by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday

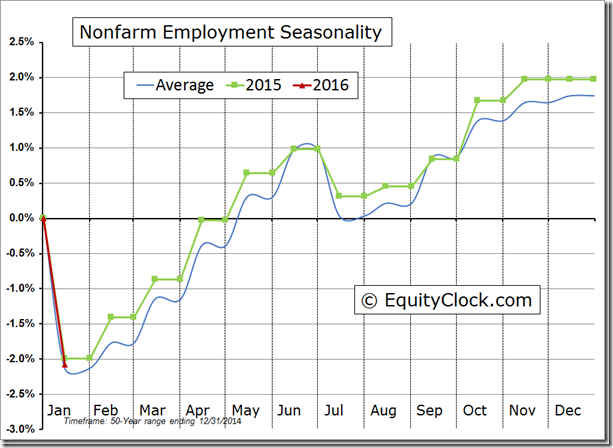

Analysts may have to adjust expectation for employment in 2016 to reflect average growth.

Technical action by S&P 500 stocks to 10:00: Bearish. 31 stocks broke support. None broke resistance.

Editor’s Note: U.S. equity indices bottomed just after 2:00 PM with the Dow Jones Industrial Average down more than 400 points. By then, another 34 S&P 500 companies broke support and two stocks (Exxon Mobil and Cincinnati Financial) broke resistance.

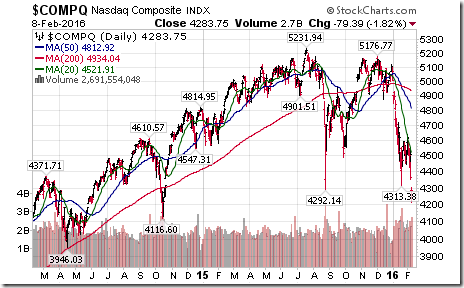

NASDAQ Composite Index resumed a downtrend on a break below 4,292.14 to a 16 month low.

Part of the reason for weakness in European equities is a drop by the Greek ETF $GREK to an all-time low.

Editor’s Note: A breakdown by the DAX Index below support at 9315 was another reason for weakness in European equities.

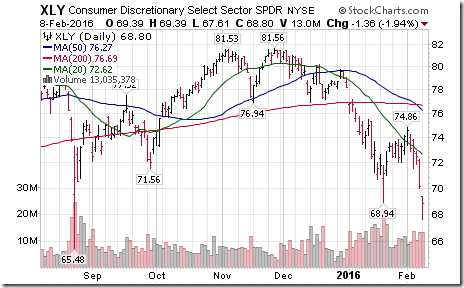

Notable sector weakness came from a break below support by $XLY below $68.94 to resume a downtrend.

Consumer Discretionary stocks breaking support included $MHK, $FOXA, $GTHD, $IPG, $LEN. $MCD, $NKE, $WYN

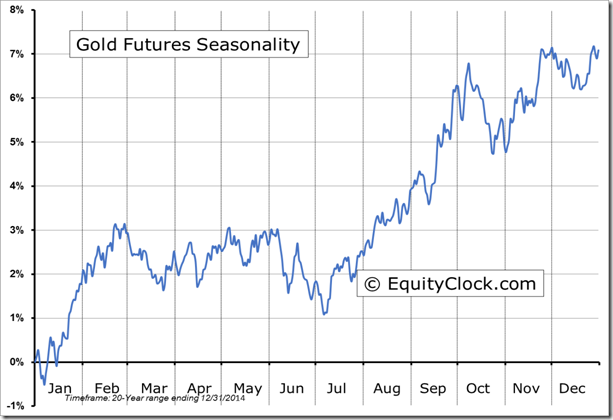

Precious metal stocks continue to break above intermediate resistance $AG, $G.CA

Editor’s Note: Add IAMGold to the list!

Nice breakout by $GLD above $113.99 to reach a 9 month high!

‘Tis the season for strength in Gold prices until the end of February!

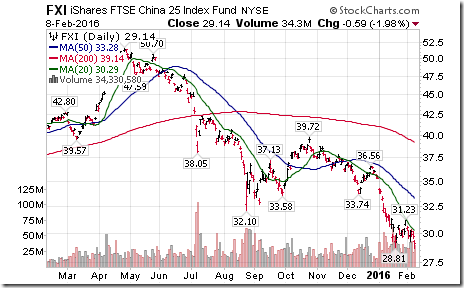

Chinese equity markets are closed for New Years, but their ETFs listed in the U.S. continue to move lower.

Trader’s Corner

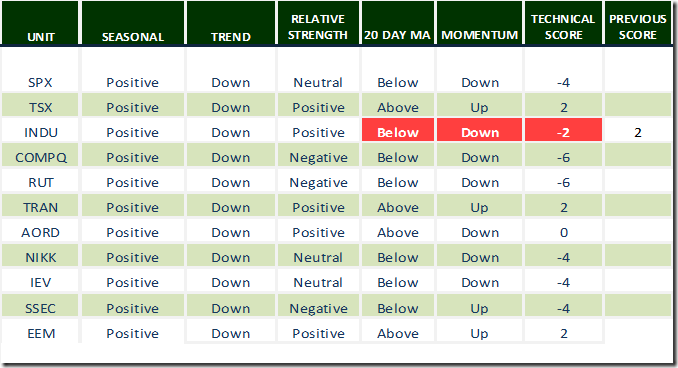

Daily Seasonal/Technical Equity Trends for February 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

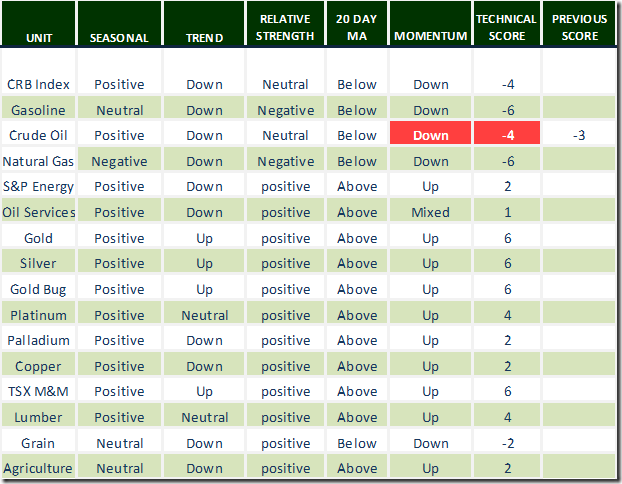

Daily Seasonal/Technical Commodities Trends for February 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

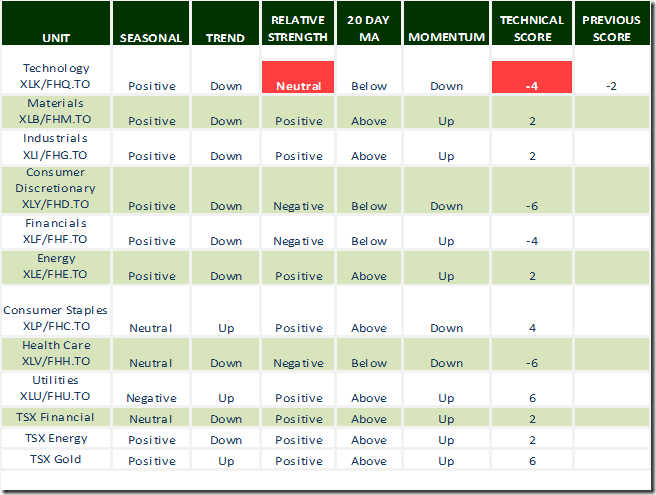

Daily Seasonal/Technical Sector Trends for February 8th 2016

Green: Increase from previous day

Red Decrease from previous day

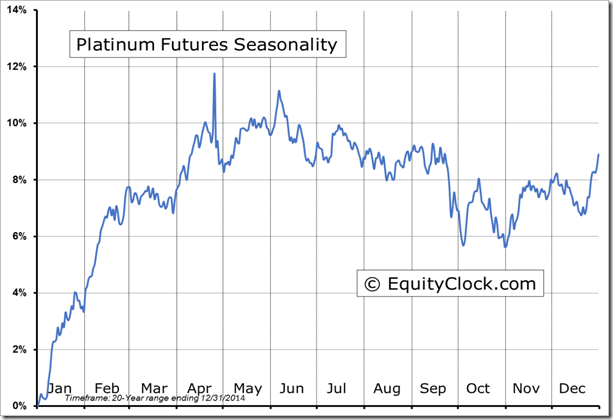

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

The Gold Ring

By Adrienne Toghraie, Trader’s Success Coach

It is important to learn from the wisdom of others who have made a success of trading. That being said, I also believe that those who dare to look for opportunity beyond what has been recommended and taught can receive the gold ring.

When I first came into the business of being a success coach for traders, there were only two other people in the field and both were men. I was told that a man would not want to work with a woman. They were right in the beginning, until I dared to go beyond that belief and prove them wrong.

You must stretch and risk and go against the norm for grabbing the gold ring.

Traders who go for the gold

Several of the traders whom I have worked with first started with a foundation of what was tried and true in the markets and then searched to find their own opportunity.

Black box

One of my clients has a mechanical system that he developed and only monitors and tweaks. Talk about a cash cow. He enjoys his life with his family all over the world taking his computer with him to monitor that the system is doing what it is supposed to. Of course, there was that one time where he lost over three hundred thousand in one trade, but in the overall picture of making over five million in a year, a small adjustment fixed it.

Abnormalities in markets

A client in Canada is cashing in on an abnormality that he found in the markets. This was after he was not sure that trading was for him. When he found that he was only able to bring in thirty percent with the technical analysis that he was taught, he knew that if he was going to stick with trading he had to find a better way.

Intuitive/discretionary trading

While I cannot help my traders with the technical side of trading, the intuitive side is my forte. This is where most of my clients, who are looking to grab the gold ring, will find that unusual opportunity. But of course, this type of trading is not for those who have not been successful as technical traders. That foundation and the handling of psychological issues is a must before you go into this realm of trading.

Improving on an idea

Now, this is an area that all who have learned a strategy can reach for and grab the gold ring. Again, I warn you this is not for the brand new trader. This is for the trader who has learned to be proficient at a particular strategy and improves on that strategy through time. This is where consistency in following pre-determined rules must be adhered to and monitored by journaling what happens with every trade that you take. If you are not consistent, you need to work with a coach on handling your self-imposed limitations on following your rules.

Conclusion

Being normal is safe, comfortable and the best place for most people to stay. But if you are one of the few who will dare to go beyond the norm, then you might be the one to also be a leader, shaker and the one who gets the gold.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Interesting Charts

Interesting breakout by the Japanese Yen above a base building pattern!

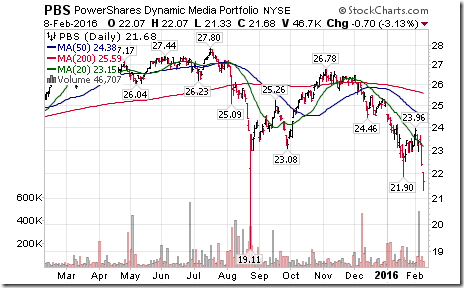

Great Super Bowl ads failed to convince investors that advertising revenues for the media sector is about to recover.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca