by Mawer Investment Management, via The Art of Boring Blog

Monetary policy “normalization” returned as a major theme this quarter. As indicators for the global economy continued to show signs of strength, central bankers in many major economies—e.g., U.S., Canada, China and Europe—have signaled that the end of a very loose monetary era is nigh. Markets may be facing an important inflection point.

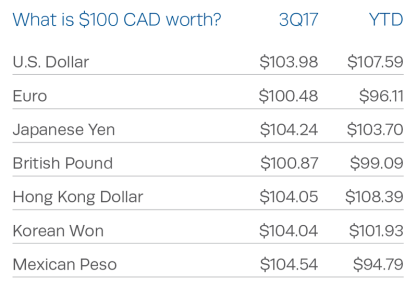

For Canadian investors, this monetary environment has landed close to home, with not one but two rate increases in the past three months. Canada has been leading the pack among those countries that are tightening their monetary policies, resulting in the Canadian dollar strengthening appreciably versus a basket of major currencies (see table). For example, the Canadian Dollar (CAD) reached a high of 82 cents to the USD in this period. One consequence to this surge has been to investments held in foreign currencies—i.e., a higher CAD has muted what would have otherwise been strong returns. As ever, we view the increase in the CAD as a temporary headwind— sometimes currency works for you, sometimes against you—and the long-term case for investing globally remains compelling.

Overall, world equity markets performed strongly, with the MSCI ACWI Index gaining 4.4% in local currencies (1.3% in CAD). In Canada, the S&P/TSX Index was helped by recovering commodity prices and a strong domestic economy and rose 3.7%. Meanwhile, rising rates in Canada and globally contributed to negative returns in fixed income. The FTSE TMX Canada Bond Universe Index fell 1.8% and the Citi World Government Bond Index dipped 2.0% (CAD). Together, this meant that Balanced returns were marginally negative for the quarter; the Mawer Balanced Fund (Series A) fell -0.3%, but remained positive for the year at +5.6%.

Big picture issues and observations:

- Central Bank expectations

The Bank of Canada doubled the overnight rate to 1.00% via two moves during the quarter. Elsewhere, the bias has been to raise rates and remove quantitative measures gradually. How quickly central banks tighten will depend on supportive data points, especially measures of growth, labour market employment, and inflation. The path forward may not be linear; for instance, if inflation fails to pick up more meaningfully, central banks may be forced to slow down. - Promises to policy

Investors have appeared concerned with U.S. tax reform, Brexit, and NAFTA negotiations. So far, NAFTA appears to be progressing toward a revision more than a repeal; in the UK, Brexit negotiations remain a long-term process with much to be determined, although the probability of a “hard” Brexit is high; and in the U.S., President Trump continues to face headwinds in implementing his policy agenda. U.S. tax reform is the legislative piece investors seem to care most about, yet markets remain skeptical about Trump’s ability to see it passed this year. - Global growth

Global growth figures have been promising in recent quarters. According to JP Morgan, Q2 global real GDP growth came in at 3.8% which is the strongest quarter since mid-2010. Q3 will likely come in slightly lower but still a very healthy rate. Supporting this thesis is the latest round of purchasing manager index (PMI) data with most countries firmly in expansionary territory and the U.S coming in particularly strong. - Political results

Angela Merkel won her fourth term as Chancellor of Germany, although her party conceded some important ground to the far-right. The Catalonian region of Spain voted overwhelmingly in favour of becoming an independent region/ country. These results seem to suggest that nationalist and populist sentiment continue to brew in Europe, although neither events really point to an existential threat. Markets digested this news without much impact. - North Korea

A lot of news this quarter centered on the ongoing crisis with North Korea. Crises like these rarely impact markets unless they spiral into truly negative territory, such as a large-scale war or attack.

Connecting with Amphenol

The International Energy Agency estimates that the worldwide electrical vehicle count was 2 million in 2016, or just 0.2% of all light-duty vehicles. This number is expected to grow rapidly. As an example, Volvo announced it will be moving its engines entirely to electric and/or hybrid starting in 2019. And China is drafting a policy to require that 8% of car sales be battery electric or plug-in hybrid vehicles starting in 2019. Clearly, this is a very large and rapidly progressing trend.

How can we take advantage of this trend from an investment perspective? And it’s not just cars: it’s the electronification of… everything!

One tactic could be to predict who will win the race in many of these exciting new technologies, a path that will likely include spectacular winners and many more companies that utterly destroy shareholder value. We don’t feel that we have an edge in isolating the winners from the losers at this point, but there are other ways to participate in technological progress.

Amphenol is a major producer of electronic and fiber optic connectors, as well as interconnect systems such as coaxial cables. These are connectors that take data or power from one input to another with the aim of minimizing power loss or the weakening of signal as much as possible.

The connector business is an example of what we refer to as a keystone business model; the product or service is critical but does not represent a major part of the purchaser’s overall cost structure. Consider automobiles: connectors are a small portion of a car’s overall cost, but they are critical to the car’s effectiveness. Keystone products also introduce some customer stickiness as switching to a different provider introduces risk for generally marginal benefit.

End markets for Amphenol’s products include not only the automobile industry, but also IT/data centres, mobile devices, and industrial processes. Furthermore, Amphenol benefits from a strong management team with a demonstrated track record of steady organic growth, accretive acquisitions, and steady margin improvement.

The investment thesis isn’t without risks. Many of Amphenol’s end markets are cyclical in nature. Competition also seems to be rising within this reasonably fragmented industry which could temper margins. And the quality of the business hasn’t gone completely unnoticed: markets are generally efficient after all. But we believe Amphenol is a resilient business that is exposed to a truly electrifying trend, and we govern these risks—particularly around valuation—by managing its position size within the portfolio.

As noted, it appears that markets are reaching an inflection point with monetary policy. If this is truly the case, then it is an important shift from previous years, when markets were frequently overwhelmed by the impact of unconventional central bank policies. The fact that central bankers are even entertaining this path means there is enough health in underlying economies (a good thing). However, the rising interest rate environment does create a headwind for bonds while increasing the potential for a re-pricing event for equities. These are risks in which investors should be mindful.

What are some of the main positives in the investment landscape?

- The credit cycle appears to still be in expansion mode for most major economies. As credit cycles underpin growth, that credit is still available and flowing in most parts of the world is good news. Balance sheets are still, on par, better than they were before the great financial crisis. Growth figures have also been decent.

- Interest rates may be increasing but the path forward still looks gradual. For the most part, central bankers look to be cautious in this process. Further, the lower inflation numbers we see, the more it is likely that this process is gradual; all else equal, a slower normalization path for interest rates is probably more supportive for both equity and bonds.

- Confidence is good among businesses. This is a necessary component to decent future growth.

- China is—so far—balancing its need to grow with its need to shore up its financial house. While China may not seem that important to the Canadian investor, the size of its economy, and the extent of its debt challenges, means that its economic health matters globally. A financial crisis in China is one of the few events that could trigger a broader investment crisis, while even just the matter of China slowing down can impact commodity prices (reverberating down the line to economies like Canada’s). It is therefore positive that China has so far managed to navigate a difficult transition period in its economy.

What are some of the main negatives?

- Valuations. Within both equities and bonds valuations leave little margin for error. In particular, current valuations in equities increase the risk that we see some re-pricing. Meanwhile, the interest rate environment is a potential ongoing headwind for bonds.

- Unknown policy outcomes. There are some significant policy frameworks being negotiated at present in both tax and trade which could have an impact on markets. The outcomes of these talks won’t necessarily be negative, as there is some potential that good policies could be enacted by politicians, but they do carry some risks. This is especially true as we see what happens in the UK and with NAFTA. Moreover, themes of populism and nationalism still could provoke problematic legislative agendas going forward.

- The Canadian housing market. While regulatory measures to provide protection from exuberant conditions have been introduced in a few major markets, housing affordability could take a significant step back if interest rates rise quickly and banks move prime rates in lock step and/or faster than the Bank of Canada.

Given the environment, we would caution investors over exuberant long-term return expectations. While equity indices have performed well and global economic indicators have been more positive of late, valuations and the changing monetary environment (increasing rates, unwinding quantitative easing measures) are headwinds at this point. Our base case is that risks are gradually building in the system—in what has been a long cycle that could go on for longer yet. Our approach is to ensure we have resiliency in portfolios. That means bonds will continue to be a component of balanced portfolios—while they may face headwinds, bonds should offer protection in an equity market pullback. Moreover, the outlook for bonds is more positive in the event the economy weakens again or normalization takes a slower path. Within equities, we continue to search the globe for companies that meet our investment criteria. Our inventory of potential investments for which we have completed our intensive analysis has grown and any near-term volatility may prove opportunistic in helping to improve portfolios built for resilient, long-term returns.

[i] Due to regulatory requirements, performance information may not be published until the Fund has completed a financial year.

This post was originally published at Mawer Investment Management