by Liz Ann Sonders, Brad Sorensen, Jeffrey Kleintop, Charles Schwab and Company

Key Points

- Near-term risks have risen, but that can help the long-running bull market continue as investor enthusiasm remains lacking. Risks exist on both sides—pullbacks are possible but so are breakouts to the upside—warranting a relatively neutral stance.

- Trade disputes as yet are not having much impact on U.S. economic growth, although the risk remains, especially with regard to China. Meanwhile, the Fed will almost assuredly raise rates later this month, but has kept overtly hawkish commentary to a minimum.

- International equities have continued to diverge from U.S. equities, but we could be nearing an inflection point; while perhaps we should be cheering for the cooler weather to come.

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

- Sir John Templeton

Feeling euphoric?

The above quote is one of our favorites—speaking to how sentiment can drive stock market behavior. Although it’s difficult to argue against some complacency, it’s equally difficult to argue for euphoria. Near-term sentiment according to the Ned Davis Crowd Sentiment Poll—a contrarian indicator at extremes—has become modestly elevated in the optimistic zone, which could signal a near-term pullback. But actions are more important than words: according to data compiled by ISI Evercore Research, mutual fund and exchange-traded fund (ETF) fund flows continue to be out of equities and into bonds—not exactly euphoria.

This lack of exuberance among investors has helped to improve the valuation picture. According to earnings data from Thomson Reuters, the forward price/earnings (P/E) ratio for the S&P 500 has moved from close to 19 to start the year to just below 17 currently—not cheap but not much worse than reasonably valued in our view. Earnings have grown faster than stock prices have risen as investors have been hesitant to jump in with both feet. And given the risks that persist—including midterm elections, ongoing trade tensions, political and geopolitical developments and dysfunction, etc.—we don’t think investors should dive in head first. But as we believe we remain in a secular bull market, we do believe investors should remain invested in U.S. stocks at normal allocation levels; remaining diversified and considering periodic rebalancing back to targets. Recent leadership shifts we’ve seen in S&P 500 sectors may be sending a signal about a change in market character. Some recent leaders in the technology sector have taken it on the chin, resulting in a shift in market leadership to slightly more defensive areas—warranting some caution in the near term in our view.

Firing on all cylinders?

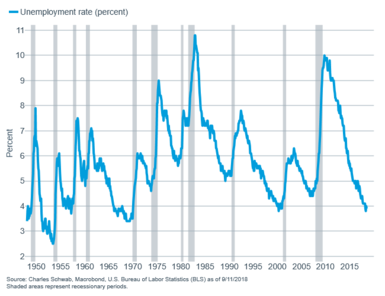

We have a strong but not overheating economy, which should continue to support a healthy earnings picture, but investors should temper expectations that the somewhat-blistering pace of growth in the second quarter is likely a new trend. The labor market remains strong and getting tighter by the day; with 201k non-farm payroll jobs added in August according to the Department of Labor, while the unemployment rate remained at a historically low 3.9%. The more forward-looking initial unemployment claims continue to plumb their lowest levels since the late-1960s.

Unemployment is historically low…

…as are jobless claims.

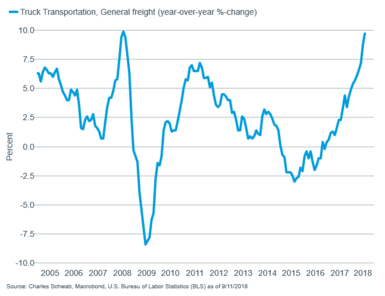

What may keep economic growth from lurching higher from its second quarter pace could be a cap in resources. Stories abound from corporate executives about the difficulty in finding skilled workers and finding trucking capacity to ship goods, among other restraints on growth.

Are trucks being maxed out?

One recent bright spot has been the improvement in productivity growth; with second quarter non-farm productivity coming in at an improved 2.9% annualized rate. With capex plans increasing according to the National Federation of Independent Business (NFIB), there is the potential for productivity to improve even more.

Can productivity maintain recent gains?

Trade risks remain, but little broad impact to this point

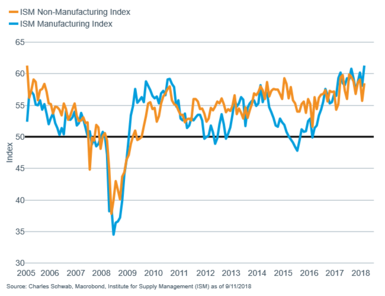

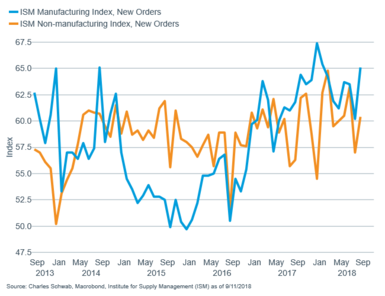

For now, capex remains healthy with both Institute of Supply Management’s (ISM) Surveys—manufacturing and services—moving higher on both the headline level and the forward-looking new order component.

Trade disputes haven’t yet hurt business confidence…

…and orders remain strong.

But within the ISM manufacturing survey, respondents did note that one of their most vexing concerns was trade. While there have been some positive signs, especially with regard to a potential NAFTA deal, the dispute with China has not improved, with new tariffs being threatened and neither side looking like they’re willing to give in to make a deal. Should trade tensions deteriorate further, capex plans would likely be formally delayed, hurting productivity and economic growth. But the flipside is also possible—deals are made and capex spending accelerates.

Fed not out to crash the party

Trade concerns are being counter-balanced by some rising wage inflation, with average hourly earnings (AHE) rising 2.9% year-over-year as of August; up from an average of 2.5% last year, according to data released with the above referenced labor report. But relative to history, wage growth does not suggest over-heating, suggesting the Federal Reserve has no intention to crimp economic growth (read more on the wage story at Waiting (Was) the Hardest Part, but Wage Growth is Finally Kicking In). The fed funds rate will likely go up another 25 basis points at the September 26 meeting, with futures contracts at close to a 100% probability. A December hike looks likely as well, but the likelihood could ebb and flow depending on incoming economic data between now and then. We are only now getting to a positive real rate on the short end of the curve, so it’s appropriate to continue to cheer still-fairly loose financial conditions; but with the tightness in the labor market and the Fed also shrinking its balance sheet, inflation could pick up further from here, causing some volatility to return to markets.

Seasonal (mis)adjustment?

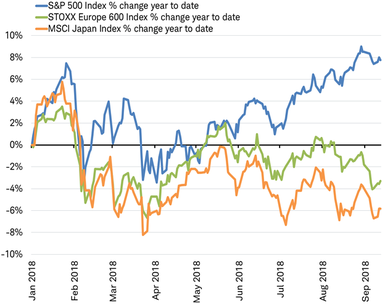

After outperforming the U.S. market last year, stocks in Europe and Japan have seen losses this year, in contrast to the gains seen in the U.S. market as you can see in the chart below.

Performance divergence

Source: Charles Schwab, Bloomberg data as of 9/12/2018. Past performance is no indication of future results.

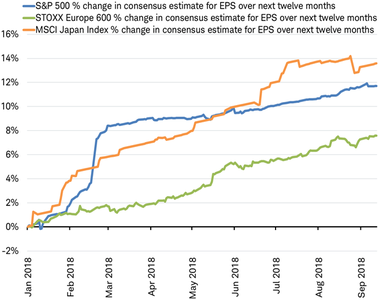

This divergence in stock market action is in contrast to the similar path of analysts’ earnings estimates for companies in the three regions, as you can see in the chart below. Analysts’ consensus estimates for earnings over the coming 12 months are rising at a high single-digit to low double-digit pace across all three regions.

Similar path for earnings per share

Source: Charles Schwab, Bloomberg data as of 9/12/2018. The chart is hypothetical and provided for illustrative purposes only. It is not intended to represent future performance of any specific investment.

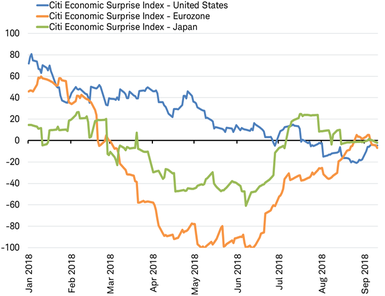

The divergence between stock performance and earnings estimates may be attributable to widening differences in the degree of confidence in those forecasts due to tax cuts and trade tensions, among other factors, affecting the relative growth outlooks. Although earlier this year, economic data was better than expected in the United States, it was worse than expected in Europe and Japan (the economic surprise index rises above zero when data exceeds expectations and falls below zero when it misses). The economic surprise indexes now reveal that data in the United States, Europe, and Japan is coming in close to expectations, as you can see in the chart below.

After diverging earlier this year economic data is now coming in close to expectations

Source: Charles Schwab, Bloomberg data as of 9/12/2018.

If economic data begins to come in better than expected broadly across all regions, it is possible that the stock market performance divergence may end as confidence in the earnings outlook may improve outside the United States. As the calendar turns to fall, are we poised for this to happen?

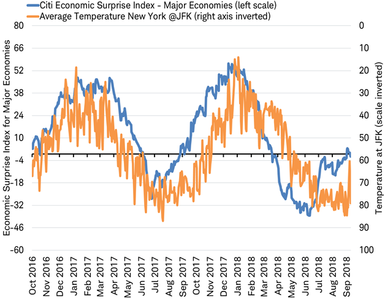

Blaming the weather became a joke among analysts when often offered as an excuse by corporate executives for missing expectations, but what about for economists? There is some historical evidence to suggest that economists are less than perfect at seasonally adjusting their forecasts. Examining the past two years in the chart below, the pattern of economic data surprises seems to closely track the temperature in the Northern hemisphere—weakening as the mercury rises and firming back up again as the weather cools off.

“Surprising” seasonal pattern

Major economies is defined as the Group of Ten (G10) countries: Australia, Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, Switzerland, United Kingdom and United States.

Source: Charles Schwab, Bloomberg data as of 9/12/2018.

The economic surprise index for the world’s major economies (G10) may now be poised to move above zero as temperatures at JFK airport in New York City begin to average less than 55 degrees Fahrenheit as winter approaches. Of course, there are many other factors that influence economic data or investors’ confidence in analysts’ earnings outlook. A cooling of trade tensions would be a big help. But, maybe cooler temperatures can also play a role in ending the regional divergence between stocks and earnings.

One more international note: look for Jeffrey Kleintop’s, Chief Global Investment Strategist, latest thoughts on recent emerging market action and what it means for investors coming on Schwab.com, Monday, September 17.

So what?

Investor skepticism should, in our view, help to keep the U.S. bull market going, but risks in the near term have risen and gains should be more modest and pullbacks are likely. Some international markets have struggled to this point in the year, but we see signs that the divergence may be waning. We recommend a neutral overall equity stance and keeping a watchful eye on trade developments and confidence measures to help determine whether we see a breakthrough, or a breakdown.

Copyright © Charles Schwab and Company