by Richard Turnill, Global Chief Investment Strategist, Blackrock

Richard explains what a delayed supply-and-demand rebalancing means for oil prices.

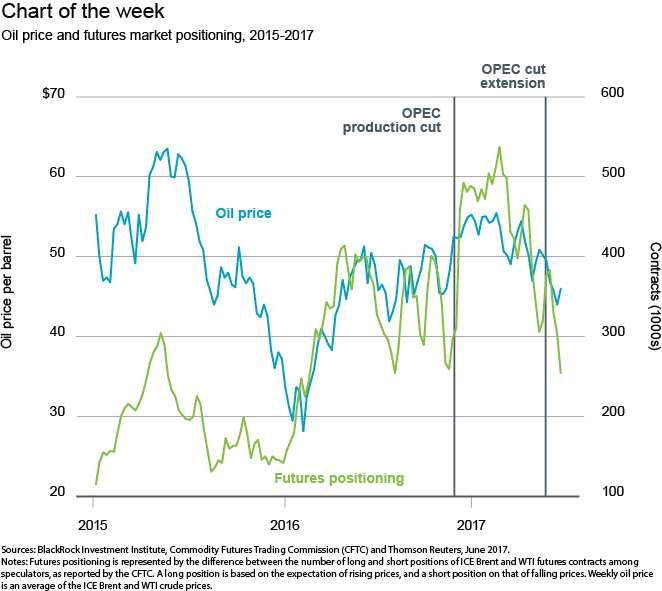

Fears of a supply glut have again hit the oil market. An expected rebalancing of supply and demand is taking longer than we thought. We now see oil trading in a range around current levels, as the market rebalances in the second half of the year.

Oil prices rose after an Organization of Petroleum Exporting Countries (OPEC) deal in November sparked optimism that production cuts would help bring supply and demand into balance. Higher-than-expected supply and weak demand then dashed these hopes. This was evident in more speculative bets on falling prices.

The supply-and-demand picture ahead

The global oil supply glut hasn’t eased as fast as we thought it would, but we expect to see a reduction in global oil inventories—and a rebalancing of supply and demand—in the second half of the year. Current OPEC compliance with production cuts is well above the historical average and it typically takes two to three quarters for inventories to reflect such cuts. Technological advances in U.S. shale are contributing to a supply surplus and keeping a cap on any oil price rise, but the growth rate of U.S. oil production has slowed recently. Also, we believe U.S. production could be further constrained by reduced labor supply and rising input costs. Elsewhere, recent increased production out of Libya and Nigeria doesn’t appear sustainable.

Global oil demand has not yet risen to offset higher supply, but we expect sustained above-trend economic growth globally to support oil demand from here. Against this backdrop of delayed rebalancing, we now see oil prices fluctuating around current levels, in a lower range than we had expected earlier this year.

We see selected opportunities in beaten-down energy assets. We prefer shares of exploration and production (E&P) companies, particularly low-cost U.S. shale producers. These firms can benefit from technological advances and operate on a short investment cycle. We also like emerging market energy equities and selected debt of high-quality E&P companies. Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of July 2017 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2017 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners.