by Blaine Rollins, CFA, 361 Capital

Cooler air in Colorado brought us a combination of golden aspen trees and white dusted peaks this weekend. As the colors have changed in our mountains, they have also changed on most market price screens from green to red. The hot U.S. economy and inflationary picture has suddenly increased the hawkishness at the Fed. Chairman Powell’s phrase that paid last week: “We’re a long way from neutral Fed Funds at this point, probably.” As a result of this more strongly conveyed mood, interest rates continued to jump higher. Probably, a bit too quickly for most investors’ comfort which caused some sharp negative price reactions across the risk spectrum. Go look at housing stocks which have fallen for 13 days in a row as investors worry over higher mortgage rates’ impact on new home sales, not to mention the higher cost to finance raw land inventory and working capital. Risk-free rates are no longer zero. They actually have a yield today between 2.2% and 3.4% depending on the maturity. If you are a borrower, you now have a cost of capital to jump over. If you are an investor, you actually have a safe place to make a few percent rather than take risk.

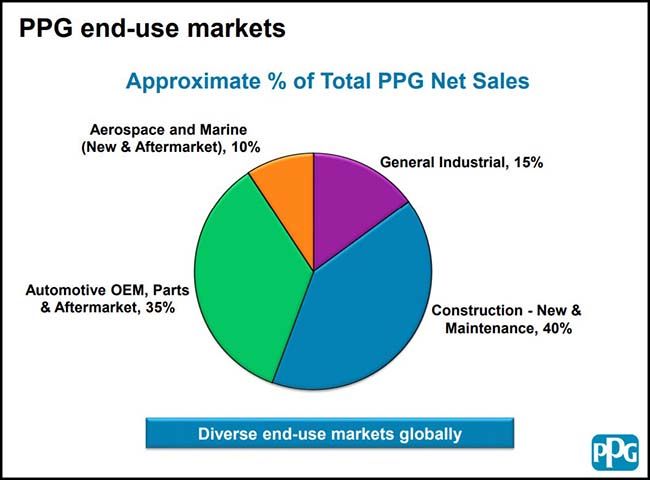

Earnings will begin to be reported this week. As always, the big banks will start us off. Investors will be looking at loan growth (in the face of rising rates) and net interest margins (in the face of a flatter yield curve). We will also be hunting for the first signs of credit weakness. And most important, we will be looking at the market’s reaction to the all-important bank stock group as they report their numbers. In July, the market rewarded the group with immediate thumps on the head. Will it be different this time? As other companies begin to report their third quarter earnings, we will be watching to see if companies can manage inflating costs, global trade impacts and rising interest rates. Just today, PPG raised all prices 10% on their paints and coatings to fight across-the-board price increases. Last week, Amazon moved its minimum wage to $15/hr to better find and keep its employees. Expect price and margin discussions to run long on the quarterly conference calls.

So, enjoy the cooler temperatures outside as you grab a coat and gloves in the morning. You might also consider packing something warm for your stock portfolio because this earnings period will be much more interesting than the last one.

To receive this weekly briefing directly to your inbox, subscribe now.

One Direction is just not your teenager’s favorite band…

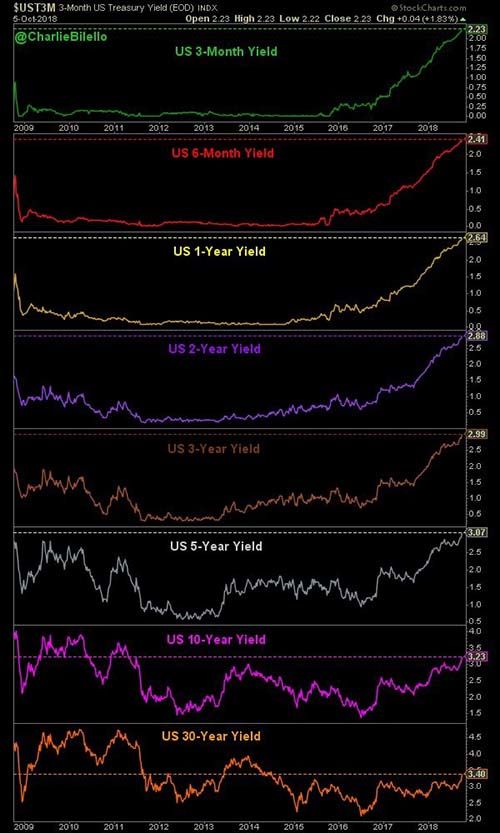

@charliebilello:

Treasury yields, highest since…

3-Mo: 2008

6-Mo: 2008

1-Yr: 2008

2-Yr: 2008

3-Yr: 2008

5-Yr: 2008

10-Yr: 2011

30-Yr: 2014

Why are yields going up?

Because for October, the Fed has turned out its claws. Below Tim Duy pens how the Fed Governors spooked the markets last week.

Federal Reserve Chairman Jerome Powell did a Q&A today. I was not surprised that he maintained the continued “gradual rate hike” mantra. I was surprised when he said “we’re a long way from neutral, probably.” That seemed like it was a bit of a slip. And a hawkish one at that. What seems remarkable to me is that I keep hearing a dovish interpretation of the Fed’s recent disavowal of r-star and the related demise of forward guidance. But what Powell let slip is that he clearly still has an estimate of neutral and we are nowhere near it. That’s hawkish.

Powell also added that “we may go past neutral.” In this sense, he is arguably a bit more dovish than colleagues such as Chicago Federal Reserve President Charles Evans, who reiterated toady his expectation that rates turn restrictive. Still, I see Powell as edging toward admitting what the forecasts reveal. Remember, you don’t have r-star as a guide anymore, but you still have the rate forecasts. You might say that there is a wide variation in the rate forecasts. But it looks like there is a common element – no matter where a central banker thinks neutral is, the majority if not all (not counting St. Louis Federal Reserve President James Bullard), expect rates will climb above their estimate of neutral. In other words, they all see policy as becoming restrictive.

Take the forecasts seriously. Handicap the data against the forecasts. Right now, the forecasts tell a hawkish story, especially if you let go of the r-star anchor. And the data doesn’t give reason to think otherwise.

A look at the broad markets for the week showed only the U.S. Dollar, Gold and Oil making any money this week…

International, Growth and Small Cap stocks joined Bonds as losing plenty of returns.

Emerging market equities continue to look very oversold on a historical basis…

(@DriehausCapital)

(@DriehausCapital)

But as J.P. Morgan knows, bad news can make oversold conditions even cheaper…

The likelihood of a “full-blown trade war” next year between the world’s two largest economies made JPMorgan Chase & Co. the latest brokerage to drop its bullish call on Chinese stocks.

The trade conflict will only escalate as the U.S. maxes out tariffs on Chinese imports, the dollar strengthens and the yuan weakens further, JPMorgan strategists including Pedro Martins Junior, Rajiv Batra and Sanaya Tavaria wrote in a report, lowering their recommendation on China to neutral from overweight…

“A full-blown trade war becomes our new base case scenario for 2019,” the strategists wrote in a note dated Wednesday. “There is no clear sign of mitigating confrontation between China and the U.S. in the near term.”

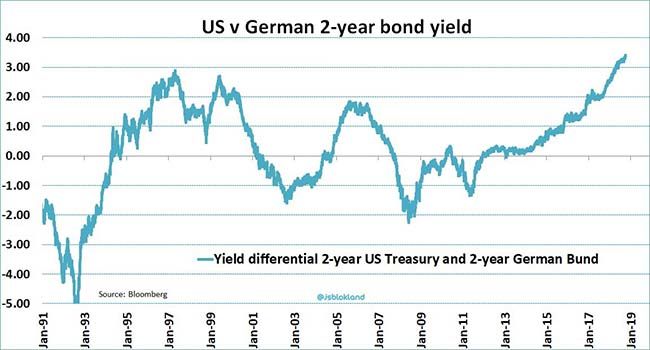

This yield gap will only increase upward pressure on the U.S. Dollar which will continue to make it difficult to invest in the emerging markets…

@jsblokland: ‘Wow’ chart! The gap between 2-year bond #yields in the US and Germany is now a staggering 3.40%!

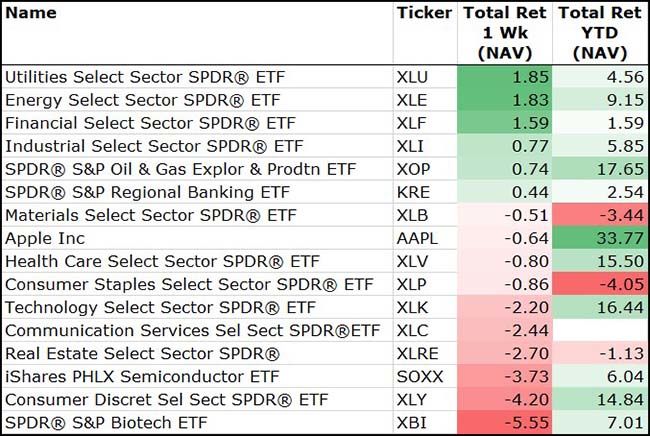

Among sectors last week…

Utility stocks won the defensive award, Energy stocks won because of higher oil and Financials rose on higher rates.

Then there were the homebuilders that only saw hammers hit fingers and thumbs…

@charliebilello: Homebuilder stocks have declined 13 days in a row, their longest down streak in history. $XHB Meanwhile, 30-Year Treasury yields ended the week at their highest level in over 4 years. $TYX

The top paint maker is raising prices 10% across all markets…

PPG can’t keep up with its costs which are rising in all areas and geographies. So the price of your new home, remodel, car, boat, airline ticket, etc. will be moving on up.

“While PPG remains aggressive in its efforts to control expenses, we have experienced continued and unprecedented cost pressures in raw materials, freight, distribution and labor, across every region,” said Rebecca Liebert, PPG senior vice president, automotive coatings. “In addition, as we collaborate with our automotive manufacturers to prepare for new autonomous driving and vehicle electrification technologies, our customers demand additional functionality from our coatings products. This price increase is vital to sustaining our history of innovating these next-generation solutions and enhancing our ability to continue to meet demand.”

(TradeTheNews.com)

PepsiCo also announced price increase actions to offset inflation last week…

* CEO – HIGHER TRANSPORTATION COSTS, COMMODITY COSTS AND INCREASE IN ADVERTISING EXPENSES EACH PRESSURED PROFIT IN THE QUARTER

* CEO – WE EXPECT RECENTLY IMPLEMENTED PRICING ACTIONS WILL IMPROVE PROFIT PERFORMANCE IN THE COMING QUARTER – CONF CALL

* CFO – WE’LL LOOK TO PRICE THROUGH INPUT COST INFLATION IN OUR DEVELOPED MARKETS – CONF CALL

* CFO – PROFIT PICTURE WILL IMPROVE IN Q4 AS A RESULT OF HIGHER PRICING – CONF CALL

* CFO – PRICING IN BEVERAGES WILL GO UP BY LOW TO MID SINGLE DIGITS – CONF CALL

(CNBC)

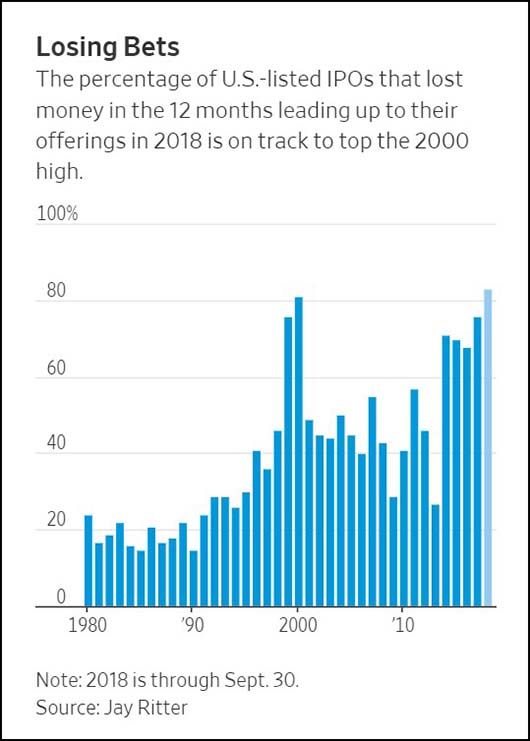

File this in the future “What the heck was the market thinking?” folder…

Stock investors are welcoming money-losing companies into the public markets this year with open arms.

About 83% of U.S.-listed initial public offerings in 2018’s first three quarters involve companies that lost money in the 12 months leading up to their debut, according to data compiled by University of Florida finance professor Jay Ritter. That is the highest proportion on record, according to Mr. Ritter, an IPO expert whose data goes back to 1980.

Some analysts and market watchers are concerned. They see similarities with the dot-com bubble of nearly two decades ago that left many investors with enormous losses. The prior high-water mark for money-losing companies going public was 2000, when 81% of stock-market debutantes were unprofitable, according to Mr. Ritter’s data.

(WSJ)

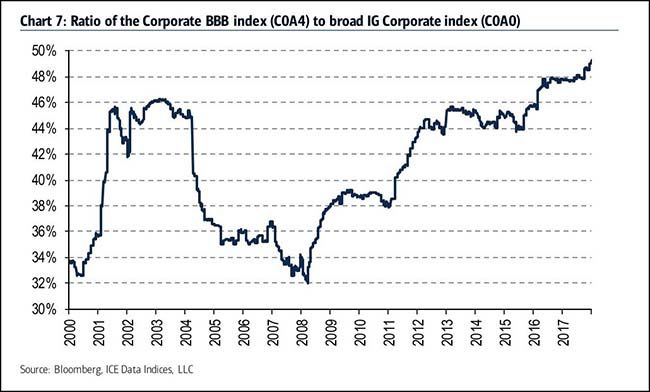

“What the heck was the market thinking Part 2?”

When the economy is healthy, the average company should be paying down debt and improving their financial ratings. Not this.

“What the heck was the market thinking Part 3?”

When the Government gets to pick the winners and losers, the free markets are always worse off…

Senator Lindsey Graham of South Carolina has been one of the biggest proponents of President Trump’s crackdown on China, welcoming tariffs on Chinese imports while conceding that they will raise costs for American businesses and consumers.

“There is no way for us to address China without absorbing some pain here,” Mr. Graham said in August.

But behind the scenes, Mr. Graham has been working to help chemical and textile companies in his home state avoid the pain of Mr. Trump’s trade war. The senator has advocated on behalf of seven South Carolina companies that import products from China, writing letters urging the Trump administration to remove materials they rely on from a list of goods subject to Mr. Trump’s tariffs.

Mr. Trump’s tariffs, Mr. Graham told the administration, could “economically harm consumers and stifle economic growth in South Carolina.”

(NY Times)

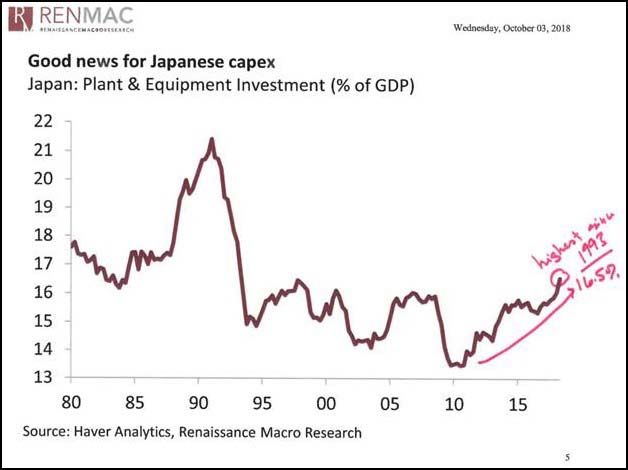

We have mentioned Japan several times..

If you are looking for a new geography to dig into, this chart looks interesting…

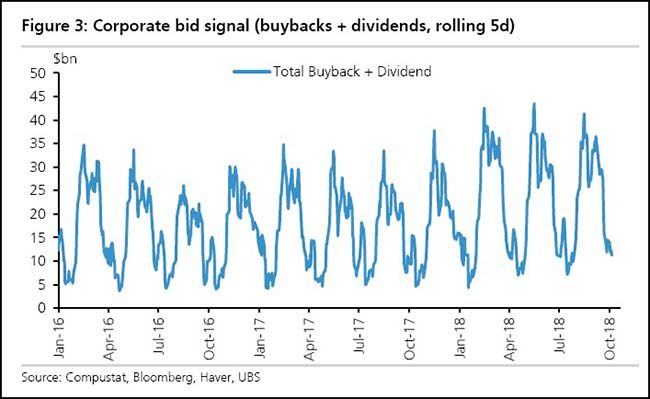

Don’t forget that one of the market’s biggest buyers is sitting on the sidelines for the next few couple of weeks…

Baseball has ended for Colorado. Now it is time to turn our attention back to the original Colorado sport…

Staff at Copper Mountain Resort, about an hour and a half west of Denver, started up the snow guns early Sunday morning. The machines coated the grasses with first layer of snow as the sun rose. The tips of the tallest mountains, however, already have a dusting of white.

The resort will open for the season on Nov. 16, spokeswoman Stephanie Sweeney said in an email. Crews started constructing snow fences at the resort last week.