by Ryan Detrick, LPL Research

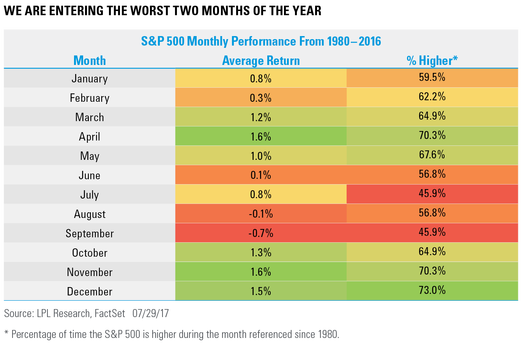

As we noted in You Are Here two weeks ago, seasonality is something to be very aware of – as history has shown, many of the worst market drops tend to take place over the next two months. With the S&P 500 Index officially more than a year since its last 5% correction, the longest streak in 22 years, and more than nine months without so much as a 3% correction, the calendar becomes even more noteworthy.

Per Ryan Detrick, Senior Market Strategist, “This has been a great year for equities so far, but can the bull buck the tricky month of August? Think of this, since 1980, only August and September have sported negative returns on average and August has been the worst month of the year twice out of the past four years. Even during the great run of ’13, August was the worst month of the year losing more than three percent.”

Let’s get one thing straight, we would use any pullback as an opportunity to add to positions. Overall, earnings are strong globally, central banks are still accommodative, and inflation remains low. But trees don’t grow forever and markets are rarely ever this calm for this long, especially as the economic cycle ages.

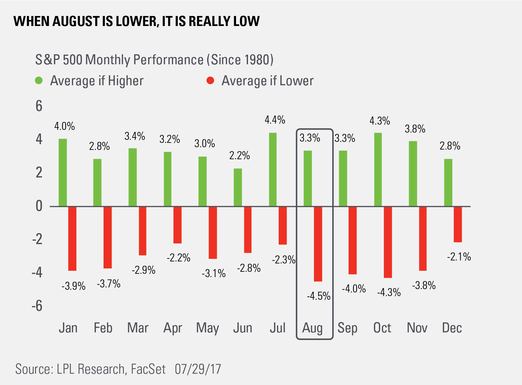

Last, note that when August is down, it is really down. According to Ryan Detrick, “Maybe it is the back to school blues, but since 1980, there is no month with a worse average return when it is lower than August. Look at the recent history of August: 2015 was the China currency issues and a 1,000 Dow drop, 2011 had the U.S. debt downgrade, 2010 saw a big drop as worries over the global economy spread, 1997 and 1998 both saw big drops in August over the “Asian Contagion” and the implosion of Long-Term Capital Management (LTCM). Oh, and Iraq invaded Kuwait in 1990. Pick a reason why these big, out of the blue events happen in August. Bottom line is they do and we should be ready ought it happen again.”

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Stock investing involves risk including loss of principal.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-630058 (Exp. 07/18)

Copyright © LPL Research