by Joachim Fels and Andrew Balls, PIMCO

We see three risks to the outlook for steady economic growth. Yet we also see opportunities for investors to target above-benchmark returns while emphasizing defense at a time of low volatility and full valuations.

Eleven years on, we don’t think another major financial crisis is likely over our cyclical horizon spanning the next six to 12 months. However, then as now, when the macroeconomic environment is as good as it gets and valuations are tight, it is time to emphasize caution, capital preservation and diversified sources of carry away from the crowded trades. Note: you just read our main high-level investment conclusion based on vigorous internal discussions at our September Cyclical Forum. Here’s more on the debate and the analysis underpinning our forecasts and investment conclusions.

Feeding the bull?

Of course, the road to a conclusion that emphasizes caution wasn’t straightforward and was plastered with intense and controversial debates – a hallmark of a nearly four-decade-old forum process that brings together all PIMCO investment professionals every quarter.

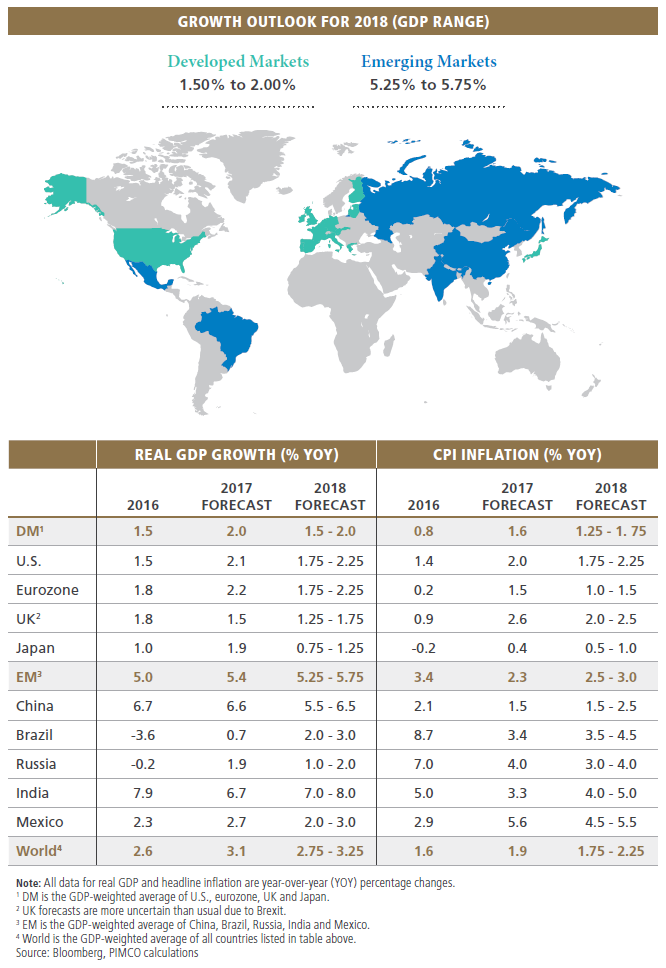

Looking on the bright side, our baseline economic forecast is for a continuation of synchronized world real GDP growth at a decent 3% pace in 2018 (the same as this year), low near-term recession risks, a moderate pickup in underlying inflation in the advanced economies, mildly supportive fiscal policies and an only gradual removal of monetary accommodation. Also, political risks emanating from nationalist/populist movements look more contained for now, particularly in Europe, partly as a function of better economic growth. Moreover, as our Asia-Pacific Portfolio Committee colleagues argued at the forum, China may well be successful in continuing to suppress volatility well beyond the 19th National Party Congress in October.

So, if you want to stay or become a bull on risk assets, all of this seems like good macro fodder.

The ABCs of caution

However, once you start to look through the smooth macro surface at the underlying risks and uncertainties, there are a few problems that might pop up even over the short-term cyclical horizon and upset the eerie calm in financial markets. Apart from the obvious geopolitical threat emanating from North Korea, the most important macro uncertainties – “the ABCs of caution” – are the aging U.S. economic expansion, the coming end of central bank balance sheet expansion, and China’s political and economic course following the party congress.

On aging, as the U.S. expansion matures and slack in the labor market keeps eroding, we expect GDP growth to slow to a below-consensus 2% or less and core CPI inflation to pick up to 2% in the course of 2018. Thus, the mix of nominal growth between real growth and inflation will become less favorable as disappearing slack makes it difficult to sustain the current pace of job and output growth. True, an acceleration of productivity growth would help, but does not seem to be in the offing as business investment outside energy remains moderate. A Federal Reserve that is fixated on the Phillips curve will likely raise the policy rate two or three times between now and the end of 2018 – less than the four hikes the Federal Open Market Committee (FOMC) currently foresees but more than the extremely shallow rate hike path that markets price in right now. Thus, the front end of the U.S. yield curve looks vulnerable.

Regarding central bank balance sheets, the market has so far taken in stride the Fed’s plans to begin the process of normalizing its balance sheet in October as well as the European Central Bank’s (ECB) hints at tapering its bond purchases next year. But don’t forget that there is virtually no historical precedent for major central banks actively reducing their balance sheets. Thus, the impact of the Fed’s balance sheet unwind on the term premium and other risk premiums is unknown, especially as it will coincide with a period of uncertainty about the future Fed chair and the composition of the Board of Governors. This is one reason for us to be slightly underweight duration and to expect a steeper yield curve.

As regards China, our forum debates centered on the implications of the more centralized and concentrated leadership that is likely to result from the party congress in October. One view, as stated above, is that the new/old leadership will focus on further suppressing economic and financial volatility through a combination of continued leverage expansion, financial repression including tight capital controls and imposition of supply discipline in commodities industries. If so, unlike in 2015–2016, China would not be an exporter of volatility to global financial markets. While this is a possible outcome, another distinct possibility is that the likely consolidation and concentration of power opens the door for significant and surprising policy changes, including major reforms affecting state-owned enterprises (SOE) and forced deleveraging, which would weigh heavily on growth and could lead to more tolerance for currency depreciation. This could potentially be signaled by a highly symbolic shift, such as the leadership dropping the growth target. Such changes, or the fear thereof, have potential to disrupt global markets. In addition, a more assertive China in foreign affairs under a “paramount leader” President Xi Jinping raises the risk of an escalating trade conflict in case the U.S. administration decides to get tough on trade policy.

Regional economic forecasts: around the globe in five minutes

And here’s our 2018 outlook for the major economies:

US

Note that in our base case, we expect a small tax cut (rather than a major tax reform) worth about $500 billion over 10 years, which is too small to move the needle on growth. Hopes for a bipartisan tax deal are likely to be disappointed as Democrats and Republicans seem too far apart on tax issues.

Eurozone

The eurozone economy is likely to grow by an above-consensus 2% in 2018 and thus significantly above trend, but past labor market reforms, persistent competitiveness gaps between eurozone member states and the euro’s appreciation suggest that core inflation will make only moderate progress toward the ECB’s target of “below, but close to, 2% over the medium term.”

Still, technical and political constraints will induce the ECB to gradually taper its bond purchases in the course of 2018, while keeping policy rates at record lows until well into 2019 and thus for longer than markets price in.

A key risk for the outlook is the Italian elections in the first half of 2018. However, compared with our previous Cyclical Outlook in March, the political risks look more contained as the Eurosceptical parties in Italy have toned down their anti-euro rhetoric (Italexit doesn’t seem very popular with Italian voters). Also, elections in France and the Netherlands earlier this year have seen limited success versus expectations for more extreme positions on euro membership.

UK

We expect growth to remain at current levels of around 1.5% for the balance of 2017 and into early 2018. Our base case expects a transitional arrangement to smooth the UK separation from the EU. If this happens, we expect growth to reaccelerate as business confidence picks up and some pent-up business investment is approved. We also see some scope for a pickup in government spending after seven years of austerity. Our UK growth forecast is in line with the consensus for 2017 and above for 2018.

We see inflation returning to the 2% target by the end of 2018, earlier than both the consensus and the Bank of England (BOE). We believe all of the rise in UK CPI so far this year can be attributed to the fall in the British pound after last year’s Brexit vote. We expect the upward pressures from import prices to fade over 2018 and with few signs of second round effects in domestically generated inflation, we see CPI back to target by the end of 2018.

In our base case we expect the BOE to start raising interest rates in 2018, although given the recent hawkish tone there is a risk of a hike in 2017. We expect to see one or two interest rate hikes by the end of 2018, with risks evenly spread around the central forecast.

Japan

We expect real GDP growth to moderate somewhat in 2018 but remain above trend, reflecting ongoing fiscal and monetary support as well as decent global growth. Core CPI inflation should creep up toward close to 1% in the course of next year as wage growth accelerates, but the 2% inflation target remains out of reach for the foreseeable future. Still, with some progress on the inflation front, we look for the Bank of Japan (BOJ) to nudge its yield target for 10-year Japanese government bonds 20 to 30 basis points higher from the current level of 0% in the second half of next year.

A key potential swing factor for the economic and market outlook will be the political future of Prime Minister Shinzo Abe and the succession of BOJ Governor Haruhiko Kuroda. In our base case, we expect Abenomics to prevail even under a potential new prime minister and/or central bank governor. However, there is a distinct risk that a new leadership might shift toward tighter fiscal policies and a normalization of monetary policy.

China

Our base case sees growth decelerating further in 2018 from the current 6.6% pace, with our (unusually wide) forecast range centered around 6%. Uncertainty about the leadership’s prospective stance on financial stability, deleveraging and economic growth following the party congress in October is unusually high.

As we noted above, one possible scenario is that the new/old leadership will focus on further suppressing volatility via continued leverage expansion, financial repression and imposition of supply discipline in commodities industries. If so, growth could hold up at around the current pace.

Another scenario is that the likely consolidation of power creates opportunities for significant policy pivots, including major SOE reforms and forced deleveraging. These changes would tend to weigh heavily on growth (pushing it to below 6%) and could lead to greater tolerance for a depreciating Chinese yuan. In this scenario we could see a highly symbolic shift, such as the leadership dropping the growth target.

Investment implications

As previewed above, in an environment in which the macro climate is about as good as it is going to get and where valuations are tight, we will emphasize capital preservation in our portfolios. The considerable uncertainty in the outlook, including the aging U.S. expansion, tapering of central bank balance sheet support and China-related risks we think necessitates a cautious approach to portfolio construction, generating income and grinding out alpha with a broad set of small trades rather than taking large concentrations in generic corporate credit.

While the baseline for the Fed’s balance sheet unwind and the ECB’s ongoing tapering – and broader central bank tightening – should be broadly priced in, the fact remains that full valuations and low volatility leave little margin for error. In the later stages of the corporate credit cycle, as active managers, we think it makes sense to emphasize portfolio liquidity and to avoid less liquid positions as a rule and focus on those bottom-up opportunities where we are truly paid for the risk.

While staying fairly close to home in the overall positioning versus the benchmark, we can aim to generate above-market return from a range of positions:

- U.S. non-agency mortgages

- U.S. agency mortgages

- Other select structured product opportunities

- Curve positioning

- Instrument selection

- Bottom-up credit positions

- Emerging markets (EM) foreign exchange positions

- EM local rate and external bond positions

- Optimization of bottom-up positioning with a high quality/income-focused bias more generally across specialist sectors

Duration

We expect to be slightly underweight duration overall, anticipating fairly range-bound markets but with the potential for a shift higher in yield across market levels that are low even in the context of our New Normal/New Neutral framework. In the U.S., as discussed above, we think the Fed is likely to hike more often than the extremely shallow path priced in by the market.

That said, while U.S. duration is in the lower part of our expected range, it continues to look attractive versus most other global alternatives. We continue to favor Japan duration underweights based on the asymmetric return profile at current levels. Over the medium term, we expect the BOJ to adjust the yield cap on 10-year bonds higher and see only modest risk of significantly lower yields. Moreover, while our baseline is for global duration to be broadly range-bound, we see Japan duration underweights as a low-cost hedge against rising global rates. In the event that we see yields rising in the U.S. and elsewhere, we would expect this to force the BOJ to relax its yield curve targeting regime over time.

Spread

We reduced corporate credit risk already across our portfolios and will continue to avoid generic investment grade and high yield corporate credit, looking to our credit specialist teams for bottom-up analysis, with a focus on high quality “bend-but-don’t-break” credit positions. U.S. non-agency mortgages and other high quality securitized assets where we see remote default risk offer defensive qualities in addition to reasonable risk premia for liquidity, complexity and uncertainty over the timing of cash flows. While we see a more balanced outlook for European macroeconomic and political risk, we do not see European peripheral sovereign spreads as offering compelling risk/reward at current levels.

Currencies

We do not see significant imbalances at present in G-10 currency markets. We will continue to favor a diversified basket of EM currency overweights to generate income where it makes sense within our overall portfolio construction, alongside other income-generating opportunities.

Equities

In asset allocation portfolios, we expect to be broadly neutral on equities and commodities. Global equities have had a good year supported by a robust synchronized recovery in earnings. While fundamentals at the global level broadly underpin performance, valuations are full. Japanese equities stand out, screening as relatively “cheap” among developed markets, with the possibility of earnings upside versus relatively subdued expectations.

Commodities

In commodities markets, while fairly neutral overall in terms of the broad beta of the asset class, we will continue to exploit bottom-up opportunities. We expect oil prices to be fairly range-bound with natural stabilizers on both the upside and downside thanks to OPEC spare capacity and the relatively quick responsiveness of shale production to price changes.

Copyright © PIMCO