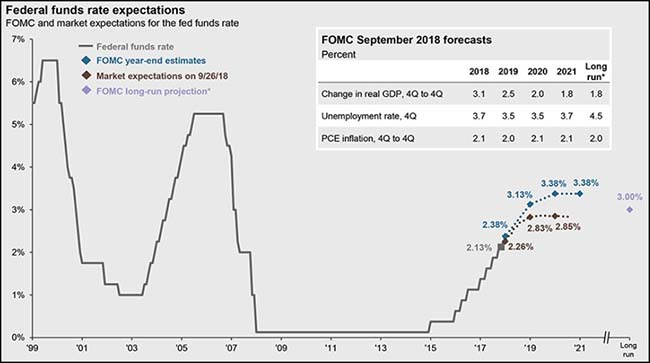

So what is your call? Is the Fed lagging behind in raising rates to cool the hot U.S. job market? Those were some ‘smoking hot’ job and wage numbers on Friday. Wonder how long the Fed thinks that the economy can keep adding 250,000 jobs without exponentially growing wage inflation? Safe to say that the Fed Fund rate hikes will continue at an upward pace until the economy cools. Good news for investors in cash. Potentially bad news for investors in most other assets. And very unfortunate news for borrowers.

As rates rise, the market remains in transition. Risk is coming out of the market as risk-free investors now have a 3% yielding alternative. Stocks are no longer rewarded for beating their earnings estimates. Market bounces are uninspiring and weak compared with the aggressive selloffs. The Oval Office’s own China trade deal remarks are now being met with market skepticism. Market-leading sectors and names have now failed and are reasons for concern as defensive stocks look to take a leadership role. After ten years of Growth stocks beating Value stocks, maybe it is finally time for a mean reversion. (Just go take a look at the list of 52-week highs today.) Apple was certainly no help to growth stocks with their earnings outlook which lowered iPhone expectations and also got rid of the metrics to track for the future. (Ignore what they said, less data provided is never a good sign.)

So here is where we sit. Financial conditions will get tighter. Stocks will continue to have a headwind as GDP growth slows and investors prefer the safety of 3% versus the risk of losing money. Investing in bonds won’t be a picnic as rates move higher due to a tight job market, and trade war inflation combined with a U.S. Treasury which needs to sell $300-400 billion each quarter to keep the U.S. operating. Credit conditions will likely weaken as the U.S. economy slows which would ripple through both the bond markets and the lending and banking system. The global economy needs a new spark. Until it arrives, watch, wait and don’t be in a rush to do much on the risk side. Better to turn up the radio and enjoy that slow ride behind the tractor until the road straightens out.

To receive this weekly briefing directly to your inbox, subscribe now.

How many months until portfolio managers are wearing full Saddlebags?

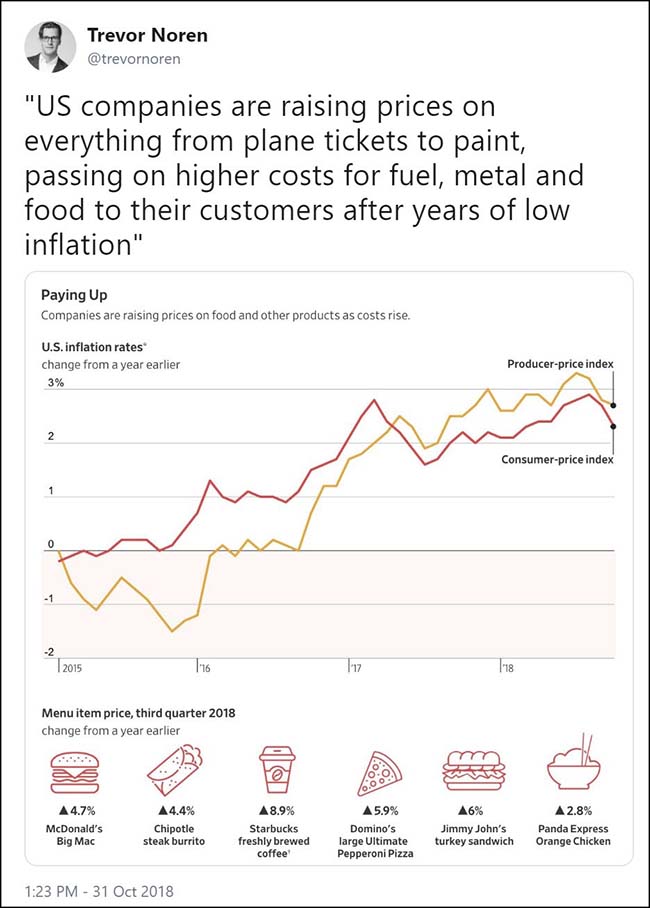

Take Friday’s wage gains, add in rising prices from the tariffs and you can see the beads of sweat forming on foreheads. Tom Wolfe would love it.

Although the latest wage number did benefit from an easy year-on-year comparison, it came on the heels of a 3.0% year-on-year rise in the Q3 employment cost index for private-sector wages and salaries excluding incentive-paid occupations, probably the single best indicator of US wage growth. Further increases in wage growth to the 3¼-3½% range are likely over the next year.

(Goldman Sachs)

And Morgan Stanley is correct to defend the Fed’s actions…

“The Fed is simply doing its job. With liquidity now being named the primary culprit for why all global asset markets are performing poorly, some are asking if the Fed is making a mistake. Even though we’ve been one of the loudest voices this year highlighting the risk of tightening financial conditions, we do not think the Fed is making a mistake. Given the exceptional strength in the US labor market and further projected rise in Core CPI, the Fed is simply doing its job and will not stop until there is a cooling in the jobs data, a financial accident, or both. Until then, they won’t—and, in our opinion, shouldn’t—back off.”

(Morgan Stanley)

As is the Wall Street Journal…

Robust hiring and wage gains last month leave the Federal Reserve all but certain to raise interest rates in December and on course to continue gradually lifting them next year.

Employers added 250,000 jobs in October, the Labor Department said Friday. Workers’ average hourly earnings rose 3.1% from a year earlier—the fastest growth since 2009—while the unemployment rate held at 3.7%, matching the lowest level in 49 years.

The figures show the labor market has continued to strengthen a decade into the second-longest expansion on record. This has happened despite cautious efforts by the Fed in recent years to prevent the economy from overheating by lifting short-term interest rates.

While rising wages and low unemployment are great news for workers, Fed officials worry that labor shortages could eventually drive up wages and prices enough to cause inflation to accelerate. That would force the central bank to raise interest rates more aggressively to keep inflation under control, potentially tipping the economy into recession.

(WSJ)

Average hourly earnings now has a three handle…

This is one of the strongest Employment reports we have seen in years. Strong headline gains in payrolls, strong labor force gains combined with increased participation and wage gains are at new recovery highs. The year over year average hourly earnings gain of 3.1% is the strongest increase since 2009. Not only are wage gains finally coming through, but they are occurring with job gains that are massive relative to the needs of the economy. This number will surely reinforce the FOMC’s thinking that they need to remain on the normalization path they have been on. Should a string of several months of reports this strong come together, then the Fed would actually have to consider tightening more aggressively.

(Jones Trading)

And the one year Treasury hits 2.70%…

A great risk-free alternative to every asset in your portfolio.

You might believe the Fed is behind the curve…

If so, then look at how behind the bond market is. Saddlebags is going to need another shirt change.

The stock market looks forward, not backward, and it doesn’t like what it sees…

Buoyed by an expanding domestic economy and a historic tax cut, corporate America is on track to report one of its most profitable quarters in years. Yet this earnings season has been marked by extreme reactions in share prices that have broken with the usual pattern. Members of the S&P 500 index are on track to report average earnings growth of 26.3 per cent for the third quarter of 2018 — the best pace since 2010, according to data from Refinitiv. More than three-quarters of those top American companies that have reported to date have exceeded analysts’ expectations, but the reaction when they have done so has been unexpected. The usual positive earnings surprise is greeted with a 1 per cent upward swing in a company’s share price, according to FactSet. As of Friday of last week, the average “earnings beat” this quarter had landed with a thud, sending the company’s stock down 1.5 per cent.

Meanwhile, companies are raising prices on everything…

(WSJ)

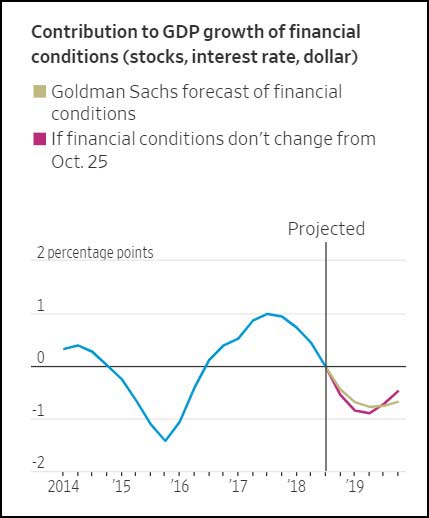

Not even 2007-08 had all three markets moving in the same direction at the same time…

Falling stocks, an expensive U.S. dollar and higher interest rates are now going to subtract from future GDP growth.

Stocks, bonds, interest rates and the dollar all influence economic performance. Rising stocks, for instance, encourage households to spend, while a cheap dollar helps exports and low interest rates boost housing. Economists at Goldman Sachs, who have compiled these financial conditions into a single index, estimate that easier financial conditions helped bolster growth throughout 2017, led by surging stocks. In 2018 that contribution ebbed, as stocks plateaued and then in recent weeks dropped. Combine flat to lower stocks with higher bond yields and a generally firm dollar, and Goldman estimates financial conditions are now subtracting from rather than adding to growth, and that drag will peak in mid-2019.

(WSJ)

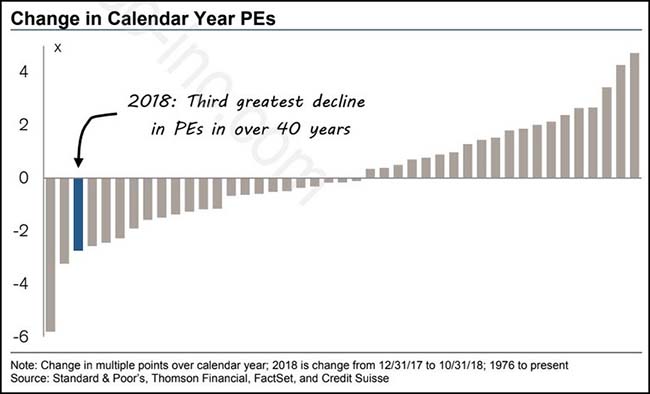

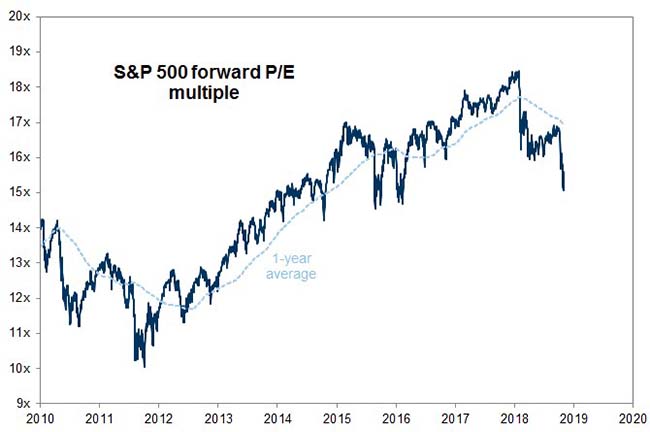

With the correction in the market, Goldman shows us the P/E multiple has returned to 2016 levels…

More interesting is that for 2018 the multiple decline has been among one of the worst in 40 years…

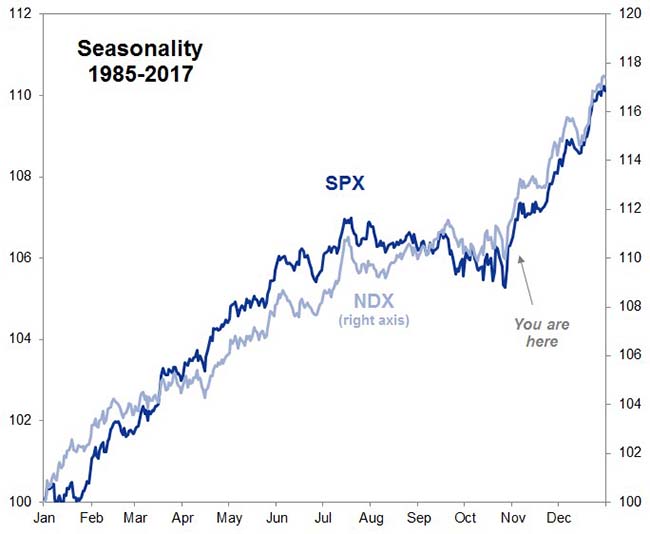

The good news for stock bulls is that seasonality is now in your favor through year end…

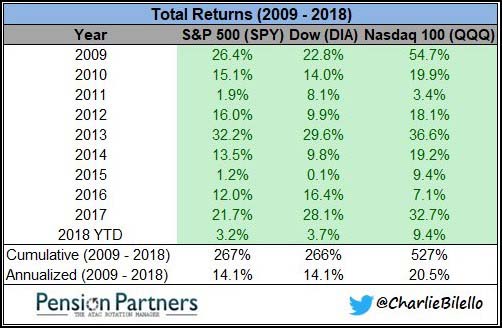

What do you think? Can the market hit green for the 10th year in a row?

@charliebilello: With 2 months to go, S&P, Dow and Nasdaq 100 on pace for their 10th consecutive up year. That would be a new record. $SPY $DIA $QQQ

A great 200-year chart of long-term stock and bond returns…

(WSJ)

As interest rates move to new highs, it looks like Bond investors want to ring that 30 year bell…

Investors withdrew $36bn from bond funds in October, the biggest monthly net redemption in almost three years, as even exchange traded fixed-income funds succumbed to the global market turbulence. Bond ETFs have become increasingly popular with investors on the lookout for cheap, simple ways to get exposure to fixed-income markets. But the deepening bond reversal led to the first monthly outflow in two years, for a net redemption of $1.57bn, according to preliminary numbers from EPFR Global. All told, bond funds around the world saw $36bn pulled out in the month to Wednesday, the biggest withdrawal since December 2015, the preliminary figures show. Of note is that the outflows follow a stampede of investors into bond investments. Last year these funds took in more than $600bn.

Another reason to want to ring the bell is the flood of issuance that needs to hit the market…

The U.S. Treasury Department estimates it will issue more than $1 trillion in debt this year as higher government spending and sluggish tax revenues push the deficit higher.

The Treasury said Monday it expects net marketable debt to total $425 billion in the fourth quarter, which would bring total debt issuance in 2018 to $1.338 trillion, compared with $546 billion in 2017. That would be the highest annual debt issuance since $1.586 trillion in 2010, when the U.S. economy was still crawling out of a recession.

The Treasury’s fourth-quarter borrowing estimate of $425 billion is $15 billion less than it estimated in July. That would be the most for any fourth quarter since 2008, at the height of the financial crisis, though the figures can be volatile from quarter to quarter.

(WSJ)

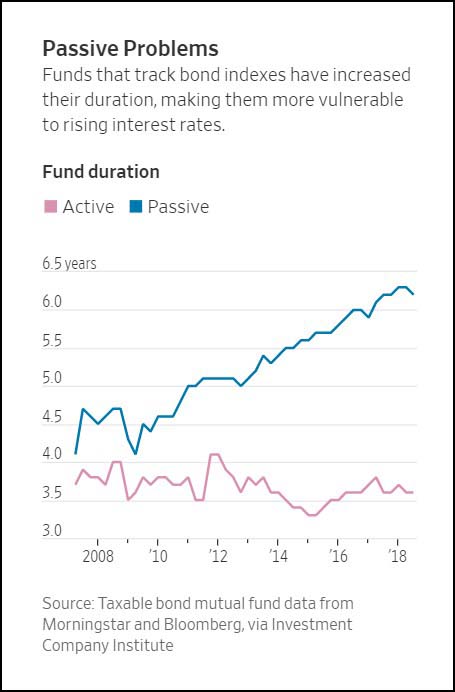

Where active beats passive…

Washington’s fiscal irresponsibility creates a bubble in Treasury issuance which sends the duration of bond indexes higher giving active PMs a tilted playing field in times of rising rates.

Active portfolio managers have been steadily shifting toward short-term debt, which is less vulnerable to losses from rising rates and inflation. The average actively managed taxable bond mutual fund has a duration of 3.6 years, down from 4 years in Sept. 2008, according to research from the Investment Company Institute. Meanwhile, index mutual funds have an average duration of 6.2 years, up from 4.7 years, according to ICI.

That is especially worrying for mom-and-pop investors who have gobbled up passive funds in recent years and may not realize that their safe-haven bond funds are vulnerable to rising rates, said Marina Gross, executive vice president of portfolio research and consulting at French investment bank Natixis SA . Those investors are now seeing declines on virtually every asset class in their portfolio, which may prompt panicked selling that locks in losses, she said…

The increase in passive fund duration is largely owed to a structural pitfall that’s baked into bond indexes. The indexes are designed to reflect the broader market, including U.S. Treasury debt. The U.S. government has issued more debt since the financial crisis to pay for things like bank bailouts, unemployment benefits and tax cuts, so Treasurys have become a larger slice of the indexes.

Treasury debt tends to be longer term than corporate debt, which has dragged duration higher. U.S. Treasurys are now 38.1% of the Bloomberg Barclays Aggregate Bond Index, up from 22.4% at the end of 2007, according to ICI.

(WSJ)

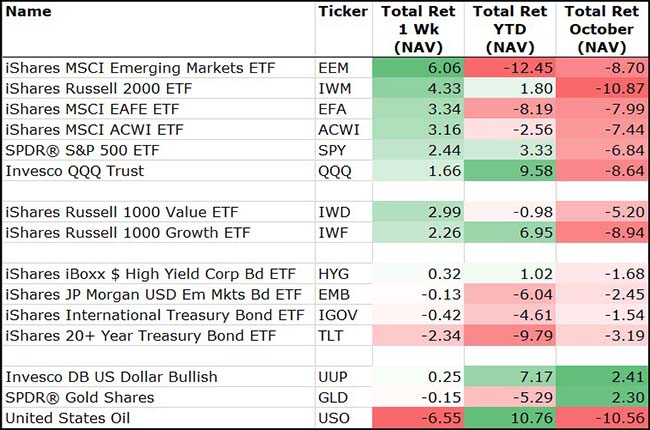

For the week, Equities bounced while Bonds and the U.S. dollar rolled lower….

(11/2/2018)

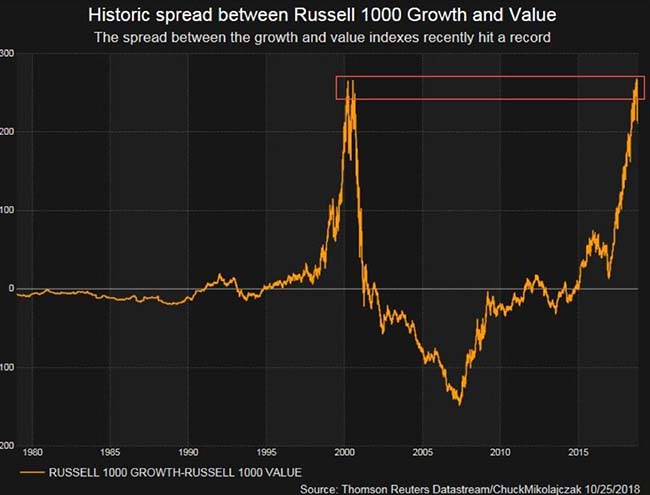

Speaking of Growth versus Value…

Goodbye FANG?

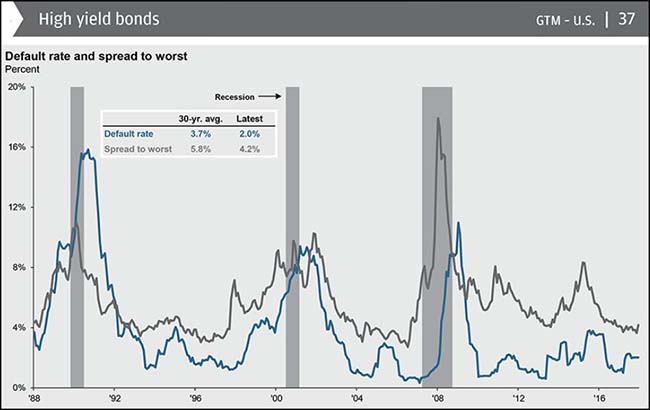

Junk Bond strength remains the head scratcher…

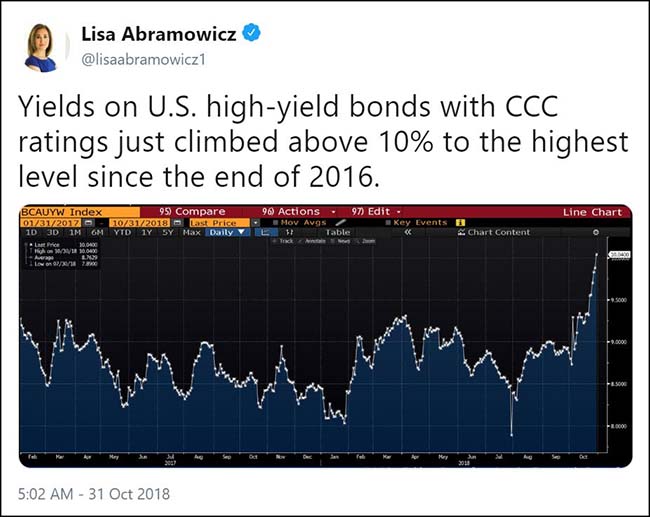

But on a short-term basis, the riskiest junk bonds are beginning to show increased stress…

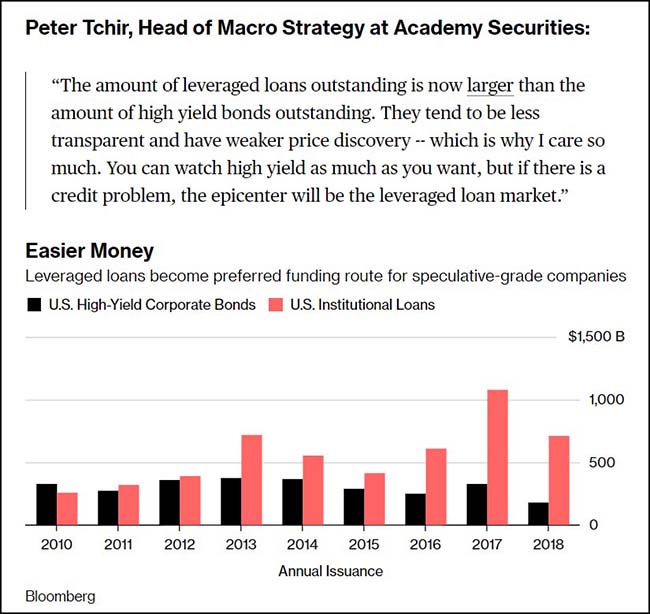

Maybe I am not seeing all of the credit risk in the U.S. economy given that so much of the risk has been pushed into Institutional loans…

Crude Oil has gotten slippery…

Iranian sanctions have this commodity yo-yo’ing along with the more worrisome backdrop of global growth slowing.

(@LMT978)

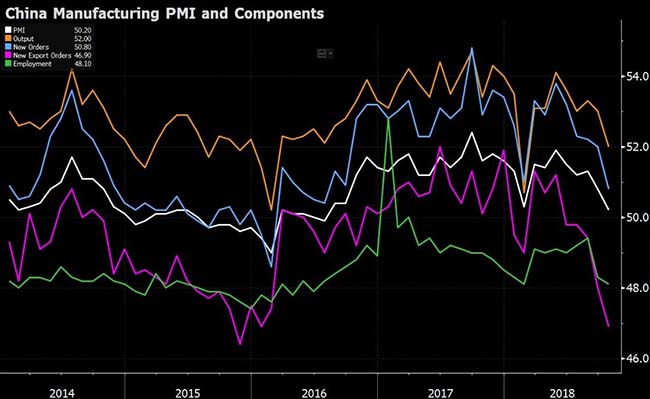

Is oil being hit by the China slowdown? Of course.

(@TeddyVallee)

The Bloomberg industrial metals index is also reflecting slowing global growth…

It is 39% weight to copper, 27% aluminum, 17% nickle and zinc 15%.

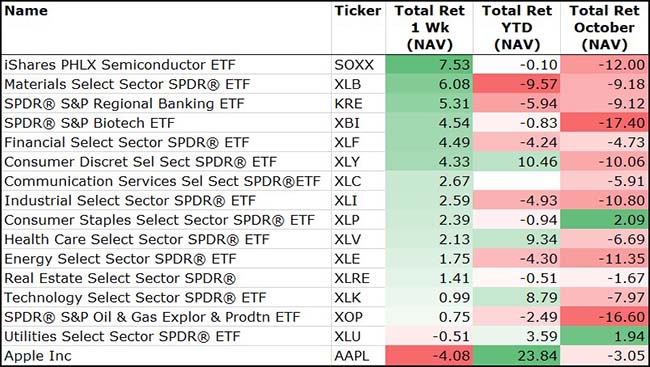

Sectors bounce last week even without Apple Inc…

Brutal October returns. Especially for Biotech and Oil/Gas.

(11/2/2018)

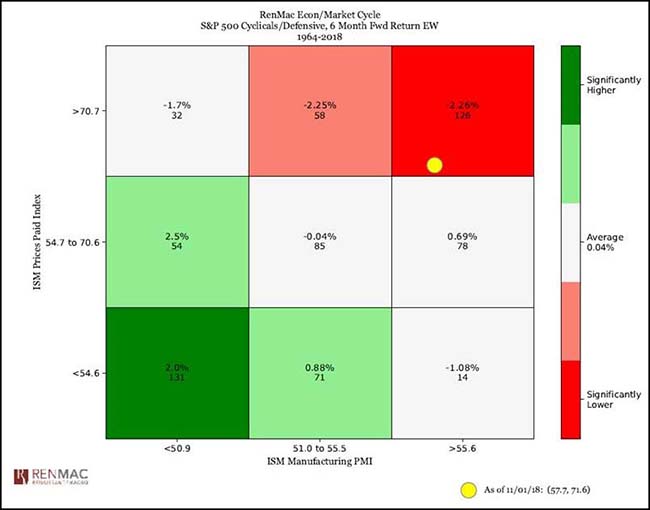

When the economy has run hot and prices are surging, it is time to reposition to defensive stocks…

@RenMacLLC: At this stage in the economic cycle, cyclicals should under-perform defensive names…

Some good insight into the markets from the new big brain at Bridgewater…

Even when assessing foreign markets, Karniol-¬Tambour keeps one eye fixed on the U.S. It is, she notes, the epicenter of a big move by central banks to start removing the liquidity they have pumped into their economies for a decade. This tightening is reverberating across global assets, hitting areas most sensitive to it, including places outside the U.S. like Turkey, where banks rely on U.S. dollars.

What of prospects within the U.S.? Karniol-Tambour expects the fiscal stimulus from the Trump tax cuts to fade as the tightening of monetary policy continues. In August she warned Bridgewater’s clients that U.S. assets (particularly stocks), having recovered faster from the financial crisis than those in other countries, were priced for perfection and hence vulnerable. That vulnerability, she notes, was exposed a little by the October stock sell-off.

“There is an extrapolation that the U.S. will keep outperforming for many years—decades,” Karniol-Tambour says. “European interest rates are not supposed to hit U.S. levels today in the next 10, 15 years. U.S. stocks are supposed to keep having higher profitability 10, 15 years. I look at that, and I say that’s pretty vulnerable.” With the U.S. priced to so vastly overperform, a little braking—say, the effects of the tax cuts petering out—could have a big impact. “You are vulnerable to that sort of correction,’’ she says. “There is risk in financial markets broadly because of this shift from an easing environment to tightening.”

(Forbes)

Don’t bet against characters played by Steve Carell in Michael Lewis films…

Steve Eisman, the Neuberger Berman Group money manager who famously predicted the collapse of subprime mortgages before the 2008 financial crisis, is shorting two U.K. banks over expectations the country will leave the European Union without a deal.

The U.K. is one of the biggest risks Eisman is watching, he said at a conference in Dubai on Sunday, declining to name the banks he’s betting against. The fund manager expects the U.K. government to agree its exit from the bloc, but said Parliament is likely to reject the deal after that.

“I’m shorting two stocks in the U.K., but I’ve got a screen of about 50, and I might short all 50 if I think Jeremy Corbyn is going to be prime minister,” Eisman said. “Corbyn’s a Trotskyite. Now I know my Trotskyites well and I know you don’t want to be invested in the U.K. if a Trotskyite is prime minister.”

$4.5 billion in direct taxpayer subsidies divided by 3,000 jobs equals $1.5 million per Foxconn job created…

It is unfortunate that State Legislatures do not require basic math, finance and accounting competency. Then again, this is why some states shrink and some states grow. Federal Darwinism in action.

But as the public has become aware of the spiralling costs for these jobs, the Foxconn deal has become something of a political liability for Walker, particularly among voters outside of southeastern Wisconsin. Those costs include taxpayer subsidies to the company totalling more than $4.5 billion, the largest subsidy for a foreign corporation in American history. Since Wisconsin already exempts manufacturing companies from paying taxes, Foxconn, which generated a hundred and fifty-eight billion dollars in revenue last year, will receive much of this subsidy in direct cash payments from taxpayers. Depending on how many jobs are actually created, taxpayers will be paying between two hundred and twenty thousand dollars and more than a million dollars per job. According to the Legislative Fiscal Bureau, a nonpartisan agency that provides economic analysis to the Wisconsin state legislature, the earliest citizens might see a return on their Foxconn investment is in 2042…

The agreement’s high cost, estimated at nearly eighteen hundred dollars per household, has created a heavy burden for taxpayers, and a political risk for Walker. After the terms were announced, last year, Governor John Kasich, Republican of Ohio, said, “I’ll tell you one thing, it’s not going to take us forty years to make back the investment we make. We don’t buy deals.” A majority of Wisconsin voters have never believed the state was getting its money’s worth, according to polls conducted by Franklin at Marquette. His polling has also consistently shown a majority of voters believe that Foxconn will not help businesses in their area. “The governor’s fortunes are so tied up with his backing of Foxconn,” Franklin said. “When it was first announced it was, in the short term, perceived as this major victory for Walker, the thing that might solidify its hold on the election.” Now Foxconn is one of the main reasons Walker has trailed his Democratic opponent, Tony Evers, the state superintendent of schools, in nearly every poll since the August primaries….

Mason reiterated Foxconn’s promise that it will eventually create thirteen thousand “permanent” jobs in Wisconsin. But the company recently changed the type of factory it plans to build, downsizing to a highly automated plant that will only require three thousand employees, ninety per cent of them “knowledge workers,” such as engineers, programmers, and designers. Almost all of the assembly work will be done by robots. Gou, Foxconn’s chairman, has said he plans to replace eighty per cent of Foxconn’s global workforce with “Foxbots” in the next five to ten years.

Soybean farmers are losing patience while building mountains of unsold soybeans…

Soybean farmers also spent millions of dollars cultivating the Chinese market. Farmers in North Dakota and other states contribute a fixed percentage of revenue to a federal fund called the “soybean checkoff” that pays for marketing programs like trade missions to China and research intended to convince Chinese farmers that pigs raised on American soybeans grow faster and fatter. In 2015, North Dakota soybean farmers footed the bill for an event in Shanghai honoring the 10 “most loyal” buyers of American soybeans.

The soybean industry’s sales pitch emphasized the reliability of American infrastructure and the political stability of the United States. The message was that the Chinese could be confident that American farmers would deliver high quality soybeans.

“I’ve been to China 25 times in the last decade talking about the dependability of U.S. soybeans,” said Kirk Leeds, the chief executive of the Iowa Soybean Association. By undermining that reputation, he said, “We have done long-term damage to the industry.”

The last two decades were a fat season in the soybean belt. The grain silos and pickup trucks in Cass County are shiny and new. Mr. Karel said a significant number of the farmers who sell crops to his company had done so well they purchased winter homes around Phoenix.

But the mood is souring quickly. Mr. Gebeke’s wife, Debra, a retired psychologist, has returned to work at North Dakota State University, to counsel distraught farmers. Public health officials in North Dakota, already confronting a recent rise in suicides, are concerned about the impact of falling prices, particularly on younger farmers with high levels of debt.

Mr. Gebeke, 65, recalled President Jimmy Carter’s decision to suspend wheat sales to the Soviet Union in 1979. The embargo ended two years later but, by then, the Soviets were getting more of their grain from Ukraine. Speaking of the soybean standoff, he said, “They could get together tomorrow and iron this thing all out and I don’t think we’ll ever get all of our market back.”

(NY Times)

Finally, this is definitely going to dent WeWork’s on-campus recruiting efforts…

Since it was founded eight years ago, WeWork has offered tenants in its locations kegs of free beer, as part of the hip vibe the fast-growing shared office startup has been selling.

Now it’s paring back— a little.

This week the company started limiting its beer to four 12-ounce glasses per person a day. Those caps apply to just three New York City locations at first, but WeWork told tenants in an email that it plans implement the policy citywide. New York is WeWork’s largest market by far, where it recently surpassed JPMorgan Chase & Co. as the largest private occupant of office space.

The change represents “an innovative, software-driven mechanism to help manage the provision of alcohol in our spaces,” a WeWork spokeswoman said.

(WSJ)

Copyright © 361 Capital