by Blaine Rollins, CFA, 361 Capital

Crowd sizes, Alternative Facts, The Bee Movie, Madonna, Tax Returns, Twitter, Facebook, 24-hour news channels and Saturday Night Live. If you enjoy political entertainment, then now is your time. That said, your investment portfolio doesn’t care if an inaugural speech writer channels Jerry Seinfeld. And, this is all just noise to distract us from making money in our portfolios. Warren Buffett will likely have some fun dropping the phrase “Alternative Facts” during one of his bridge games, but when it comes to making money in the markets, he is much more focused on the actions of the incoming Cabinet members, who he said last week he “overwhelmingly” supports. In addition to listening for comments from Tillerson, Ross, Mnuchin and the others, keep a close eye on Congress who has a big agenda on their plates. We know what the majority of the House and Senate want, but how much will they accomplish. For now the key themes remain ‘Growth,’ ‘Lower Taxes,’ ‘Less Regulation’ and ‘Made in America’. Throw these four items in the meat grinder and inflation is going to pick up. Little way around that. An offset could be the sizable cuts in spending that actually improve the budget deficit and future U.S. Government borrowings. But that dream scenario is a bit out of focus for now. Maybe something to consider for the next term.

Plenty of new Cabinet member chatter last week. Here was Steve Mnuchin’s top focus…

“The most important issue we have is economic growth…In 1984, we had 7% and in 1998 we had 5% and in 2005 we had 3%. That was the last time we had appropriate growth rates. I share the president-elect’s concern of low growth. Our number one priority from my standpoint is economic growth.”

(Treasury Secretary Nominee Steve Mnuchin)

We also heard loudly from Wilbur Ross…

During his confirmation hearing Wednesday, Mr. Ross said he preferred to focus on boosting exports and using carrots to keep factory jobs in the U.S.

“Get the Toyotas and other companies like that to build their factories here…And I think with the right tax policies, regulatory policies, and other policies we can accomplish that,” he said.

What about sticks? Mr. Trump threatens to hit trading partners with tariffs of 35% to 45%. Mr. Ross suggested he would pursue tariffs on a case-by-case basis, rather than the across-the-board approach used in the 1930 Smoot-Hawley Act, which many historians believe worsened the Great Depression.

“Tariffs do have a useful role…correcting inappropriate practices [and] as a negotiating tool,” Mr. Ross told Congress. “I’m keenly aware of Smoot-Hawley…That kind of approach didn’t work very well then, and it very likely wouldn’t work very well now.”

(WSJ)

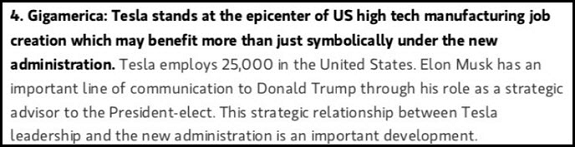

Speaking of ‘Made in America,’ Morgan Stanley was talking up America’s most concentrated automobile manufacturer last week…

(@jyarow)

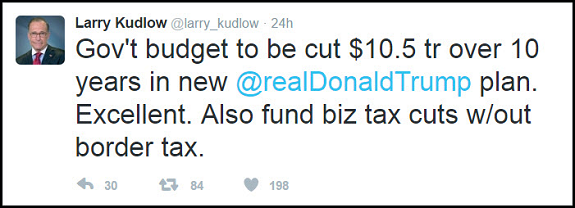

Sounds like the new Administration is using a playbook from the Heritage Foundation. If you are worried about cost cuts, you might want to go hunt the book down…

The departments of Commerce and Energy would see major reductions in funding, with programs under their jurisdiction either being eliminated or transferred to other agencies. The departments of Transportation, Justice and State would see significant cuts and program eliminations.

The Corporation for Public Broadcasting would be privatized, while the National Endowment for the Arts and National Endowment for the Humanities would be eliminated entirely.

Overall, the blueprint being used by Trump’s team would reduce federal spending by $10.5 trillion over 10 years.

The proposed cuts hew closely to a blueprint published last year by the conservative Heritage Foundation, a think tank that has helped staff the Trump transition.

(The Hill)

(@CharlesSchwab)

As the focus shifts to growth, the drum beats of inflation will grow louder. UNP railroad is seeing it. And the Fed is going to let it continue…

“As for inflation, we expect 2017 inflation will be around 3%, which will equate to a cost that is significantly higher than the inflation was in 2016.” Union Pacific CFO Rob Knight.

“Right now our foot is still pressing on the gas pedal, though, as I noted, we have eased back a bit. Our foot remains on the pedal in part because we want to make sure the economic expansion remains strong enough to withstand an unexpected shock, given that we don’t have much room to cut interest rates.” Federal Reserve Chair Janet Yellen (Central Bank)

10-year Treasury yields have had a good pullback as the Trump Growth Trade excitement cools. But will yields seek out new highs if talk becomes action?

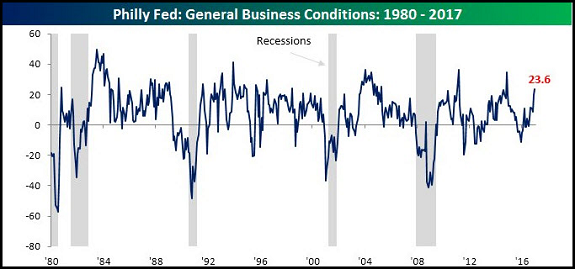

U.S. economic data continues to trend higher…

@bespokeinvest: Philly Fed headline reading broke out to its highest level in over two years.

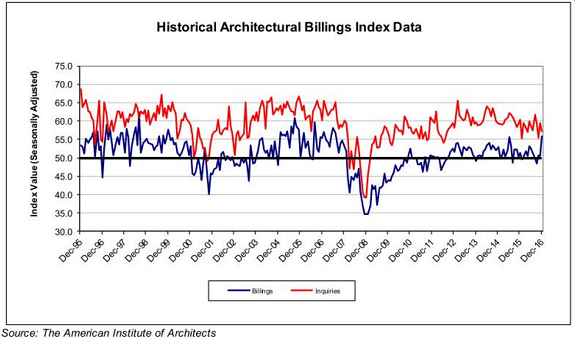

Architectural Billings finish 2016 on a high note…

@DriehausCapital: ICYMI: The Architecture Billings Index ends ’16 strongly, Dec. 55.9 vs. 50.6 in Nov. Best number in almost a decade!

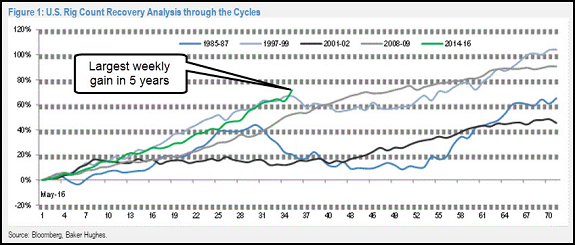

Even the ‘left for dead’ rig count posted its largest gain in five years…

The Baker Hughes U.S. rig count increased by 35 to 694 rigs, recording the biggest weekly gain in over five years, driven by increases in most of the plays but led by the Permian (+13) and the Midcontinent (+9). Horizontal rigs comprised roughly two-thirds of the increase (+22). This week, the recovery slope for the 2014-17 cycle outpaced 1997-1999 in the 35th week from the trough. We note the U.S. has now added 290 rigs off the May-16 bottom (+79%) but remains 1,168 rigs (-63%) off the June 2014 peak. (JPMorgan)

And several strong tidbits in the Beige Book last week…

Some Beige Book headers:

New York: Broadway theaters reported that ticket prices have increased by considerably more than the seasonal norm during this past holiday season.

Cleveland: Shortages of homebuilding materials have been driving up prices, especially for concrete, drywall, and framing lumber.

Chicago: Contacts continued to indicate that the labor market is tight and that they are experiencing more difficulty filling positions at all skill levels.

St. Louis: The strengthening of the U.S. dollar is putting downward pressure on grain prices.

Minneapolis: Weather was warm in November, ‘so there was no Christmas feel in the air’ and weather in December was “too cold to encourage shopping.”

San Francisco: Demand for IT business services remained strong, and expectations of future increases in the demand for cloud computing services boosted infrastructure investment in data centers. Sales of gaming products picked up, particularly for games sold through online channels.

(JonesTrading)

Look at all of the active portfolio managers drooling…

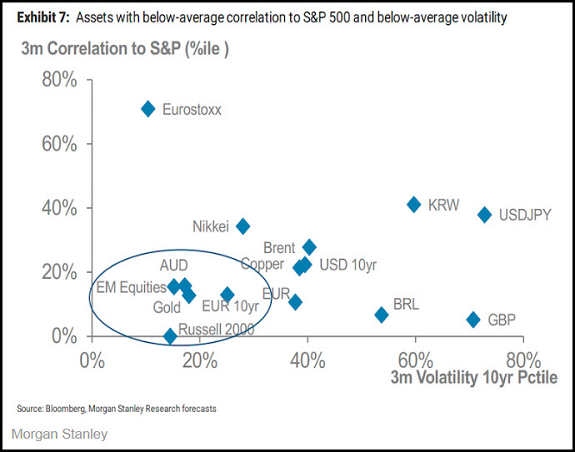

“‘Crash’ is not a term used lightly (indeed our editors here at Morgan Stanley won’t let us use it without a good reason),” Phanikiran Naraparaju and a team of strategists wrote in a note on Friday.

“But we struggle to think of another word to describe just how much, and how sharply, cross-asset correlations have fallen. In just four months, we have gone from a market of unusually close linkages across markets to one with usually divergent returns.”

Naraparaju noted that these collapses in correlations usually happen in the late stage of an economic cycle. By this time, individual assets are influenced more by events peculiar to them and less by broader concerns about an economic downturn, Naraparaju said. In other words, market drivers become more diverse, so the linkages between various assets break down.

Keep an eye on Goldman’s actions in London. Any major shift by their employee base would be quickly copied by its rivals. And if London loses its Financial Center tag, the economy, real estate and the Pound will get hit very hard…

Goldman Sachs Group Inc. may cut its London staff in half to 3,000 workers while transferring some to other locations as it prepares for the U.K.’s exit from the European Union, Handelsblatt reported, citing unidentified people in the financial industry.

A spokeswoman for the bank said it hasn’t made any decisions.

The company is considering moving as many as 1,000 employees including traders and compliance managers to Frankfurt as the firm shifts operations across the Continent and to New York, the newspaper said. Some people in trading operations who develop new products would probably move to the company’s New York headquarters, it said.

Investment bankers focusing on corporations in France and Spain would work from those countries, the publication said. And so-called back-office staff would probably go to Warsaw, it said.

If you need a good potential source of alpha for your watch list, put CSX Corp at the top of your screen…

This interesting railroad company acquired all of my attention last week when the best CEO in the industry, Hunter Harrison, at Canadian Pacific Railway, quit his job and left behind a mint in future compensation and benefits. When I heard the news, I knew that it only meant one thing and that he had a much better job lined up. Given that he previously tried to acquire and merge the CSX, that railroad moved to the top of the hit list. Maybe he even thought under a new Administration that a nationwide rail merger could be possible. But within hours, we had more details and it became clear that he was rejoining a former investor to make a run at fixing CSX.

Let’s take a look at Hunter’s track record in improving railroad companies and making shareholders money…

First at Illinois Central where Hunter broke onto my screen.

He then took his game to Canadian National, which bought the Illinois Central, and gave Hunter the keys to all of the rail switches and locomotives…

CNI rose five fold versus a flat stock market until he decided to “retire.”

Then after a couple years of R&R and deciding that he was not yet done fixing railroads, Bill Ackman convinced him to return and work on Canadian Pacific…

This also worked out very well for shareholders.

We even put CP on your radar screen five years ago when Hunter took over: from our Weekly Research Briefing from 12/10/2012…

If you are looking for a stock to add to your rainy day watch list, put Canadian Pacific (CP) on it. Hunter Harrison’s initial plans to improve the railroad were well received last week. He knows how to fix broken railroads and had success at Illinois Central and Canadian National…

Canadian Pacific Railway Ltd. is slashing close to a quarter of its work force over four years, as recently arrived CEO Hunter Harrison aggressively carves out costs to create a more competitive railway… The job cuts are the centrepiece of a sweeping restructuring plan that aims to change CP’s reputation as one of North America’s least-efficient railroads. U.S. hedge fund manager Bill Ackman and his company, Pershing Square Capital Management, won a fiercely contested battle this spring to gain control on the railway’s board and install Mr. Harrison, a highly regarded railway manager, as its new chief executive officer.

So now it may be time to hook your car to Hunter’s train again…

Ask any of my former colleagues who I worked with in the 1990’s or 2000’s and they will tell you about Hunter Harrison. Read this old article and you will get a sense of how he thinks as well as what a character he is:

Looking at the chart below, you can see that while CSX has been a good stock over the last 10 years, it was lagging the industry group until the Hunter news last week. If he can fix the CSX operating margins and lower them from 70% into the 50% range, their earnings could be looking at a 50%+ increase. Throw in a stronger U.S.A. and lower corporate income taxes and the step up in earnings can move toward +75%. Of course, he still needs to be successful in getting the top job. But he must have a good idea that he can pull this off by walking away from nearly $100m in wealth at Canadian Pacific. And if you were a Board Member at CSX and the Michael Jordan of Railroads entered the room and asked if he could play for your team, would you say no? I think not either.

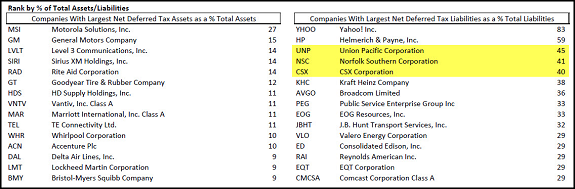

Another reason to look at CSX…

Not only are U.S. railroads well positioned domestically for President Trump’s ‘America First’ program, but they also win if Congress changes the tax schedules. Railroad companies will significantly benefit from falling corporate tax rates as their large asset depreciation has created a sizable future tax liability which will now be paid off at a much lower rate.

(The Leuthold Group)

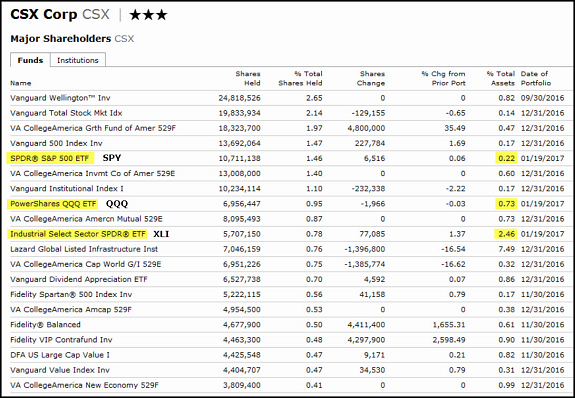

One of the more interesting items about CSX is that it has 3x the weight in the Nasdaq100 than it does in the S&P 500…

So if your Fund or portfolio is benchmarked against the NDX, you may want to consider moving CSX to the top of your research list.

Finally, if you have a good ear and like music, you must give TIDAL a try…

I am a music geek but my college roommate who is a musician and big audiophile convinced me to give Tidal a try. Using just average headphones and comparing side by side, I was blown away by the quality of the music. There were parts of the Interstellar and Inception soundtracks that I had never heard before across the Pandora, Spotify, or Amazon services. I was instantly sold. You can even throw it across your Sonos hardware for easy access. Give it a trial run.

Copyright © 361 Capital