SIA Weekly: A Look at USDCAD and 30-yr Bond Yields

For this week’s Equity Leaders Weekly, we are going to take a look at the USDCAD relationship and the CBOE 30 Yr Interest Rate, as we want to continue to monitor the key movements in both those charts. These relationships affect many investments, especially long-term Fixed Income strategies that will need to be closely monitored.

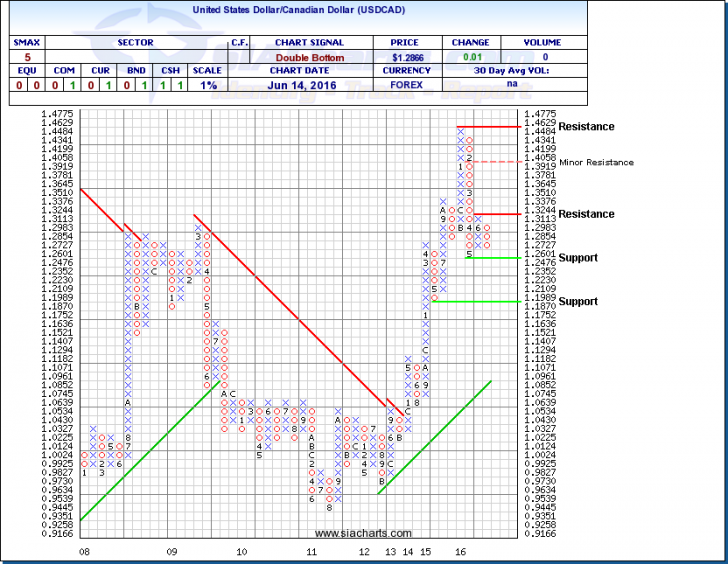

U.S. Dollar/ CAD Dollar (USDCAD)

The U.S. Dollar has been under pressure since the Federal Reserves change in policy this past January. Since then, the U.S. Dollar has weakened to the 1.2601 level and after a short bounce is poised to test that level again in the near term. The weaker U.S. Dollar policy was predicated on weakness in American multinational companies' earnings, weak employment in the domestic energy sector, and large trade partners, such as Canada, that depend on stronger crude prices. The unknown is how far the Fed is determined to weaken the dollar and whether they have seen enough at this time.

Looking to the technicals on the USDCAD, we see that the 1.2601 level is under attack again on the chart with a close below 1.2476 suggesting room to the 1.1989 range. To the upside resistance is found at the recent top of 1.3113 with a close above 1.3244 needed to regain the USD strength over the CAD Dollar.

Looking forward it would seem counterproductive for the Fed to weaken the Dollar too much as this would create an environment of de-investment in U.S. stocks and bonds. The recent weakness appears to have had little effect on foreign investment into the U.S. markets but there would be a tipping point if the USD continued to decline. Probably not a great election year event for the Fed to stickhandle. That being said, Yellen and crew have done an unprecedented intervention and only they know how far they want to take it. The chart above gives us a smaller range to watch to determine their true intentions. We will watch the nearby support and resistance levels for an understanding of the goals they are looking for.

Click on Image to Enlarge

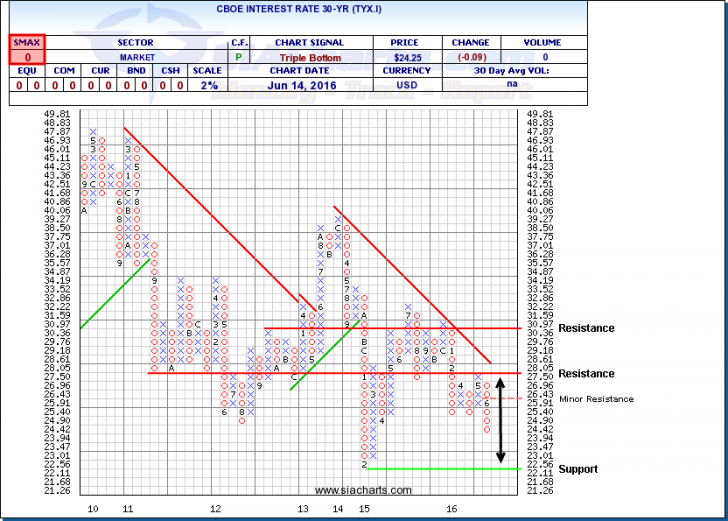

CBOE Interest Rate 30-yr (TYX.I)

We last looked at Treasury yields about a month ago where TYX.I was approaching a support level around 2.5%. The CBOE 30-Year Interest Rate has continued its weakness and has now moved down below this past support level to around 2.425%. If this weakness continues, look for the lows from February of 2015 at 2.211% to possibly provide support. As there is little prior history at these low levels, only seen in the beginning of 2015, the trading range has widened to include a possible reversal to the first resistance level at 2.805% that could come into play like it did as a high in May of this year. Further resistance above this can be found at 3.097%.

To nobody’s surprise, the Federal Reserve chose to leave the Fed Funds rate at 0.25-0.5% yesterday as is, who has provided little insight into possible future rate hikes and left most investors to anticipate a 'cautious' approach moving forward. Low long-term interest rates continue to help many long-term bonds that are at or near their all-time highs in many cases. For those looking for help building an ETF or Mutual Fund Fixed Income strategy, please feel free to reach out to SIA Support at siateam@siacharts.com to see how to construct your optimal Fixed Income strategy that has shown long-term bonds to be Favored through Relative Strength analysis.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our customer support at 1-877-668-1332 or at siateam@siacharts.com.