by Richard Turnill, Global Chief Investment Strategist, Blackrock

European populism has flared up again. Richard explains what this means for investors.

Italian politics have revived market attention to the risk of European fragmentation, adding to already heightened global economic uncertainty. Yet our base case is still that global growth will be sustained amid gradually rising interest rates. We see a structural discount on some European assets being confined to the region for the near term. We still like U.S. and emerging market (EM) stocks.

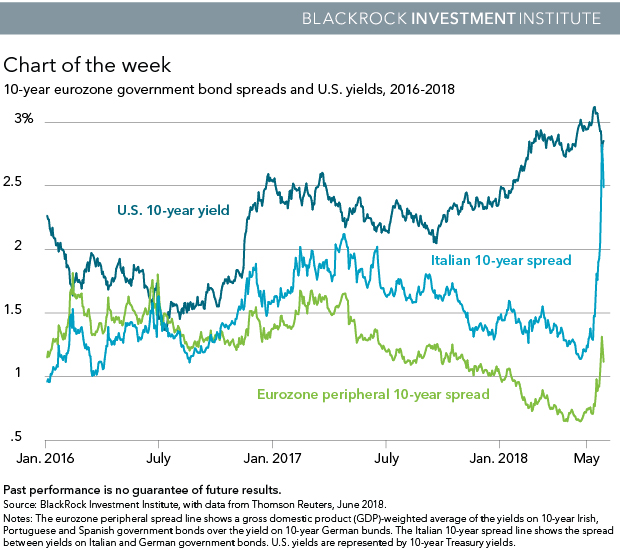

The proposed nomination by Italian populist parties Five Star Movement (M5S) and the League party of a finance minister hostile to the euro and the prospect of new Italian elections prompted major market angst. See the chart below. Italian 10-year borrowing costs relative to German bonds soared (the light blue line). The contagion extended to the euro-zone periphery, pushing bond yield spreads sharply wider (the green line), and to global markets. The U.S. dollar surged against the euro, and U.S. 10-year yields fell in a flight to safety. A last-minute agreement on a less overtly anti-euro cabinet restored confidence, and these moves mostly reversed late last week. See the far right of the chart. Yet we see political uncertainty holding down equity valuations and keeping credit spreads wider across Europe, including on peripheral sovereign debt. The prospect of new political leadership in Spain adds to the uncertainty.

Confrontation time

After a rough few days, Italian politics are likely to settle into a state of uneasy steadiness. An anti-establishment government is happening under a M5S-League coalition, this time with a finance minister less openly critical of the European Union (EU) than the prior candidate. Yet the political situation in Italy remains a moving target, and confrontations with Brussels are likely to rise. Polls show a majority of Italians support staying in the euro, but views that the single currency and Europe have been negative for Italy area widespread. It’s also likely the new potential government will have a confrontational attitude toward Europe and Germany, slowing momentum for further integration.

The risk of European fragmentation–one of the top 10 risks monitored in our recently launched Geopolitical risk dashboard–adds to rising global economic uncertainty. It comes amid the U.S. implementing tariffs against China, the EU, Mexico and Canada, triggering retaliatory actions. Other uncertainties include the impact of hefty U.S. fiscal stimulus on growth and the duration of this cycle. Yet unless European fragmentation risks intensify dramatically, we don’t see European risks denting our outlook for the sustained global economic expansion to roll on. We see gradually rising inflation and central banks slowly normalizing rates.

The looming risk, however, is likely to keep credit and sovereign spreads elevated in Italy and peripheral Europe. It may also lead to sustained lower valuations for European equities versus global ones, particularly banks. European stocks have under-performed global stocks for the past several weeks, and earnings momentum in Europe was already lagging other regions. It’s too early to assess the economic impact of this looming risk, but political uncertainty may slow regional economic activity and investment, further weighing on European earnings expectations. We retain a preference for U.S. and EM equities. Within Europe, we favor quality firms with exposure to global growth.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.