by Cliff Stanton, CFA, 361 Capital

Long/Short Equity is by far the largest of the single strategy alternative mutual fund categories tracked by Morningstar. Why? Investment flexibility and the potential to dampen portfolio volatility are among the top reasons.

In times of market uncertainty and dwindling returns from traditional asset classes, investors are looking to long/short equity strategies to capture equity-like returns while managing downside risk.

Investors find long/short strategies appealing for several reasons

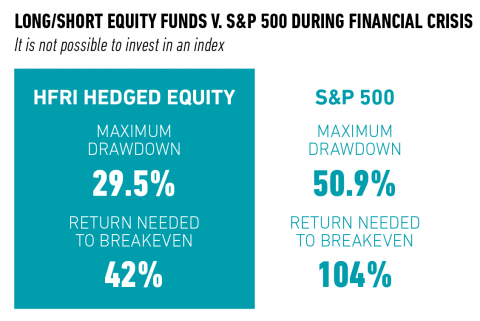

1) Long/short managers can dampen volatility and help mitigate the possibility of a large loss. For example, the maximum drawdown for the HFRI Hedged Equity Index was 29.5% during the financial crisis, while the S&P 500 experienced a drawdown of 50.9%. An investor who experienced the loss of the HFRI index needed to generate a return of approximately 42 percent to get back to even, while an investor in the S&P 500 required more than double—a return of 104 percent. Point being, while a 29.5% loss is undoubtedly tough to stomach, climbing out of that hole is far less daunting than what long-only investors faced.

2) The ability to go long or short provides the ultimate investment flexibility that is fully responsive to manager conviction. When long-only managers come across a security with a lower expected risk-adjusted return profile they can do one of two things: underweight it relative to the index or avoid it altogether. Long/short managers, on the other hand, have greater flexibility to express their views on all securities that they research. A security identified as having superior characteristics is purchased; a security with a poor outlook is shorted; and a security believed to have a market-like payoff is put aside until such time that either valuation or fundamentals turn it into a higher conviction long or short position. Greater efficiency is possible because more of the information uncovered during the research process can be acted upon.

3) Liquidity is less of a concern compared to other alternative strategies. It’s no secret that size is the enemy of all investment strategies: the more assets raised, the harder it is to put those assets to work without incrementally lowering the portfolio’s return potential. Long/short equity is no exception, but global equity markets are deep enough to mitigate liquidity concerns until a fund raises several billion dollars. (Depending, of course, on the market cap characteristics of the long and short book.) In addition to equities, long/short managers are also able to use options, total return swaps or single stock futures to implement their views, all of which can help manage liquidity-related issues. Investors should additionally keep in mind that our observations have shown that hedged equity managers tend to take a long position on smaller stocks and short larger stocks over time. As such, it’s best to consider the overall liquidity profile of each manager during the underwriting process.

Why long/short equity makes sense now

One option for tackling these unpredictable times is for advisors and clients to examine the effectiveness of long/short equity strategies.

The starting point for such an evaluation is current market valuation and fundamentals. Equities continue to exhibit lofty valuations by historical standards, with a Shiller Cyclically Adjusted PE Ratio of about 29 times earnings versus a long-term average of 16.6, and interest rates remain near their all-time lows, as measured by the 10-year Treasury.

While equity valuations can reside far from their means for extended periods, bond valuations expressed in current yields do tend to be more predictive of near-term returns for investment grade debt, a key component of the typical core portfolio. With that in mind, let’s explore the potential pathways for rates.

Closer to zero

What if rates remain relatively flat for the next few years? Over the medium term, the best predictor of bond market returns, as measured by the Barclays Aggregate Bond Index, is the yield at the time of investment, and the yield on the index was about 2.6 percent as of April 3.

Further, an estimate of future inflation based on a model that combines the inflation forecast from the Philadelphia Fed’s Survey of Professional Forecasters and the implied breakeven rate of inflation between nominal Treasuries and TIPS (adjusted for the liquidity premium), suggests that inflation will run around 2.4 percent over the next 5 years.

Therefore, even without a much-feared rise in interest rates, the best investors can reasonably hope for from their U.S. investment grade bond holdings over the next five years is a return of very close to zero on a real basis.

Of course, the math will likely be worse if rates rise. Long-term corporate bonds and long-term government bonds experienced four consecutive decades of negative real rates of return beginning in the 1940s. Forty years is an entire investment horizon for the typical investor, who begins saving at age 25 and retires at age 65. While it would seem highly unlikely that history would repeat in such a way, advisors and their clients need to be aware that it isn’t outside of the realm of possibility.

And what if rates continue to fall? If that is the case, the U.S. economy will undoubtedly be knee deep in a worsening quagmire. Investors could still do well in investment grade debt for a while longer, but equities would likely falter.

All of this is exacerbated by the fact that clients don’t have the luxury to wait to earn the “average” returns offered by the long term. With only a few decades over which to save and invest for retirement, a prolonged period of low real returns can be quite detrimental, as that reduces the time over which compounding can work its magic. The math of a big loss can be very difficult from which to recover.

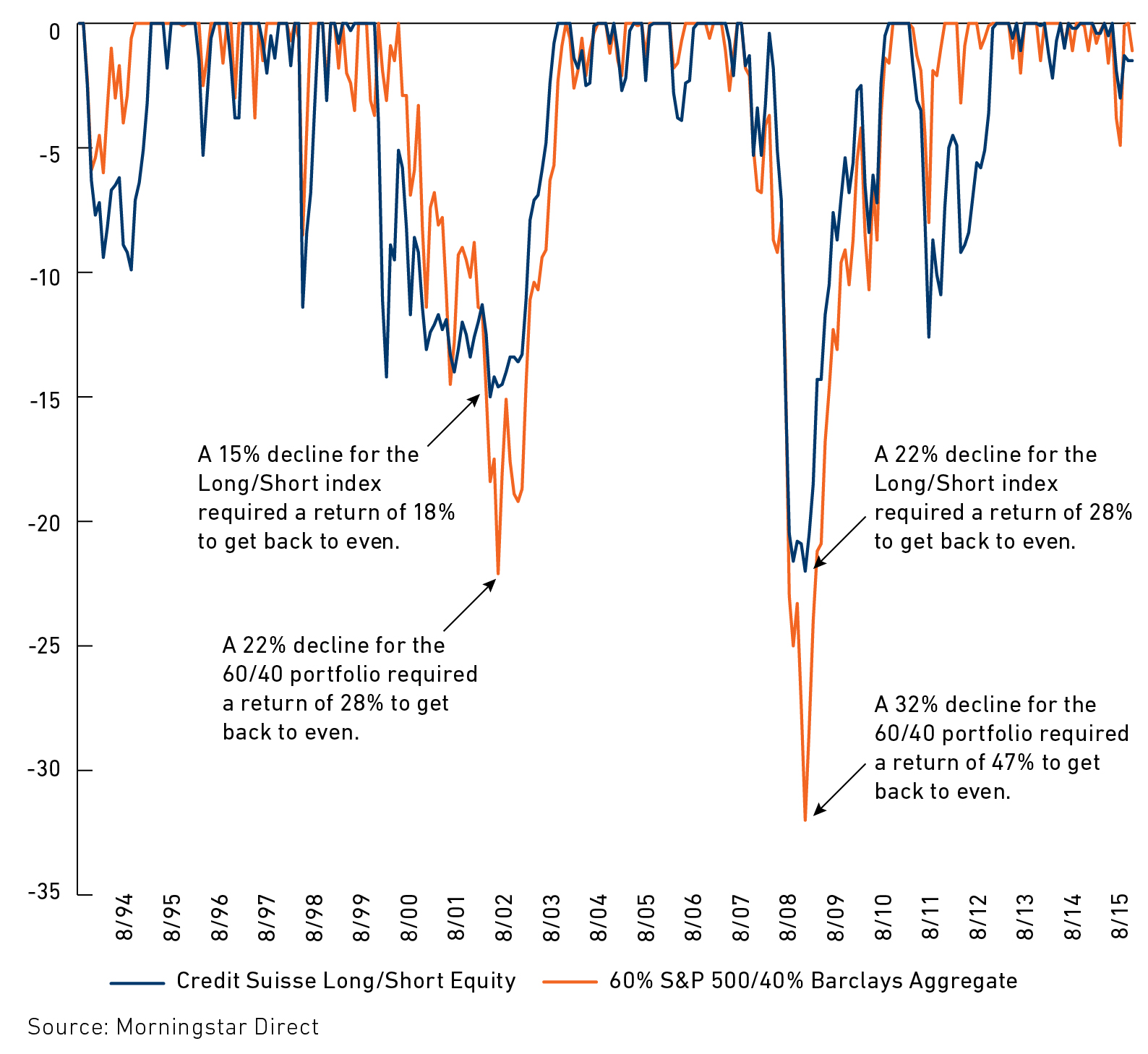

The bottom line is that investors need to improve upon the return potential of an investment grade debt portfolio without taking on too much equity risk. Adding long/short equity while reducing both long-only equity and investment grade debt does just that. Over multiple market cycles (including two major crashes), long/short equity strategies have outperformed the 60/40 core on a risk-adjusted basis. In a market environment that portends low future returns, every basis point counts.

Copyright © 361 Capital