by Lance Roberts, Clarity Financial

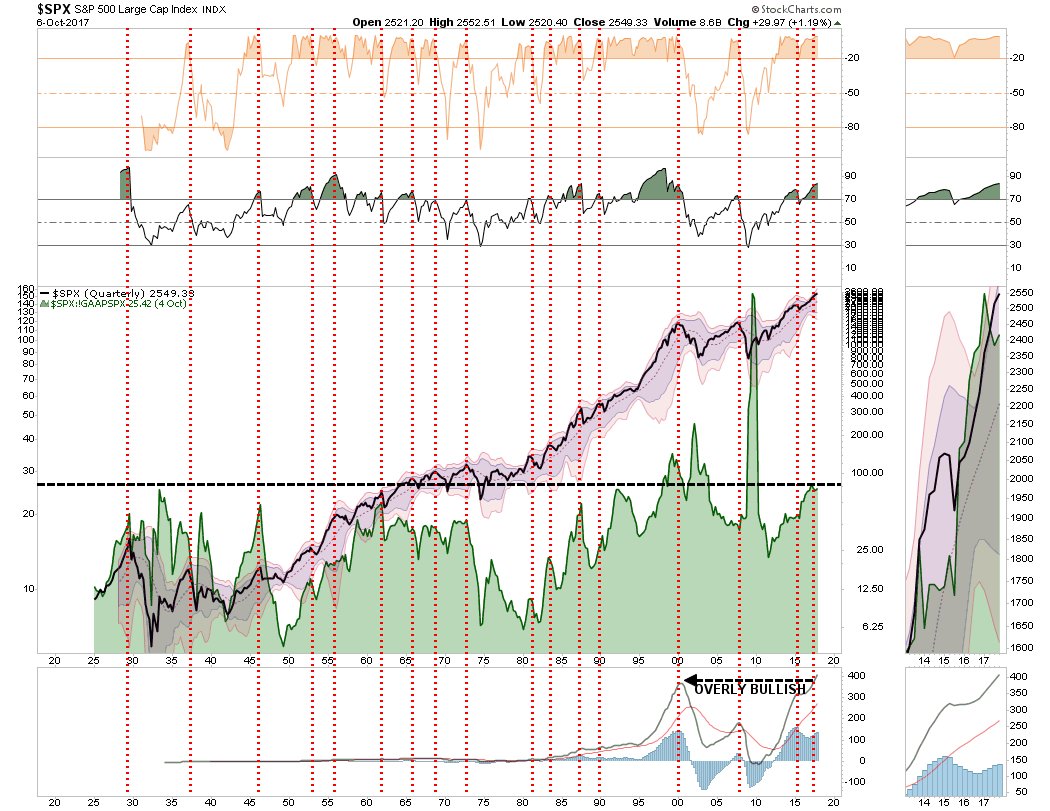

This past weekend, I discussed what appears to be the markets ongoing melt-up toward its inevitable conclusion. Of course, that move is supported by the last of the “holdouts” that finally capitulate and take the plunge back into a market that “can seemingly never go down.” But therein lies the danger. To wit:

“However, it should be noted that despite the ‘hope’ of fiscal support for the markets, longer-term conditions are currently present that have led to rather sharp market reversions in the past.”

“Regardless, the market is currently ignoring such realities as the belief ‘this time is different’ has become overwhelming pervasive.”

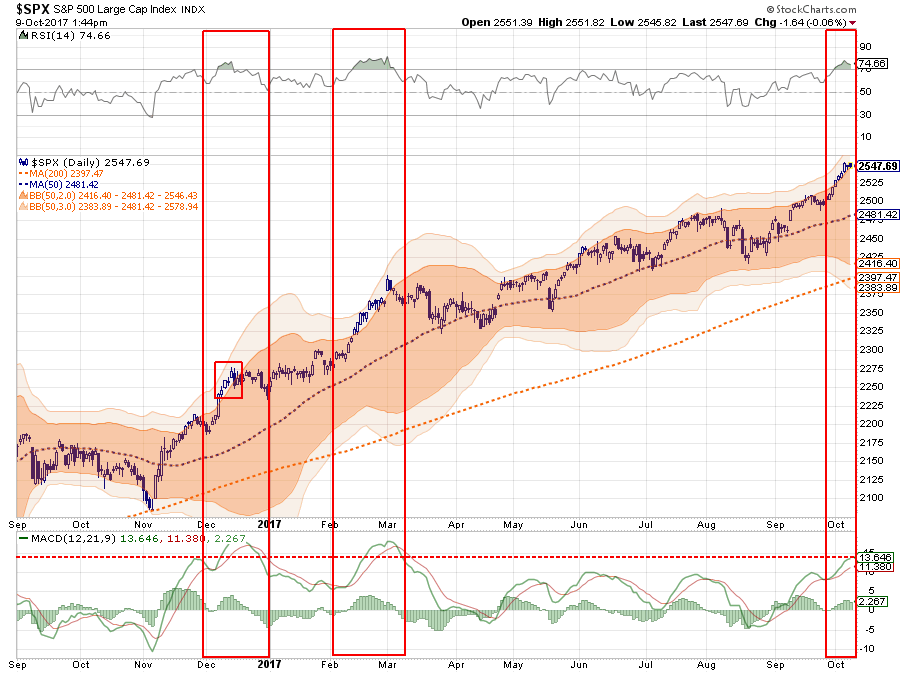

The other problem on a short-term basis is the market is pushing very elevated levels currently. As shown below, with RSI (14) now above 70, the market 3-standard deviations above the 50-dma, and the MACD over 13, in both previous cases over the last year a short-term reversal followed.

A similar outcome would not be surprising this time either, so some caution is advised.

Positioning Review

The COT (Commitment Of Traders) data, which is exceptionally important, is the sole source of the actual holdings of the three key commodity-trading groups, namely:

- Commercial Traders: this group consists of traders that use futures contracts for hedging purposes and whose positions exceed the reporting levels of the CFTC. These traders are usually involved with the production and/or processing of the underlying commodity.

- Non-Commercial Traders: this group consists of traders that don’t use futures contracts for hedging and whose positions exceed the CFTC reporting levels. They are typically large traders such as clearinghouses, futures commission merchants, foreign brokers, etc.

- Small Traders: the positions of these traders do not exceed the CFTC reporting levels, and as the name implies, these are usually small traders.

The data we are interested in is the second group of Non-Commercial Traders.

This is the group that speculates on where they believe the market is headed. While you would expect these individuals to be “smarter” than retail investors, we find they are just as subject to human fallacy and “herd mentality” as everyone else.

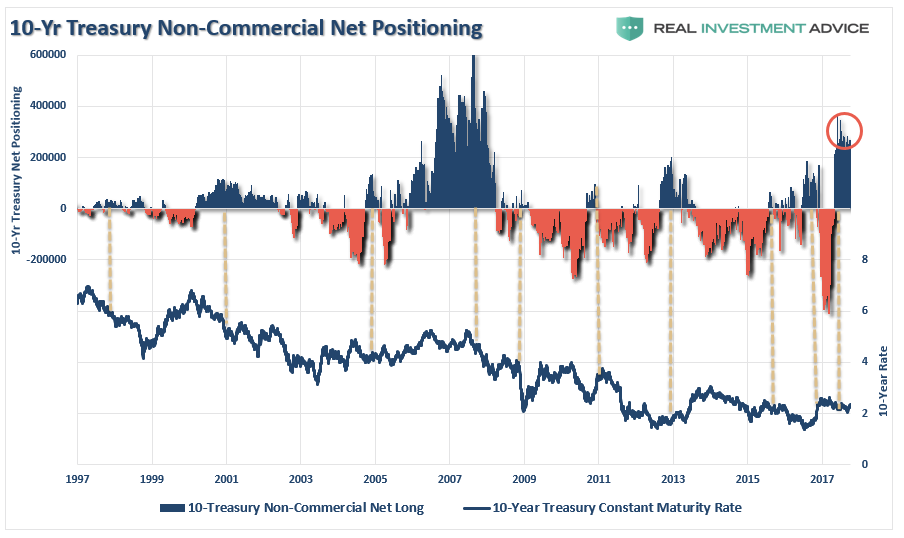

Therefore, as shown in the series of charts below, we can take a look at their current net positioning (long contracts minus short contracts) to gauge excessive bullishness or bearishness. With the exception of the 10-Year Treasury which I have compared to interest rates, the others have been compared to the S&P 500.

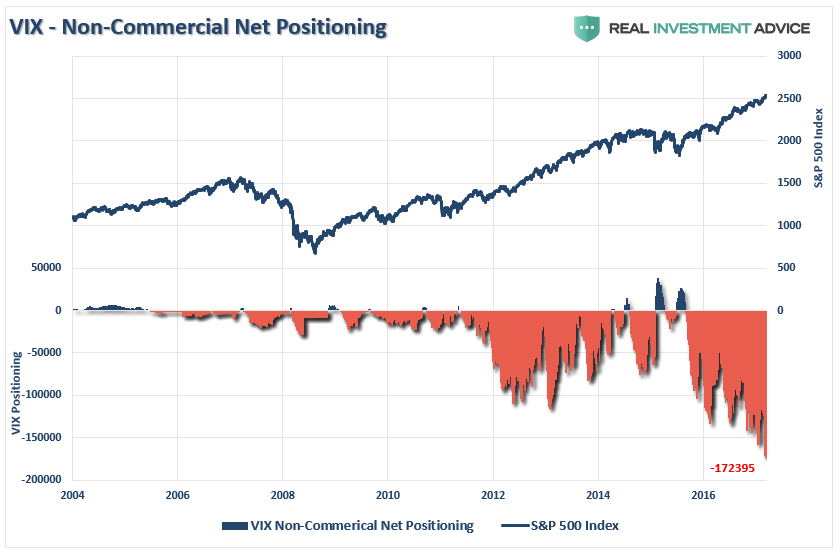

Volatility Extreme

The extreme net-short positioning on the volatility index suggests there will be a rapid unwinding of positions given the right catalyst. As you will note, reversals of net-short VIX positioning has previously resulted in short to intermediate-term declines. With the largest short-positioning in volatility on record, the rush to unwind that positioning could lead to a much sharper pickup in volatility than most investors can currently imagine.

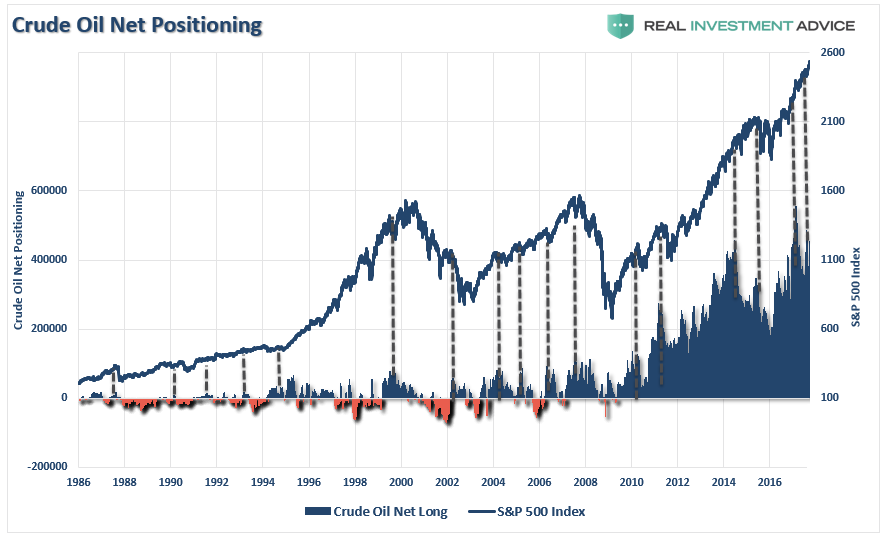

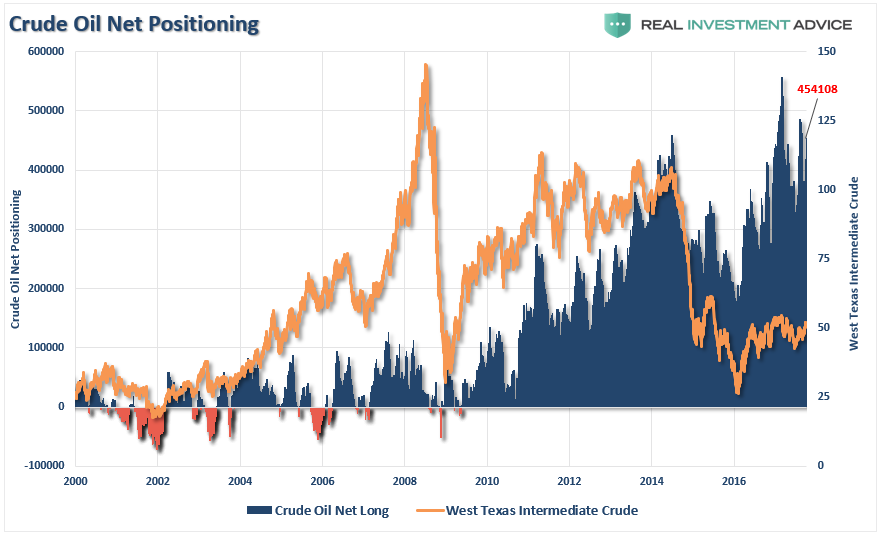

Crude Oil Extreme

The recent attempt by crude oil to get back to $50/bbl coincided with a “mad rush” by traders to be long the commodity. For investors, it is also worth noting that crude oil positioning is also highly correlated to overall movements of the S&P 500 index. With crude traders currently extremely “long,” a reversal will likely coincide with both a reversal in the S&P 500 and oil prices being pushed back towards $40/bbl.

While oil prices could certainly fall below $40/bbl for a variety of reasons, the recent bottoming of oil prices around that level will provide some support. Given the extreme long positioning on oil, a reversion of that trade will likely coincide with a “risk off” move in the energy sector specifically. If you are overweighted energy currently, the data suggests a rebalancing of the risk is likely advisable.

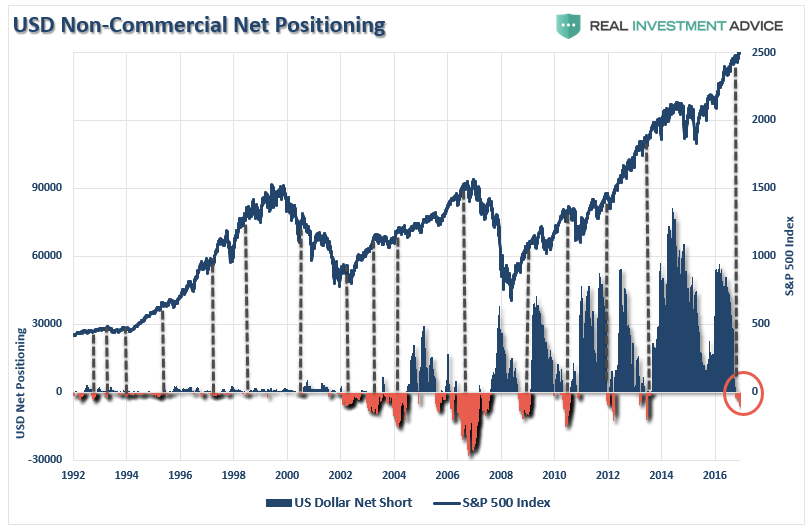

US Dollar Extreme

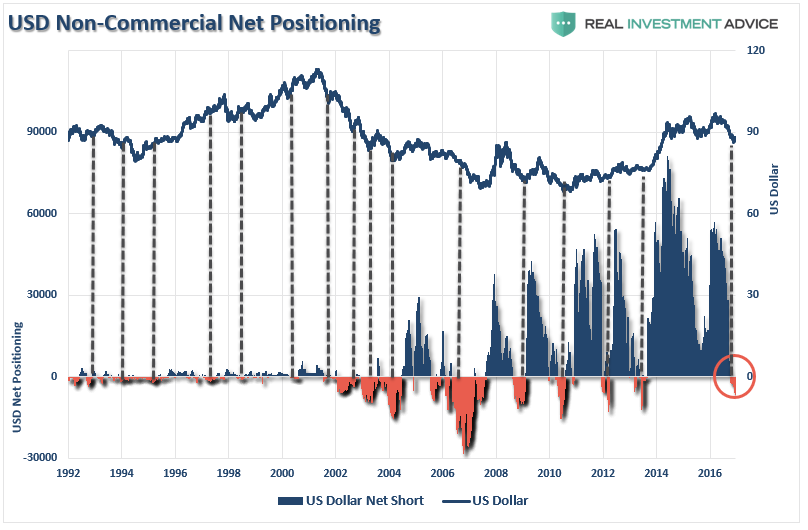

Recent weakness in the dollar has been used as a rallying call for the bulls. However, a reversal of US Dollar positioning has been extremely sharp and has led to a net-short position.

As shown above, and below, such negative net-short positions have generally marked both a short to intermediate-term low for the dollar as well as struggles for the S&P 500 as a stronger dollar begins to weigh on exports and earnings estimates.

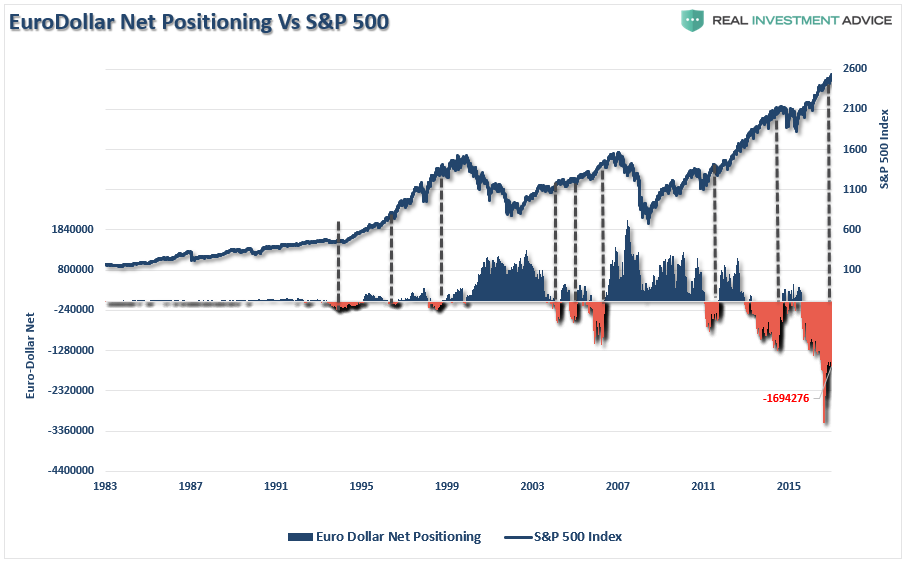

It is also worth watching the net-short positioning the Euro-dollar as well which has also begun to reverse in recent weeks. Historically, the reversal of the net-short to net-long positioning on the Eurodollar has often been reflected in struggling financial markets.

Interest Rate Extreme

One of the biggest conundrums for the financial market “experts” is why interest rates fail to rise. Apparently, traders in the bond market failed to get the “memo.” With the net positioning in bonds at some of the highest levels since the financial crisis, there is little reason to believe the “bond bull” market is over. Look for a reversal of the current positioning to push bond yields lower over the next few months.

Smart Vs. Dumb Money Extreme

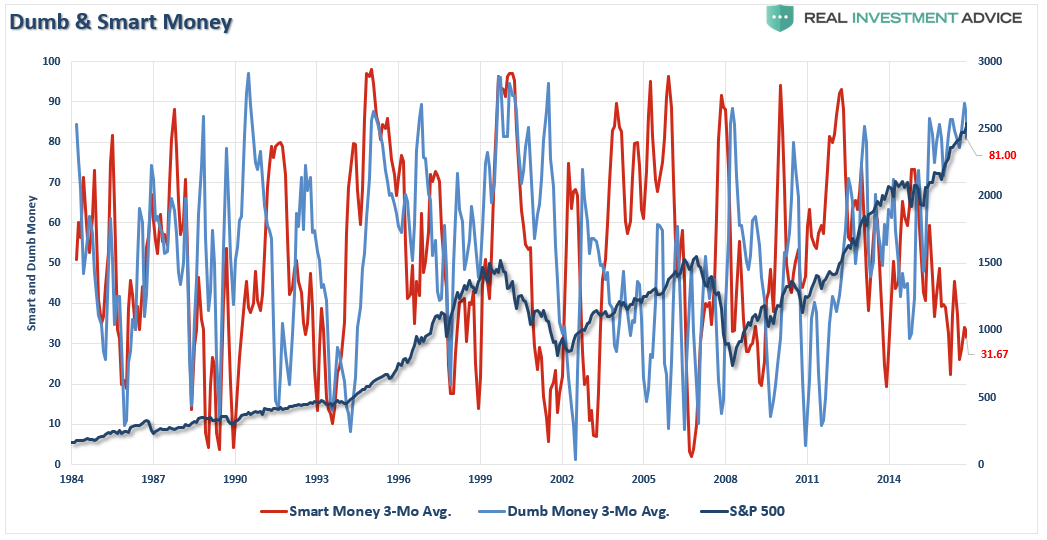

While we have been looking at solely the large non-commercial traders above, they are not the only ones playing in the future markets. We can also dig down into the overall net exposure of retail investors (considered the “dumb money”) versus that of the major institutional players (“smart money”)

The first chart below shows the 3-month moving average of both smart and dumb-money players as compared to the S&P 500 index. With dumb-money running close to the highest levels on record, it has generally led to outcomes that have not been favorable in the short-term.

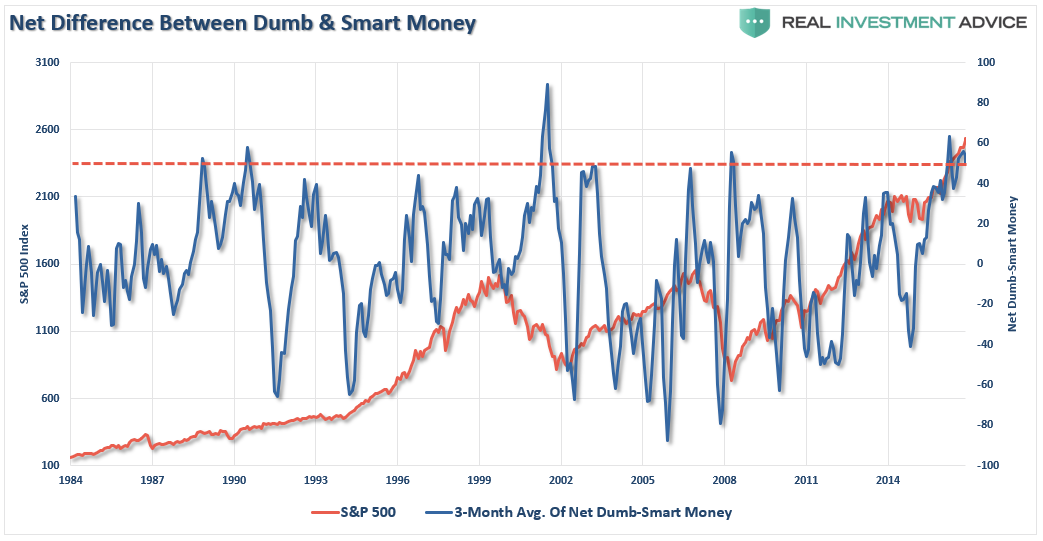

We can simplify the index above by taking the net-difference between the two measures. Not surprisingly, the message remains the same. With the confidence of retail investors running near historic peaks, outcomes have been less favorable.

None of this analysis suggests that a market “crash” is about to occur tomorrow. However, with complacency high, and investors scrambling to find excuses why markets can only go higher, suggests that extremes in positioning have likely been reached.

This was a point made by Macquarie’s Viktor Shvetz, the bank’s head of global equity strategy, yesterday:

“Investors seem to be residing in a world without any notable perceived risks. It is an extraordinary and unprecedented situation, particularly given unresolved issues of over-leveraging and associated over-capacity as well as profound disruption of business and economic models, which are not just depressing inflation but also causing extreme political and electoral outcomes while feeding Maslowian-type disappointments across labor markets.

What can explain such lack of concern regarding potential risks?

In our view, the only answer is one of investors’ perception that, as we discussed in our preview of 2H’17, ‘slaves must remain slaves’ and hence, neither Central Banks nor other public institutions can afford to step aside but need to continue to guarantee asset price inflation. In its turn, this can only be achieved by ensuring that volatilities are contained (as they are the deadliest enemy of an ongoing leveraging) and liquidity is expanding at a sufficient pace to accommodate nominal demand.

We remain constructive on financial assets (both equities and bonds), not because we expect a return to self-sustaining private sector-led recovery and growth but because we believe that an ongoing financialization is the only politically and socially acceptable answer.

In our view, therefore, the greatest risk is one of policy.”

The complete disregard for “risk” has never worked out well for investors in the past and is unlikely to be different this time either. But remember, in the short-term, the markets can remain irrational longer than logic would predict and they always “feel” their best at the peak.

Copyright © Clarity Financial