by Jeff Hussey, Russell Investments

We all know that investing is inherently risky and that diversification is one way to help to manage risk. Most investors or advisors—who know just how important a diversified portfolio can be—would not go all fixed income, or all value stocks, or put all their money in a single company.

Those kinds of investors know that markets are cyclical. What is winning today could lose tomorrow. Diversification, as part of a total investment strategy, can help to protect against losses. And, according to modern portfolio theory pioneered by Harry Markowitz, diversification is the only free lunch in town. These days, it seems our entire industry is dedicated to finding ever more exotic portfolio diversifiers.

Protection against cyclicality

It may seem elementary, but the primary reason we diversify is because of market cyclicality. Asset allocations come in and out of favor. For example, we believe in diversifying across growth and value, because market favorability cycles between those two factors. So then, do investors need to diversify across active management and passive investing? I believe that diversification is only necessary if active and passive also perform in a cyclical nature. But do they?

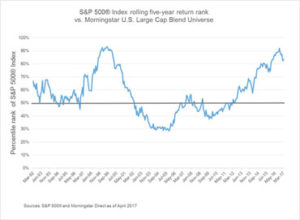

Let’s look at the data. The chart below shows the cyclicality of active and passive in the U.S. market. When the blue line is below the 50th percentile, the S&P 500® is performing below the average active manager. Note that, on this chart, peaks in passive management performance tend to be followed by severe drops. As always, investors should be wary of buying high.

So then, do active and passive behave cyclically? Yes.

Over the long-term, we believe cyclicality is inevitable. That’s why the industry refers to a generation of performance as a market cycle. In other words, if the law of mean reversion holds true, recent years are not likely to reflect the years to come. And, in my view, the proper way to look at the performance of either an asset class, or an investment approach, is to look at the entire market cycle.

Therefore, in the same way many investors diversify across exposures, they may need to diversify across active and passive investment approaches as well, to help mitigate performance-chasing behavioral risks and to optimize potential opportunity. Because, like most aspects of investing approaches, passive results are also cyclical, as the chart above shows. Sometimes passive wins. But many times, under many market conditions, active management can outperform.

The search for returns

Earlier this year, I wrote about the low-return imperative, which states: When expected future market returns are likely to be lower than the required rate of return, we believe an investor cannot afford to ignore any investment strategy that may help to offer incremental return, take on risks they do not expect to get paid for or disregard implementation efficiency.

We believe that including an active approach in a dynamically managed, multi-asset portfolio not only helps to create a well-diversified portfolio, but also can help to include exposures to a wide variety of return sources. For example, having real estate, infrastructure and even a very small allocation to commodities may make sense for some investors.

In our view, for any multi-asset portfolio, including active and passive may be a key part of helping to capture those outperformance opportunities and manage the potential downside risk that comes with an undiversified approach.

Copyright © Russell Investments