by Rick Friedman, GMO LLC, via Wells Fargo Asset Management

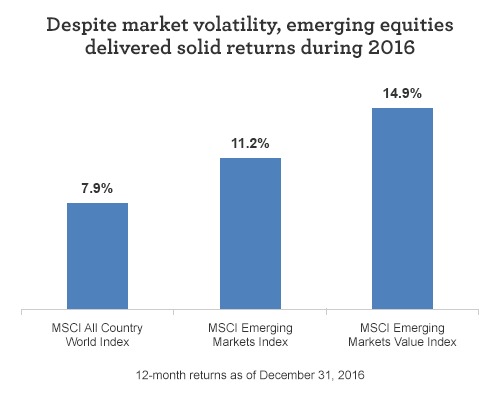

Let’s imagine Plutus, the Greek god of wealth, was feeling so benevolent at the beginning of 2016 that he let all emerging market investors in the land know the following events would occur with certainty in the coming year: 1) growth concerns and threats of currency devaluation in China would shake the emerging and developed markets alike; 2) drastic declines in oil and commodities prices would follow; 3) a faction of the Turkish Armed Forces would attempt a coup d’état in Turkey; 4) Brazil would suffer a shattering political scandal (leading to President Rousseff’s impeachment) and a debilitating outbreak of Zika; 5) Donald J. Trump, after campaigning on a highly protectionist platform, would be elected President of the United States; and, finally 6) similar to what happened in Brazil, the Korean president would be impeached. Most investors, after falling to their knees in thanks for this prescience, would likely have moved quickly to take all their capital out of emerging market investments and then waited for the ensuing carnage. Would that have been the right call? Absolutely not. While emerging equities (and debt, for that matter) displayed volatility during the year due in large part to those headlines coming true, they delivered solid returns of 11.2%, considerably outperforming global equities.

Emerging market value stocks did even better, generating gains of nearly 15% in 2016 as shown in the chart below. As is often the case, especially with emerging markets, an asset priced for horrific news can do just fine even when faced with bad news. By the way, Brazil was the best performing stock market in the world in 2016. Arjun Divecha, the head of GMO’s Emerging Markets Equity team, is fond of saying that in the emerging markets “You make more money when things go from truly awful to merely bad, than when they go from good to great.”

Source: GMO

Past performance is no guarantee of future results.

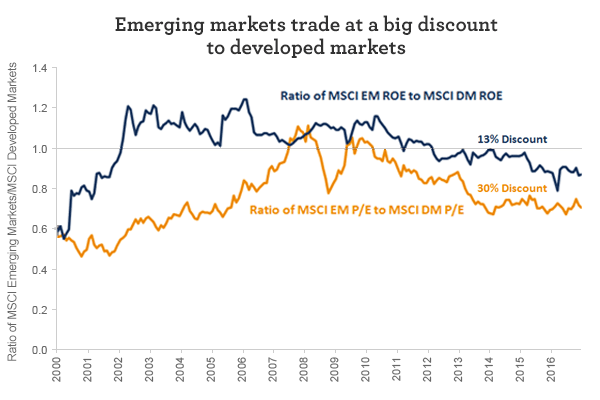

In the chart “Emerging markets trade at a big discount to developed markets,” the blue line indicates that things are not all good or even great in the emerging markets. Return on equity (ROE) for the asset class has been declining for years relative to the developed world. After years of superlative performance during the height of the commodities super cycle, ROEs for the emerging markets offer 13% less than their developed counterparts.

As of 12/31/16

Source: Bloomberg, MSCI, FactSet

While falling relative ROEs may lead some investors to sell emerging market equities, we believe they should trade at a discount to their developed brethren because of their higher levels of fundamental risk. Developed countries separate themselves from emerging countries based on the durability of their institutions. Strong, weak, dynamic, or dull leaders come and go, but developed countries’ key institutions have lived on. Emerging countries don’t offer such consistency and are prone to chaotic and highly dilutive events. As such, a discount of about 10% seems appropriate to us, but today that discount has swelled to a whopping 30% as the gold line in the chart above suggests. Recently, investors have rightly been concerned about a variety of issues in the emerging markets, most significantly the radiating effects from slower than expected growth in China. The election of Donald Trump has further intensified these anxieties.

One camp of investors sees only bad news ahead as a result of Trump’s victory. For these bears, the double whammy of stimulative U.S. fiscal policies coupled with possible protectionist barriers typically makes emerging investments less attractive. The potential for a stronger U.S. economy will likely lead to higher inflation, interest rate increases, and a strong U.S. dollar: a brew that will be bad for countries (and companies) carrying high U.S. dollar-denominated debt and running current account deficits. This group expects funds to continue to flow out of emerging markets and back to the U.S., putting pressure on emerging asset prices and raising financing costs. Protectionist strategies in the U.S., moreover, would put pressure on countries like Mexico, China, and Korea, whose export sectors are relatively large and compete directly with U.S. industries.

While those concerns are valid and should be contemplated, they should be weighed against the more constructive realities facing emerging markets. An expansionary U.S. fiscal policy driven in part by infrastructure spending would be pro-cyclical and beneficial to certain sectors (like energy and materials) in the emerging markets. While certain countries may see currencies pressured, emerging currencies in general are cheap. The credit cycle (save in certain countries with elevated credit conditions, like China) has moderated and appears close to neutral. Importantly, it is unlikely that any one administration in the U.S. can dramatically alter the long-term earnings power for emerging companies. Yes, the short-term earnings of some countries/companies may be impaired, but as equity owners our horizon extends out for decades, not the length of any single administration. Even if Plutus were kind enough to come back to signal the actual policies the Trump administration will pursue and, more importantly, be able to implement, extrapolating future asset returns is not as simple as the headlines might suggest. Countries and companies will respond and retool over time to maintain their competitiveness and profit levels. Some will be more successful than others. The question all investors should be asking is not, “Is it risky?” but rather, “How is that risk being priced?” While the absolute valuations of emerging equities are nothing to get too excited about, we believe the relative valuations are most definitely attractive.

Copyright © Wells Fargo Asset Management