by LPL Research

Asset growth in sustainable investments, a term that refers to strategies that attempt to augment traditional financial analysis with analysis of additional factors such as environmental, social, and governance (ESG) practices, has been strong in recent years, with U.S. assets under management totaling more than $8.7 trillion in 2016, or nearly one out of every five dollars under professional management.[1] However, even with recent growth, there are still some broad misconceptions about these types of strategies, two of which we address below:

- Sustainable investing methods haven’t changed over time.

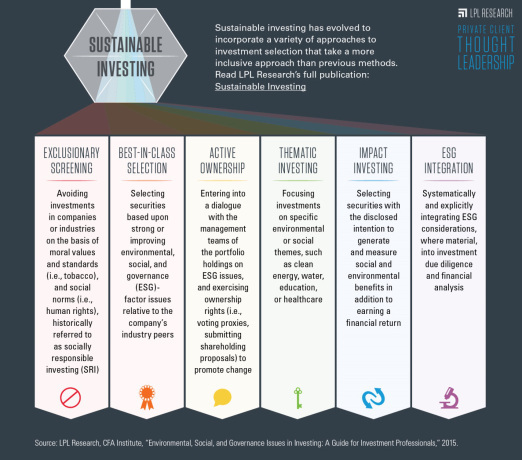

Sustainable investing strategies actually have evolved, and the changes may surprise those who haven’t looked at the space in some time. Many investors associate sustainable investing with socially responsible investing (SRI), which avoids investments in companies or industries on the basis of moral values and standards. However, SRI is just one strategy among many. The term sustainable investing also includes several other strategies outlined in the infographic below:

- Sustainable investing constrains the investment universe, potentially leading to lower returns.

This is a common concern about sustainable investing that may keep some investors away from the strategy. However, sustainable investing has evolved from its SRI roots to incorporate other strategies, including ESG investing, which focuses on finding companies that are best in class in this area rather than using an exclusionary approach. The idea is that by selecting companies with stronger ESG practices, investors may be able to avoid legal, reputational, and other risks that could lead to financial losses. Our recent Thought Leadership publication, Sustainable Investing, begins with examples of such situations.

Sustainable investing is not a new concept, and we understand the trepidation that some investors feel regarding the term. Although exclusionary approaches have worked well for some, we recognize they are not for everyone. Our main goal in bringing this topic back to the forefront is to ensure that investors and their advisors are aware of the evolving nature of the space, and that it may be worth a second look, not only for those who want to align their investments with their values, but also for investors who are concerned that ESG factor risks could turn into financial challenges for companies.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Sustainable Investing is subject to numerous risks, chief amongst them that returns may be lower than if the advisor made decisions based only on investment considerations.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-611818 (Exp. 05/18)

Copyright © LPL Research