by Blaine Rollins, CFA, 361 Capital

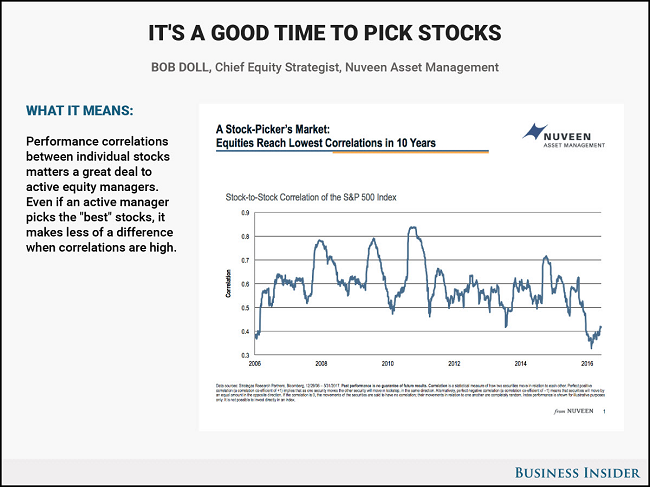

If you are not already on break, then you are thinking about busting out soon to take some days off before the Q2 earnings season hits in three weeks. This is the last week of June and the second quarter so expect some window dressing into the July 4th holiday weekend. It is pretty easy to see which sectors PMs do not want to show in their portfolios this weekend and which ones they want to make prominent for July client meetings and conference calls. Global equities will be looking toward their seventh straight quarter of gains. And with equity correlations continuing to free fall during June, active managers are looking to beat up on the indexes.

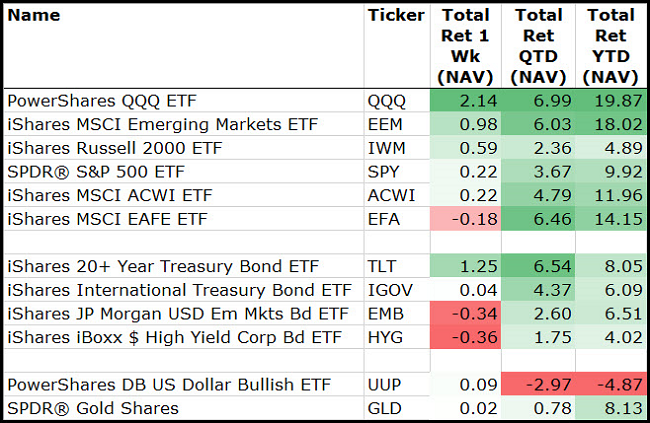

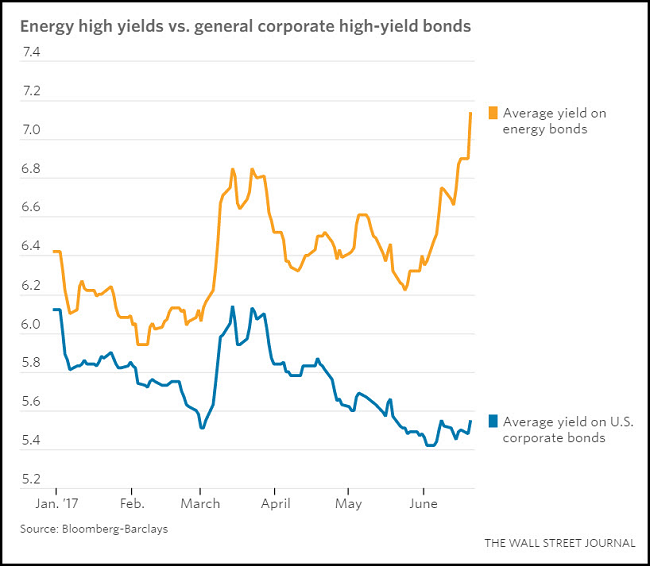

With the bounce in Tech and the surge in Biotech last week, the Nasdaq 100 is in a tight race with the EAFE and Emerging Market indexes for the top Q2 slot. For fixed income, the major bond asset classes were positive across the board, although U.S. High Yield has slowed in recent weeks as energy prices have corrected. The wind appears to be at the backs of International investors as the U.S. dollar looks to end the quarter with losses. So have a good trip not only with your suitcase, but also with your portfolio.

(Prices 6/23/17)

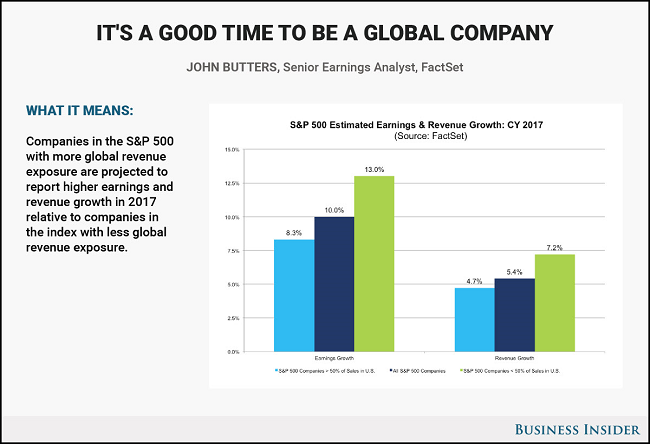

If you can’t invest in foreign stocks, at least find those U.S. stocks with foreign revenues and earnings…

Faster growth overseas and a falling U.S. dollar will lead to better top line and bottom line growth for U.S. multinationals.

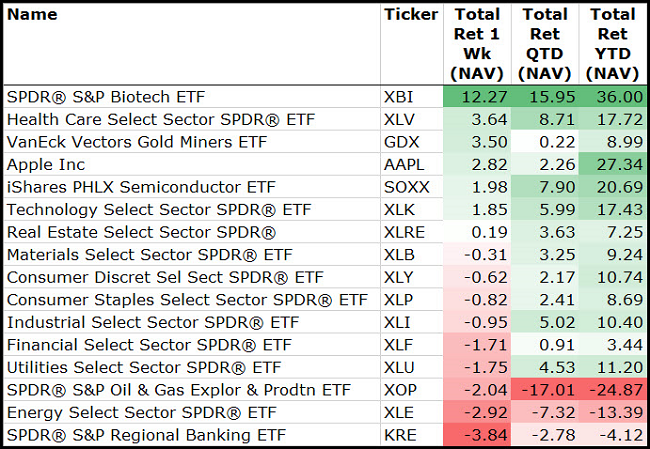

Looking at the major U.S. equity sectors on the week shows a further disconnect in correlations…

The biotech and pharma surge has helped healthcare recover. HMO’s and hospitals also had a good week as the ACA replacement hit the Senate floor like a spilled bedpan. Energy and Banks continue to accumulate losses as both energy prices and interest rates test 2017 lows. The energy weighting in the S&P 500 has cost investors almost 50bps in the Q2 and 100bps for 2017. S&P ownership of U.S. bank exposure has cost about one-third of these amounts. So guess where active portfolio managers won’t be investing this summer?

(Priced 6/23/17)

Thank you Biotech…

The run in Biotech stocks came just in time to reward active portfolio managers for the second quarter. And given the opposition to the House and now Senate ACA replacement bills, Healthcare looks to have even more smooth sailing into the third quarter.

(@stt2318)

As a result, Healthcare now rivals Technology stocks for the top sector slot in 2017…

Now looking at decade lows in S&P 500 equity correlations…

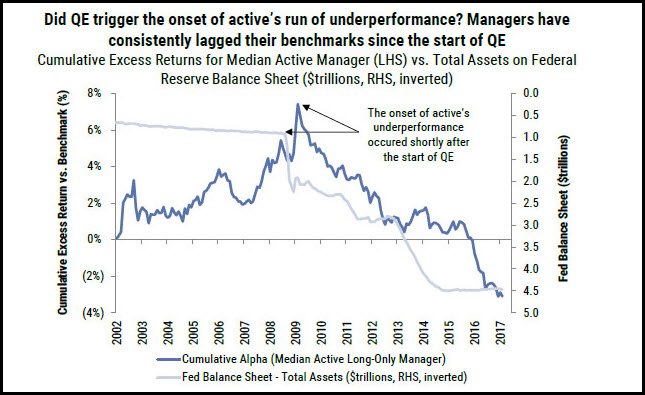

Plenty of reasons as to why active managers have underperformed…

This chart from Goldman Sachs illustrates one of the best reasons: the ramp in QE.

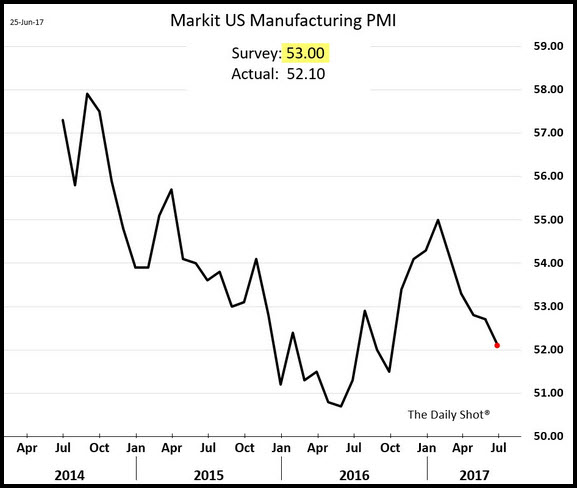

U.S. economic data points continues to miss…

Again the Markit U.S. Mfg PMI missed last week.

(WSJ/Daily Shot)

Ongoing misses are making the Economic Surprise chart look horrific…

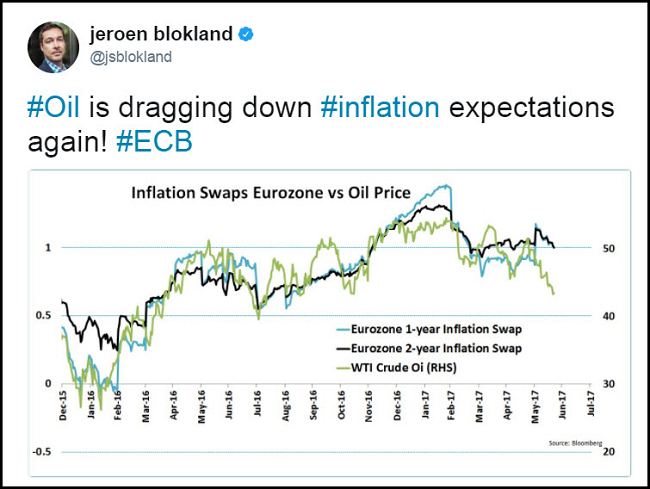

An equally ugly chart is the price of Oil which danced with $42/bbl last week…

(@stt2318)

The good news is that this can lower inflation expectations…

That is assuming you want lower inflation expectations.

The bad news is that lower oil prices can worry the credit markets…

(WSJ)

One energy CEO didn’t hold back on a room full of investors last week…

This is from the Anadarko CEO, Al Walker, and it is great.

“The biggest problem our industry faces today is you guys. You don’t reward capital efficiency, you reward growth. When you guys stop rewarding growth and reward capital efficiency, guess what — and the share prices react, people will stop chasing growth for growth’s sake. As long as investors continue to invest in companies with growth with marginal wellhead economics, you’ll get more growth. So you guys can help us, help ourselves. This is kind of like going to AA. We need a partner. We need somebody to sit through that class with us, but we do. I mean, we really need the investment community to show discipline, just like you’re asking us, I think, appropriately so in this environment, to show discipline. We need you to be disciplined in the way you allocate your investment dollars because first off: a) most of you are not getting big funds flows right now; b) you’re underweight in energy because you’ve made sector bets that are probably a better place to be than energy in the foreseeable future, and those of you that are in energy that want to stay in energy you are probably doing some securities rotation right now. All of that’s understandable. So just think about trying to look at situations where capital efficiency actually can be rewarded and that’s not a company-specific comment, it’s more of a generic, because the more the capital-efficient companies are rewarded in the marketplace and growth is not, then you guys will help us help ourselves and we’ll be in a better place, but if you keep rewarding growth without return, you’re just going to help compound the problem that we have today, where I think a lot of us feel very much in need of showing growth because if you’re a growth and value investor, you need to see little bit of both.”

(Oil Pro)

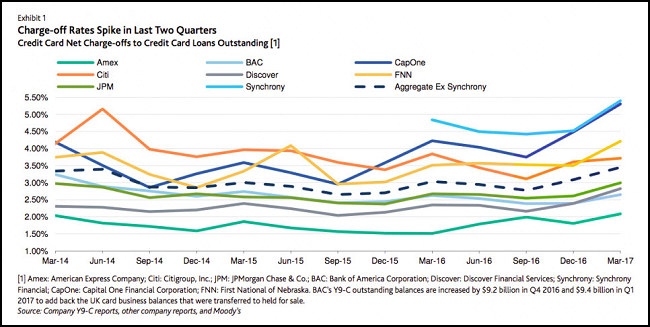

Something to keep an eye on…

Credit card lending standards have gotten too easy. The economy hasn’t flinched too much and so with charge-offs starting to gain, it can only mean that the issuers are giving out the cards and lines too easily. Expect them to pull back or begin to lose much more money.

The “I am. I can. I will. I do.” chart of the week…

Unbelievable. Just wait until SpaceX goes public.

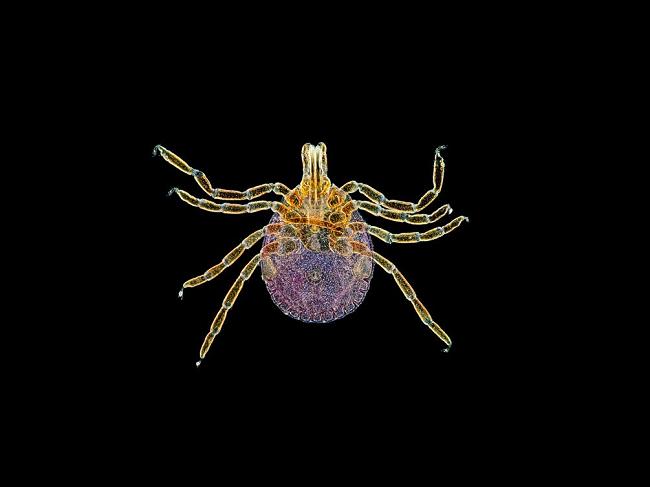

Finally, could this little bug be the solution to global warming?

We know that cows and pigs are major contributors to carbon emissions. So take this story to the sci-fi extreme where this tick bites most humans on earth, makes us allergic to red meat and global cooling begins faster than you can say Chick-fil-A.

Red meat, you might be surprised to know, isn’t totally sugar-free. It contains a few protein-linked saccharides, including one called galactose-alpha-1,3-galactose, or alpha-gal, for short. More and more people are learning this the hard way, when they suddenly develop a life-threatening allergy to that pesky sugar molecule after a tick bite.

Yep, one bite from the lone star tick—which gets its name from the Texas-shaped splash of white on its back—is enough to reprogram your immune system to forever reject even the smallest nibble of perfectly crisped bacon. For years, physicians and researchers only reported the allergy in places the lone star tick calls home, namely the southeastern United States. But recently it’s started to spread. The newest hot spots? Duluth, Minnesota, Hanover, New Hampshire, and the eastern tip of Long Island, where at least 100 cases have been reported in the last year. Scientists are racing to trace its spread, to understand if the lone star tick is expanding into new territories, or if other species of ticks are now causing the allergy.

(Wired)

Copyright © 361 Capital