by LPL Research

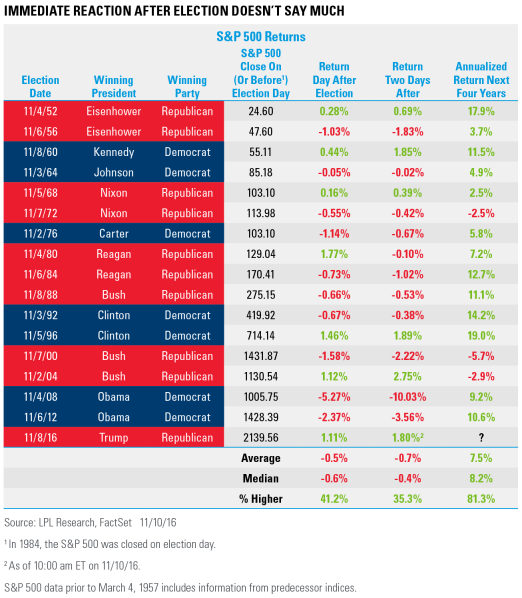

The election is finally over and to the surprise of many, equity prices rallied after the Trump victory. It was widely believed a Trump victory would bring with it increased uncertainty and a likely equity selloff. That wasn’t the case, as the S&P 500 gained a surprising 1.1% on the day after the election. The big question now is: could this early strength tell us anything about future returns?

Historically, the immediate reaction after the election has been to sell off. For instance, both of President Obama’s victories saw drops (with 2008 dropping 10% the next two days), but by the time the next election rolled around four years later, there were very solid returns for both of Obama’s terms. According to Ryan Detrick, Senior Market Strategist, “Although early market strength after the election is rare and caught many off guard this year, there is virtually no sign that it means much longer term, positive or negative. For longer-term returns, you need to remember to continue to focus on valuations and fundamentals.”

To borrow a quote the great value investor, Benjamin Graham, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”