by Richard Turnill, Blackrock Chief Global Strategist, Blackrock

Global corporate bond spreads have shrunk this year and are expected to tighten further, should the European Central Bank (ECB) extend its asset purchases. Richard explains what this could mean to investors.

We see global corporate bond spreads tightening further, driven by our expectations for European Central Bank (ECB) asset purchases.

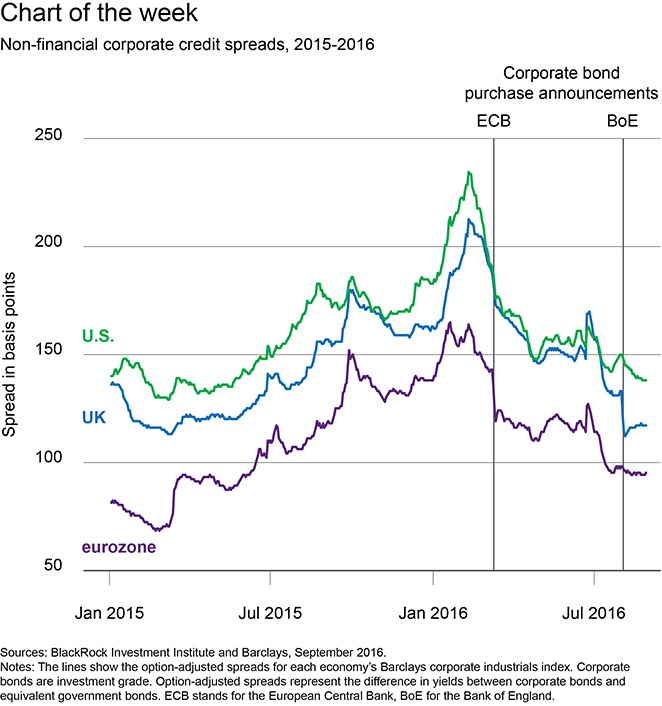

The ECB and Bank of England (BoE) both started buying non-financial corporate bonds this year, driving down corporate credit spreads globally. This is evident in the chart below.

Spreads are the difference in yields between corporate bonds and government counterparts. Eurozone, U.S. and U.K. non-financial corporate credit spreads have shrunk this year. We expect they will compress further, as the ECB extends its asset purchases.

Stubbornly low eurozone inflation expectations—just 1.3% annually over the next five years implied by bond markets—should push the ECB to extend its stimulus beyond March 2017.

The ECB’s only way forward: keep easing

Further ECB monetary easing measures could come as early as this week. We see an extension of the March end point for the ECB’s quantitative easing (QE) program as more likely than an increase in the size of monthly purchases or pushing interest rates even lower from its current -0.40% deposit rate.

A longer QE program would require the ECB to relax its self-imposed asset purchasing rules to ensure it has enough eligible bonds to buy. A rule change could increase the percentage of any single bond the ECB can buy, broaden the composition of sovereign bonds bought, expand the universe of eligible corporate bonds or even expand the program to include stock purchases—a radical move we see as unlikely at this stage.

Any QE-program change would likely result in price changes for asset classes affected by the rule relaxations. Bottom line: Ongoing strong central bank demand should support European and global bond prices, though selectivity is key. We see opportunities in eurozone peripheral government bonds. We also like selected European corporate bonds, such as those of technology and pharmaceutical firms. We are overweight U.S. credit with a preference for investment grade bonds. Read more market insights in my latest Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Copyright © Blackrock