SECOND QUARTER 2017

Tilting towards EM, Europe

David Wolf, Portfolio Manager, and David Tulk, CFA, Institutional Portfolio Manager, Fidelity Investments

Key Takeaways

• Late-cycle environment requires prudence in overall equity risk

• Macro and valuation contrasts drive cross-market opportunities

• We are underweight U.S. equities vs other developed markets and underweight Canada vs EM

As the first quarter of the year drew to a close, with positive economic data surprises appearing to crest and the likelihood of major fiscal stimulus and tax reform in the United States appearing to wane, we took the opportunity to lock in some of the post.U.S. election gains from our tactical overweight to equities (see New Era, Old Cycle). This leaves us with a broadly neutral equity weighting across our Canadian multi-asset class funds.

Even with a neutral stocks/bonds allocation, however, we continue to see opportunities along the numerous other dimensions of our active asset allocation mandate to enhance return and manage risk in the funds. We remain overweight foreign assets on an unhedged basis and continue to favour lower.duration and inflation.protected fixed income exposures. In addition, we see significant opportunities to drive fund performance through active positioning across regional equity markets. We discuss two elements of that positioning below.

First, we have moved to underweight U.S. equities, funding an overweight to equities in Europe and the Far East (EAFE), in the Fidelity Managed Portfolios and multi-asset Private Investment Pools.

A lot of good news has been priced into the U.S. market, both generally after several years of strong performance (see Exhibit 1) and specifically following the result of the

U.S. election and its apparent promise of equity-friendly policy. Surveys of U.S. business and consumer confidence have dutifully surged, pointing to the release of animal spirits that could provide a further tailwind to economic growth. However, the challenges that President Trump has faced when moving from campaigning to governing have reduced the likelihood of a timely fiscal boost to demand. The risk of market disappointment in the U.S. appears to be growing, with the margin for error small given full valuations.

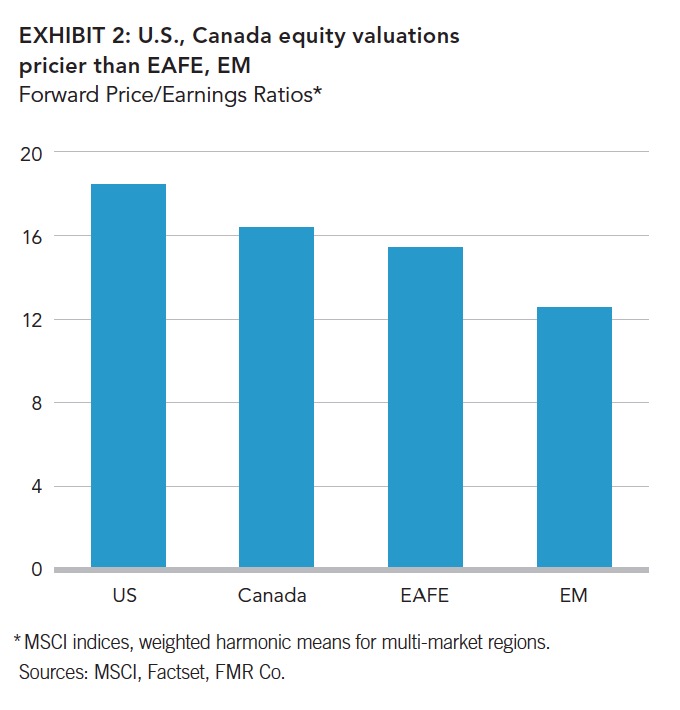

In other developed markets, by contrast, we generally see a younger business cycle, cheaper valuations and less demanding market expectations (see Exhibit 2). In Europe in particular, the improved global economic tone and the years of healing from the trauma of the 2011 sovereign debt crisis and related shocks have allowed for a cyclical upturn in economic growth. Monetary policy support has been key here, and the region's central banks have only hinted at the prospect of paring back some of the extraordinary stimulus introduced in recent years, in contrast to the already-tightening Fed. While ongoing structural challenges such as low productivity and a slow pace of institutional reform will restrain the fundamental speed limit of these economies, we see better prospects for their markets in the period ahead.

One important concern investors have with Europe, and likely part of the reason for cheaper valuations, is political. Upcoming elections in France and Germany threaten to extend the wave of populism and reignite fears of the disintegration of the European Union. While these events undoubtedly pose a risk, the candidates running on nationalistic platforms are arguably more familiar than the unquantifiable uncertainty surrounding the lead-up and outcome of the U.S. Presidential election and Brexit vote in the U.K. Moreover, the equity rallies following those two events are a reminder that, for markets, the resolution of uncertainty itself is often more important than how the uncertainty is resolved. As a result, we believe we are being adequately compensated for these political risks in the current market environment.

Second, we maintain our long-standing underweight to Canadian equities, funding an overweight in emerging market equities.

As we've discussed previously, these two markets offer similar factor exposures – both particularly sensitive to global growth, commodity prices and investor risk appetites. However, relative to Canada, EM is cheaper and more diversified, with superior long-term growth prospects stemming from better demographics and prospects for productivity growth. These considerations lead our secular research team to project that real returns from emerging market stocks will be more than double that of Canadian stocks over a long-term horizon.

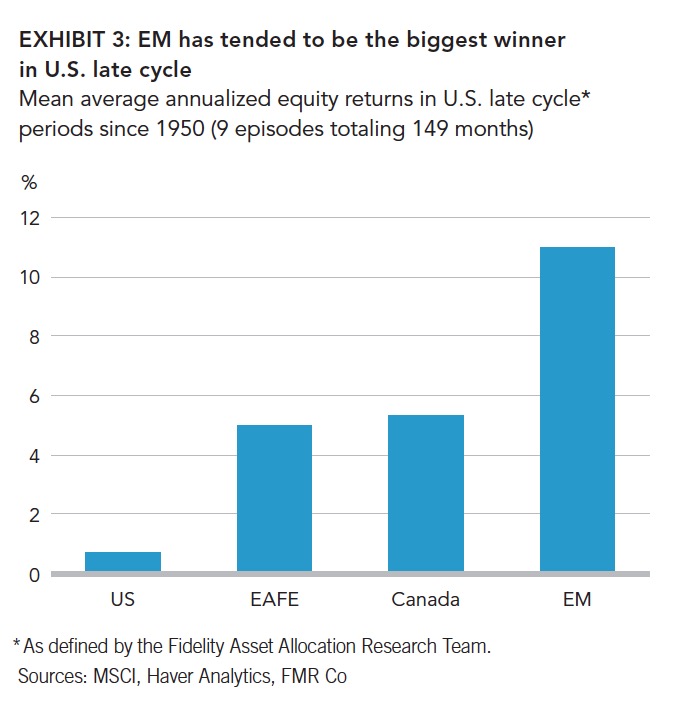

Shorter-term considerations also look to be in the favour of EM. While the high-frequency Canadian data have been strong of late, the cyclical outlook for the domestic economy remains challenged by its reliance on housing investment and household leverage, particularly given the risk of higher long-term interest rates. The uncertainty on the policy front south of the border is also expected to restrain business investment and export activity. By contrast, emerging market economies, which have generally had a harder time of it in recent years, are expected to benefit both from greater diversification in their international trading partners and the maturation of the USD bull market. This better EM performance relative to Canada would also be consistent with the broader historical pattern as the U.S. cycle enters its latter stages, with emerging markets gaining traction in a more inflationary environment while being less tethered to the tiring U.S. (see Exhibit 3).

To conclude, even as the late cycle environment demands prudence in our overall risk posture in the Canadian multi-asset class funds, we continue to find cross-market opportunities to generate risk-adjusted performance.

David Wolf and David Tulk, April 21, 2017

Authors

David Wolf | Portfolio Manager David Wolf is a portfolio manager for Fidelity Investments. He is the co-manager of Fidelity Managed Portfolios, Fidelity Canadian Asset Allocation Fund, Fidelity Canadian Balanced Fund, Fidelity Monthly Income Fund, Fidelity U.S. Monthly Income Fund, Fidelity U.S. Monthly Income Currency Neutral Fund, Fidelity Global Monthly Income Fund, Fidelity Dividend Fund,

Fidelity Global Dividend Fund, Fidelity Income Allocation Fund, Fidelity Balanced Managed Risk Portfolio andFidelity Conservative Managed Risk Portfolio. He is also portfolio co-manager of Fidelity Conservative Income Private Pool, Fidelity Asset Allocation Private Pool, Fidelity Asset

Allocation Currency Neutral Private Pool, Fidelity Balanced Private Pool, Fidelity Balanced Currency Neutral Private Pool, Fidelity Balanced Income Private Pool, Fidelity Balanced Income Currency Neutral Private Pool and Fidelity U.S. Growth and Income Private Pool.

David Tulk, CFA | Institutional Portfolio Manager David Tulk is an Institutional Portfolio Manager at Fidelity Investments. In this role, he serves as a member of the investment management team, maintaining a deep knowledge of portfolio philosophy, process, and construction. He assists portfolio managers and their CIOs in ensuring portfolios are managed in accordance with client expectations.

For Canadian investors

For Canadian prospects and/or Canadian institutional investors only. Offered in each province of Canada by Fidelity Investments Canada ULC in accordance with applicable securities laws.

Before investing, consider the funds' investment objectives, risks, charges and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

The information presented above reflects the opinions of David Wolf and David Tulk as at April 21, 2017. These opinions do not necessarily represent the views of Fidelity or any other person in the Fidelity organization and are subject to change at any time based on market or other conditions. As with all your investments through Fidelity, you must make your own determination as to whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation and your evaluation of the security. Consult your tax or financial advisor for information concerning your specific situation.

Investing involves risk, including the risk of loss.

© 2017 Fidelity Investments Canada ULC. All rights reserved.

799413.1.0