by Lance Roberts, Clarity Financial

Congratulations! If you are reading this article it is probably because you have money invested somewhere in the financial markets.

That’s the good news.

The bad news is the majority of you reading this article have probably NOT saved enough for retirement. Such isn’t my assumption, it is what survey after survey tells us. To wit:

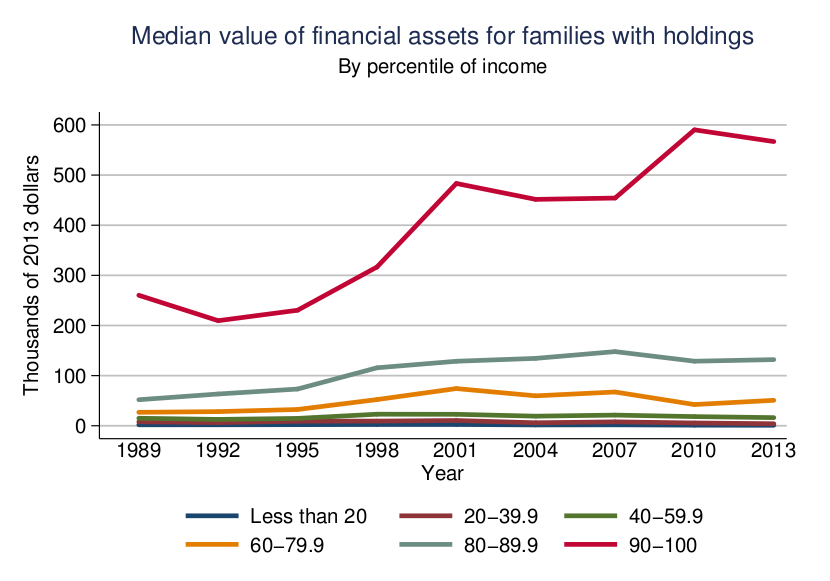

“While the ongoing interventions by the Federal Reserve have certainly boosted asset prices higher, the only real accomplishment has been a widening of the wealth gap between the top 10% of individuals that have dollars invested in the financial markets and everyone else. This was shown by the Fed’s most recent consumer survey.“

“With the average American still living well beyond their means, the reality is economic growth will remain mired at lower levels as savings continue to be diverted from productive investment into debt service. This skew in wealth, between the top 10% and bottom 90%, has distorted much of the economic data which suggests savings rates and incomes are rising across the broad spectrum of the economy. The reality, as shown by repeated studies and surveys, is an inability for many individuals to meet even small emergencies, must less being anywhere close to having sufficient assets to support a healthy retirement. To wit:“

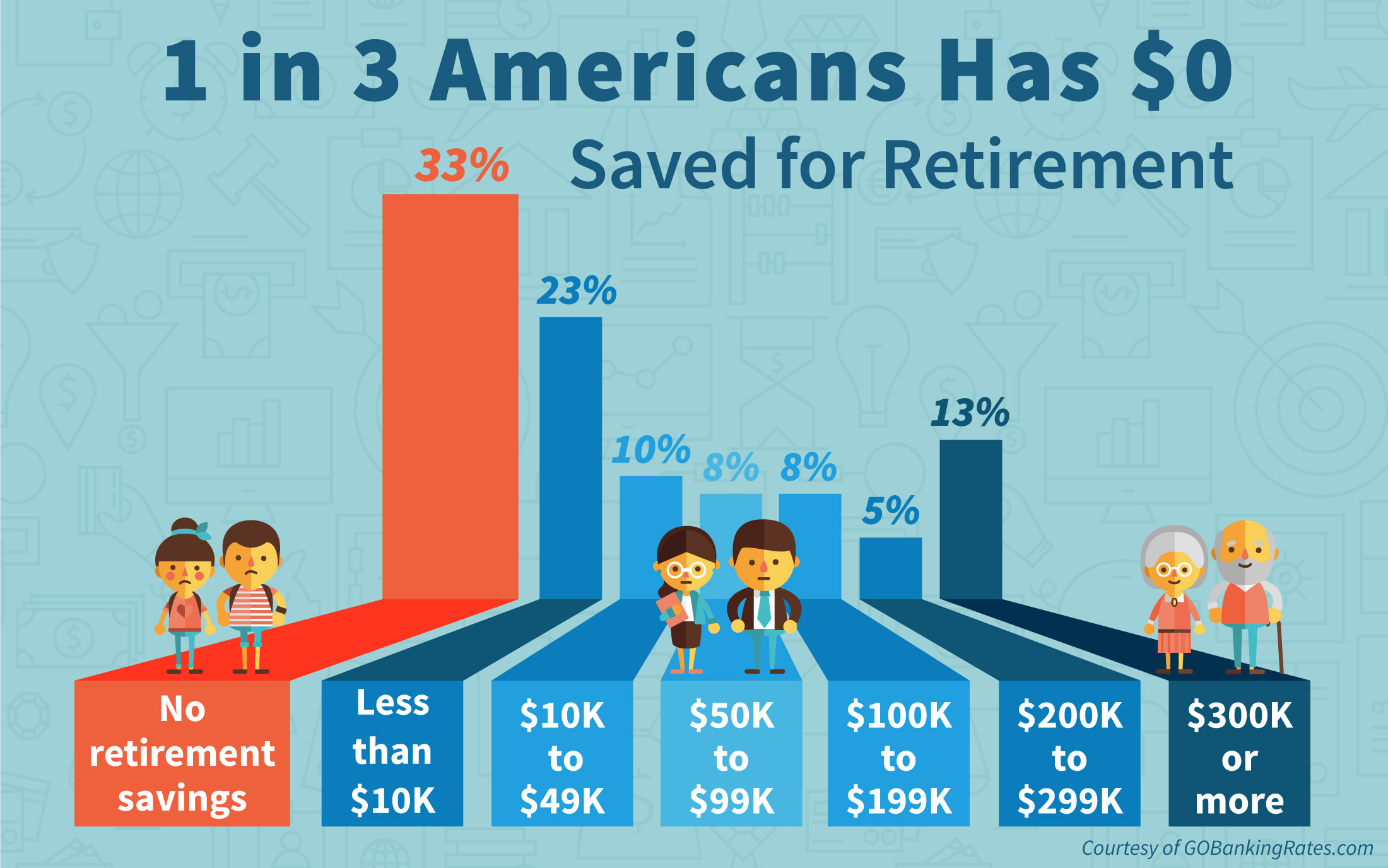

“Take a look at that graphic carefully.

- 33% of Americans have $0 saved for retirement.

- 56% only have $0-$10,000

- 66% have less than one-year of median income saved.

- 74% have less than $100,000 saved for retirement.

With 3/4th’s of America dependent upon an already overburdened social security system in retirement, the “consumption function,” on which roughly 70% of the economy is dependent, is being grossly overestimated. “

In other words, 74% of American’s are “hoping” the financial markets will bail them out of their “under-saving.”

This is the same problem that faces every pension in America right now…and the pensioners depending on them.

As I discussed last week in the “Myth Of Passive Investing:”

“The idea of “passive” investing is ‘romantic’ in nature. It’s a world where everyone just invests some money, the markets rise 7% annually and everyone one’s a winner.

Unfortunately, the markets simply don’t function that way.”

During strongly trending bull markets, investors tend to forget that devastating events happen. Major events such as the “Crash of 1929,” “The Great Depression,” the “1974 Bear Market,” the “Crash of ’87”, Long-Term Capital Managment, the “Dot.com” bust, the “Financial Crisis,” etc. These events are often written off as “once in a generation” or “1-in-100-year events,” however, it is worth noting these financial shocks have come along much more often than suggested. Importantly, all of these events had a significant negative impact on individual’s “plan for retirement.”

I bring this up because I received several emails as of late questioning me about current levels of savings and investments and whether there would be enough to make it through retirement. In almost every situation, there are significant flaws in the analysis due primarily to the use of “online financial planning” tools which are fraught with wrong assumptions.

Your Personal Returns Will Be Less Than An “Index”

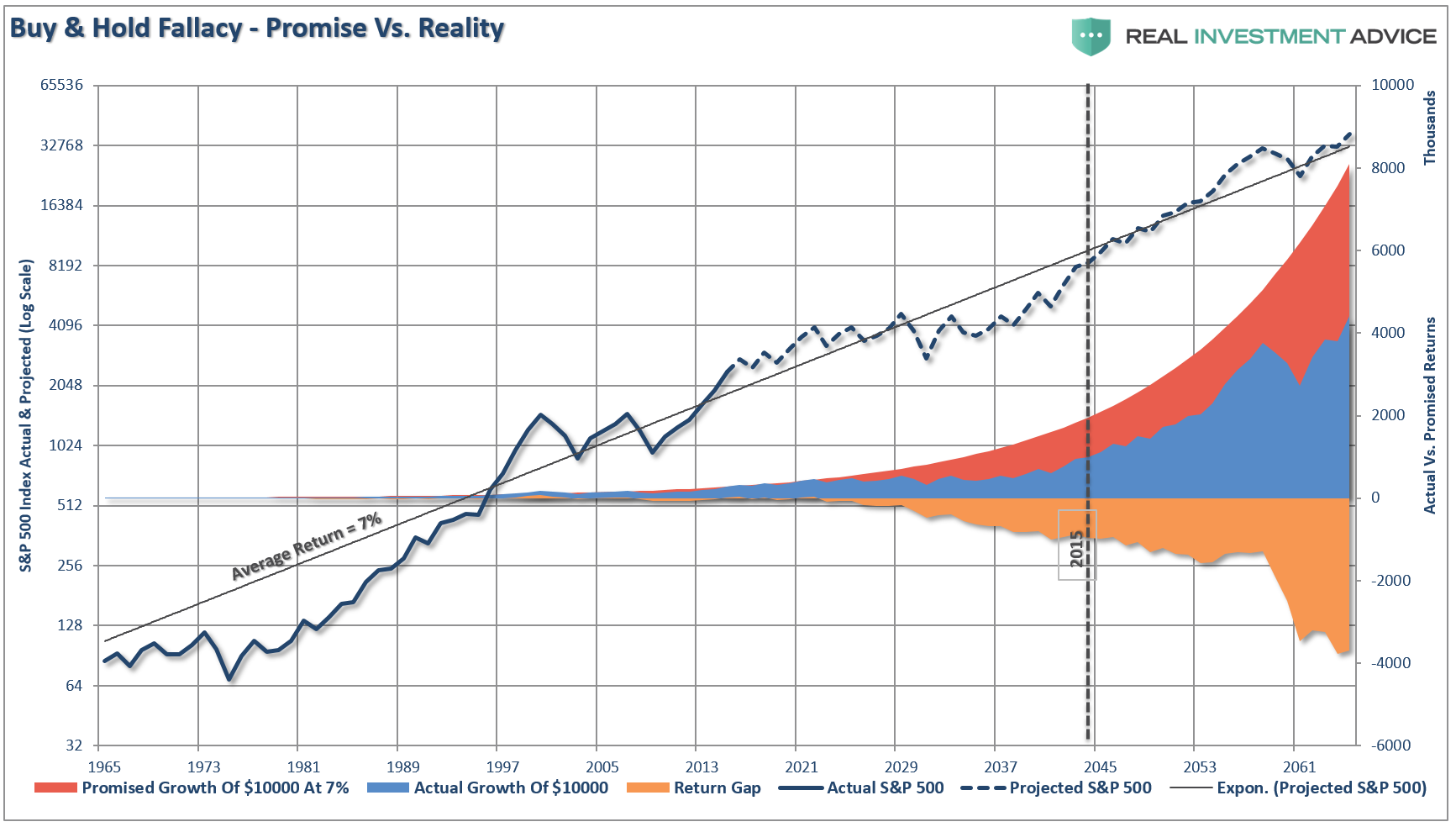

One of the biggest mistakes that people make is assuming markets will grow at a consistent rate over the given time frame to retirement. There is a massive difference between compounded returns and real returns as shown above. Furthermore, the shortfall is compounded further when you begin to add in the impact of fees, taxes, and inflation over the given time frame.

The chart below shows what happens to a $1000 investment from 1871 to present including the effects of inflation, taxes, and fees. (Assumptions: I have used a 15% tax rate on years the portfolio advanced in value, CPI as the benchmark for inflation and a 1% annual expense ratio. In reality, all of these assumptions are quite likely on the low side.)

As you can see, there is a dramatic difference in outcomes over the long-term.

Chasing an “index” is fraught with risk and problems:

- The index contains no cash

- An index has no life expectancy requirements – but you do.

- It doesn’t have to compensate for distributions to meet living requirements – but you do.

- It requires you to take on excess risk (potential for loss) in order to obtain equivalent performance – this is fine on the way up, but not on the way down.

- It has no taxes, costs or other expenses associated with it – but you do.

- It has the ability to substitute at no penalty – but you don’t.

- It benefits from share buybacks – but you don’t.

The reality is that you have nothing in common with a “benchmark index.”

Investing is not a “competition” and treating it as such has disastrous consequences over time.

When You Start Makes All The Difference

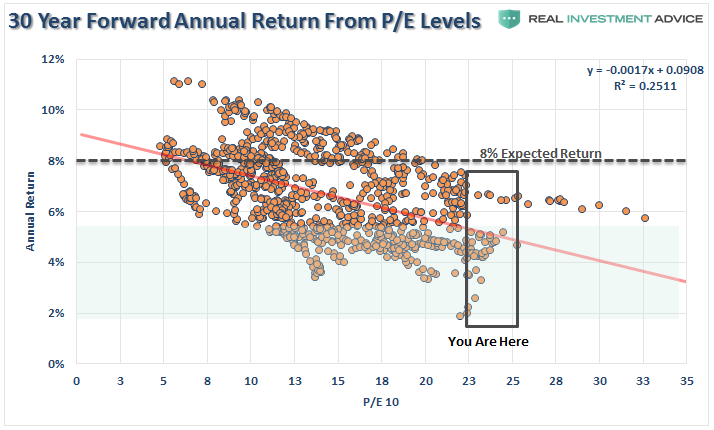

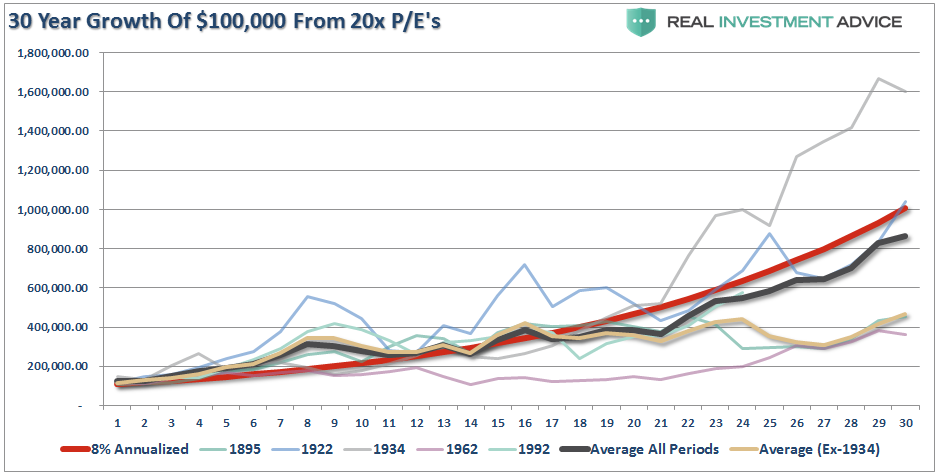

Importantly, the return that investors receive from the financial markets is more dependent on “WHEN” you begin investing with respect to “valuations” and your personal “life-span”.

The single biggest mistake made in financial planning is NOT to include variable rates of return in your planning process.

Furthermore, choosing rates of return for planning purposes that are outside historical norms is a critical mistake. Stocks tend to grow roughly at the rate of GDP plus dividends. Into today’s world GDP is expected to grow at roughly 2% in the future with dividends around 2% currently. The difference between 8% returns and 4% is quite substantial.

Also, to achieve 8% in a 4% return environment, you must increase your return over the market by 100%. The level of “risk” that must be taken on to outperform the markets by such a degree is enormous. While markets can have years of significant outperformance, it only takes one devastating year of losses to wipe out years of accumulation.

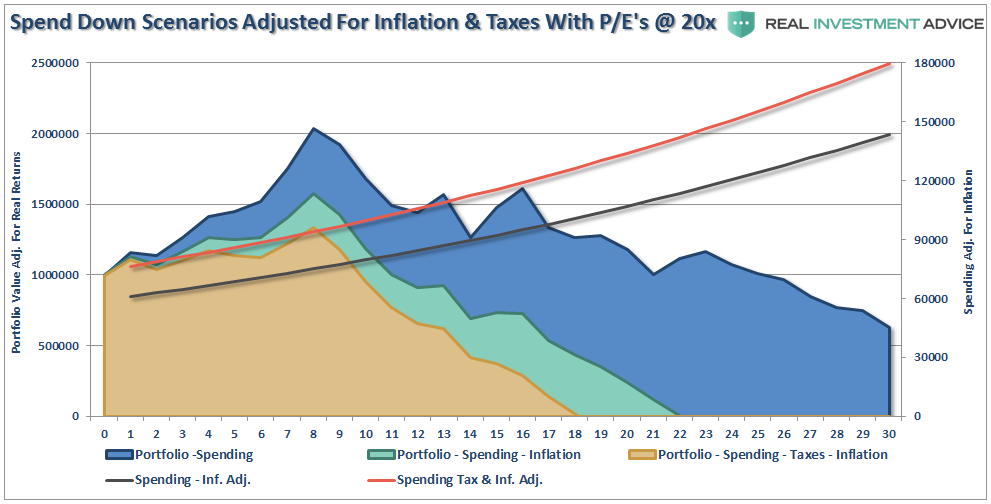

The chart below takes the average of all periods above (black line) and uses those returns to calculate the spend down of retiree’s in retirement assuming similar outcomes for the markets over the next 30-years. As above, I have calculated 4% annual withdrawal rate include the impact of inflation and taxation.

On the surface, it would appear the retiree would not have run out of money over the subsequent 30-year period. However, once the impact of inflation and taxes are included, the outcome becomes substantially worse.

What Your Financial Planning Should Consider

The analysis above reveals the important points individuals should consider in their financial planning process:

- Expectations for future returns and withdrawal rates should be downwardly adjusted.

- The potential for front-loaded returns going forward is unlikely.

- The impact of taxation must be considered in the planned withdrawal rate.

- Future inflation expectations must be carefully considered.

- Drawdowns from portfolios during declining market environments accelerates the principal bleed. Plans should be made during up years to harbor capital for reduced portfolio withdrawals during adverse market conditions.

- The yield chase over the last 8-years, and low interest rate environment, has created an extremely risky environment for retirement income planning. Caution is advised.

- Expectations for compounded annual rates of returns should be dismissed in lieu of plans for variable rates of future returns.

Time To Get Real

You cannot INVEST your way to your retirement goal. As the last decade should have taught you by now, the stock market is not a “get wealthy for retirement” scheme. You cannot continue under-saveing for your retirement hoping the stock market will make up the difference. This is the same trap that pension funds all across this country have fallen into and are now paying the price for.

Chasing an arbitrary index that is 100% invested in the equity market requires you to take on far more risk that you most likely want. Two massive bear markets over the last decade have left many individuals further away from retirement than they ever imagined. Furthermore, all investors lost something far more valuable than money – the TIME that was needed to prepare properly for retirement.

Investing for retirement, no matter what age you are, should be done conservatively and cautiously with the goal of outpacing inflation over time. This doesn’t mean that you should never invest in the stock market, it just means that your portfolio should be constructed to deliver a rate of return sufficient to meet your long-term goals with as little risk as possible.

- Save More And Spend Less: This is the only way to ensure you will be adequately prepared for retirement. It ain’t sexy, or fun, but it will absolutely work.

- You Will Be WRONG. The markets go through cycles, just like the economy. Despite hopes for a never-ending bull market, the reality is “what goes up will eventually come down.”

- RISK does NOT equal return. The further the markets rise, the bigger the correction will be. RISK = How much you will lose when you are wrong, and you will be wrong more often than you think.

- Don’t Be House Rich. A paid off house is great, but if you are going into retirement house rich and cash poor you will be in trouble. You don’t pay off your house UNTIL your retirement savings are fully in place and secure.

- Have A Huge Wad. Going into retirement have a large cash cushion. You do not want to be forced to draw OUT of a pool of investments during years where the market is declining. This compounds the losses in the portfolio and destroys principal which cannot be replaced.

- Plan for the worst. You should want a happy and secure retirement – so plan for the worst. If you are banking solely on Social Security and a pension plans, what would happen if the pension was cut? Corporate bankruptcies happen all the time and to companies that most never expected. By planning for the worst, anything other outcome means you are in great shape.

Most likely what ever retirement planning you have done, is wrong. Change your assumptions, ask questions and plan for the worst. There is no one more concerned about YOUR money than you and if you don’t take an active interest in your money – why should anyone else?

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial