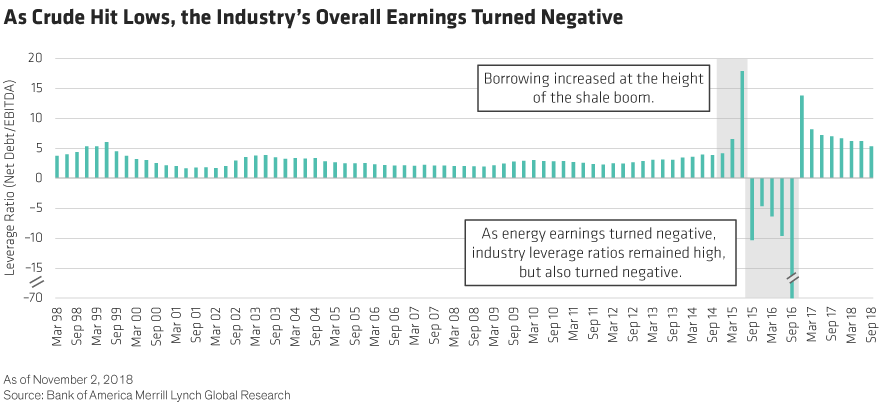

Original high-yield energy issuers have also cut costs and deleveraged since the crisis. Most of these companies had gone on a borrowing binge during the US shale oil boom that took off in 2009, when commodity prices were high. Overall net debt levels rose from $15.6 billion at the beginning of 1998 to $244 billion just before the 2014 sell-off. Unfortunately, much of this debt funded projects that were only profitable if oil prices stayed high. As WTI prices fell, industry net leverage ratios rose to 17.9 times earnings, leading to a large uptick in bankruptcies in 2016 and 2017.

The numbers have improved substantially since then. The default rate currently stands at 1.92%, while the total stock of energy debt is largely unchanged over the past three years. Rising profits and lower debt loads have pushed the leverage ratio back to 5.4 times earnings. While that is still on the high end of historical levels, we believe that the ratio will continue to shrink even if oil prices fall as much as 20% from their current levels (Display 2).

Just as importantly, many energy companies are adapting for the future. The United States is becoming a net exporter of natural gas, which should help alleviate the domestic overabundance that has weighed on prices. Energy companies are also investing in pipelines that will lower costs in the long term. Finally, the industry is consolidating, which could create even stronger companies going forward.

How Troubling Are These Oil Prices?

It’s unsettling to be invested in energy bonds when oil prices drop. But the important thing to consider is whether the decline represents a long-term shift in the global energy regime or a spate of volatility. Today, we believe it’s the latter.

After a long run-up in 2018, global oil prices hit a four-year high on October 3. They began falling amid general market jitters over the direction of global growth, US dollar strength and stock market weakness. Tensions among Europe, the United States and Saudi Arabia over the murder of a journalist at the Saudi Embassy in Turkey deepened the downward pressure.

Geopolitical trouble and complex economic concerns are everyday fodder for oil markets, unlike what happened in 2014. In October of that year, it became clear that Saudi Arabia was no longer willing to act as the world’s swing producer.

While there have been murmurs about a potential surplus in 2019, price declines are unlikely to be as severe or prolonged as when Saudi Arabia dug in its heels four years ago. And having cut costs, most high-yield energy issuers can remain profitable even if prices dip a bit lower. Besides, supply is only one half of the price equation. Global demand should rise over the next few decades as the middle-class expands in India and China.

The fact is, energy is one of the most attractive sectors for high-income investors, as spreads don’t yet reflect the industry’s progress in fixing the problems that had brought it to its knees. The spread on energy bonds on November 8 was 432 basis points, compared to 336 basis points for the rest of the high-yield market.

Speaking of the rest of the high-yield market, however, most issuers in other sectors would welcome lower oil and gas prices. It’s true that energy comprises a relatively large part of the high-yield universe at some 15%, but high-yield investors must consider that the effects of commodity price movements on their portfolios are likely to be complex in nature.

Even for investors with significant energy exposure, today’s volatility will likely prove to be little more than noise–provided they take the time to research which issuers are financially sound, have high-quality assets and are making smart investments for the future.

Copyright © AllianceBernstein