by Jeffrey Saut, Chief Investment Strategist, Raymond James

Jesse Livermore was one of the legendary icons of Wall Street speculation. Known as the “boy plunger,” because he began trading at the tender age of 14, he was subsequently banned from many “bucket shops” for winning too often. Therefore, he moved to New York City to swing in the big leagues. By the age of 15, he had earned profits of over $1,000 ($27,000 in today’s dollars). He became famous on the Street of Dreams by selling Union Pacific railroad “short” right before the 1906 San Francisco earthquake. Most notably, he was worth $3 million and $100 million after the 1907 and 1929 stock market crashes ($100 million in 1929 equals roughly $1.4 billion today). His investment style, and investment operation metrics, are chronicled in the must read book “Reminiscences of a Stock Operator” (Reminiscences). Of interest is the fact that, when Jesse became out of step with the stock market, he would completely shut down his investment operations and go on an international cruise, sometimes for months. And, that is kind of what I feel like doing since I have been out of step with the stock market for the past three weeks. That does not mean I am not making money, because most of the stocks featured in these missives have done pretty well. But, in the short term, I am clearly wrong footed.

In the past when this has happened, I have reread Jesse Livermore’s investment rules. To wit:

1. There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.

2. The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among professionals.

3. I never lose my temper over the stock market. I never argue the tape. Getting sore at the market doesn’t get you anywhere.

4. They say you can never go poor taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market. Where I should have made twenty thousand I made two thousand. That was what my conservatism did for me.

5. Remember that stocks are never too high for you to begin buying or too low to begin selling.

6. A man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street ... nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains, they cannot sit tight.

7. After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was the sitting. Got that? My sitting tight!

8. Losing money is the least of my troubles. A loss never bothers me after I take it . . . But being wrong – not taking the loss – that is what does the damage to the pocketbook and to the soul.

9. Prices, like everything else, move along the line of least resistance. They will do whatever comes easiest.

10. The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear. In speculation when the market goes against you hope that every day will be the last day – and you lose more than you should had you not listened to hope – the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and you get out – too soon. Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts . . . Instead of hoping he must fear; instead of fearing he must hope.

As I read Jesse’s investment rules over the weekend I centered on rules 2 and 7:

2. The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among professionals.

7. After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was the sitting. Got that? My sitting tight!

Indeed, these two rules sound very much like one of Warren Buffett’s investment strategies, “[One of our investment styles can best be describe as] lethargy bordering on sloth.” Last week, however, the D-J Industrial Average (INDU/20821.76) was anything but lethargic as the Industrials tacked on a nearly1% gain, again Trumping most Wall Street metrics. It was the 11th straight gain for the senior index, punctuated by 11 new closing highs, which is the longest such skein since 1987. Worth mentioning is that forgetting the “new highs” moniker, the equity markets rarely go more than seven to nine sessions in any one direction without an opposite directional move. In fact, the longest such skein chronicled in my notes is an upside skein that lasted 14 sessions (1897) and then the 13 session run of 1987 (the dyslectic of 1897), so we will see this week if that record is broken.

As the always insightful Jason Goepfert (SentimenTrader) writes on the bearish side:

The Dow climbed to its 9th straight record. Going back to 1897, the index has accomplished such a feat only 5 other times. The momentum persisted in the months ahead every time, with impressive returns. But when it ended, it led to 2 crashes, 1 bear market and 1 stretch of choppiness. The five instances were 1927; 1929; 1955; 1964 and 1987. ... Like many instances of massive momentum, however, when it stopped, it stopped hard.

On the bullish side, my friends at the Bespoke organization scribe:

There have been 27 years since 1945 where January was a positive month and February was a positive month. In those 27 years, the S&P 500 gained an average of 19.9%. Technically, it wasn’t up every year because in 2011 it dropped 0.0032%. I know, splitting hairs. However, for the March through year end period the S&P 500 averaged a gain of 12.4% with positive returns 25 out of 27 times.

Splitting hairs indeed, because both of these folks are VERY bright, one bullish the other bearish. But as previously stated, “I, and my models are currently confused, which doesn’t happen very often!” So, maybe I should follow Jesse’s advice and take an ocean cruise.

To the potential trading top point, there are rumors swirling around Capitol Hill that tomorrow night’s State of the Union (SoU) address is going to be disappointing with no real concrete news on tax reform, repatriation of offshore profits, Obamacare, etc. I guess I should inform my non-D.C. centric readers that Tuesday’s SoU is not really a State of the Union address, since President Trump has only been in office for a little over a month. The real SoU will come around this time next year, but I digress.

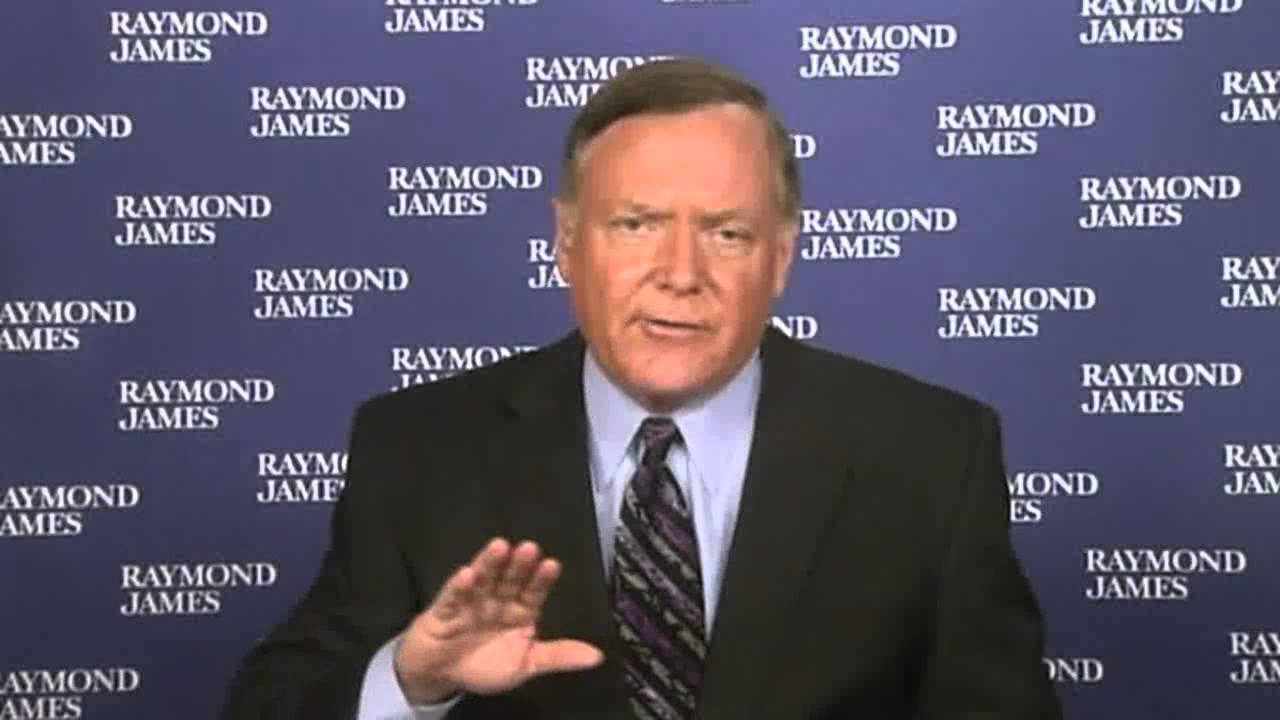

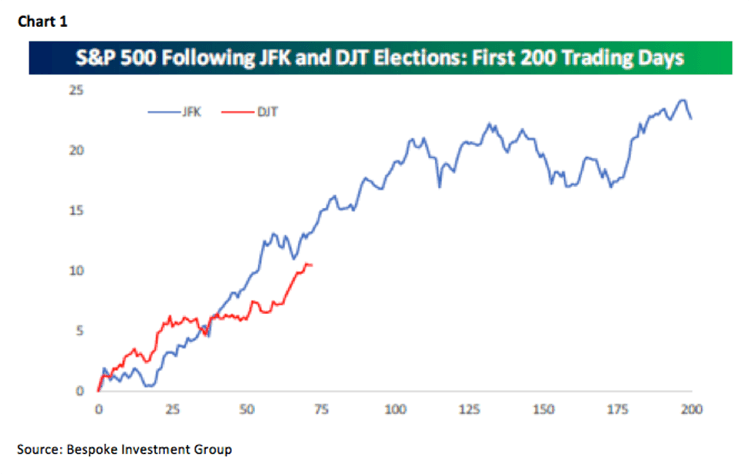

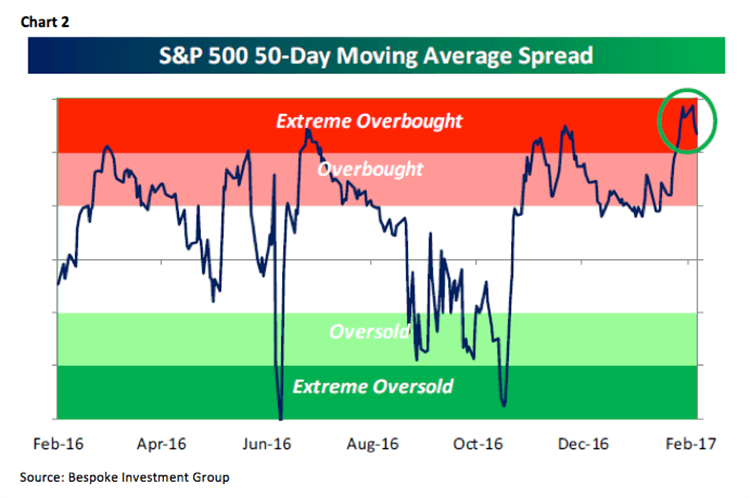

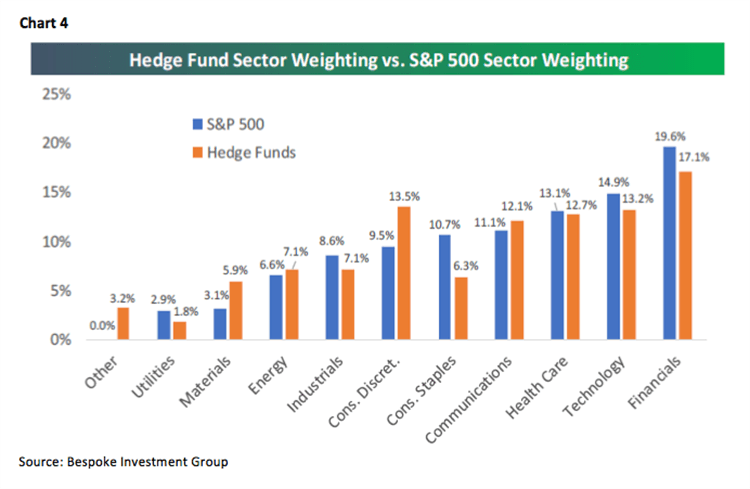

The post-election stock market rally, at 72 days, is moving in an historic duration. Only President John Kennedy’s post-election rally of 13.12% in 72 days has eclipsed DJT’s 10.48%. As can be seen in Chart 1, the “Kennedy Rally” continued for a long time. The “Trump Rally” has left the S&P 500 fairly overbought (Chart 2) and the yield on the 10-year T’note looks set to breakout (Chart 3 – higher yields). And then there was this from the astute Helene Meisler, “5 of the last 6 trading days have seen net volume negative on the NYSE. In that time the SPX has gained 18 points ... Friday was lowest volume for Nasdaq in a month.” Still, earnings continue to impress with Technology (77% beat rate), Financials (65%), Health Care (64%), and Industrials (62%) showing the strongest momentum. Evidential, however, hedge funds are not paying attention to those “beat rates”, because they have less than a sector weighting in all of those sectors (Chart 4).

The call for this week: Last week, my short-term proprietary model flipped positive, but the intermediate model remains in cautionary mode. Like I said, confused! When this has happened in the past, I found it best to do nothing. The long-term model, however, flipped positive in October 2008 and has never been negative since then. Maybe tomorrow’s SoU address will resolve things. Until then, “Sometimes me sits and thinks and sometimes me just sits!”

Copyright © Raymond James