Connecting the Dots - January 5, 2016

by Erik Swarts, Market Anthropology

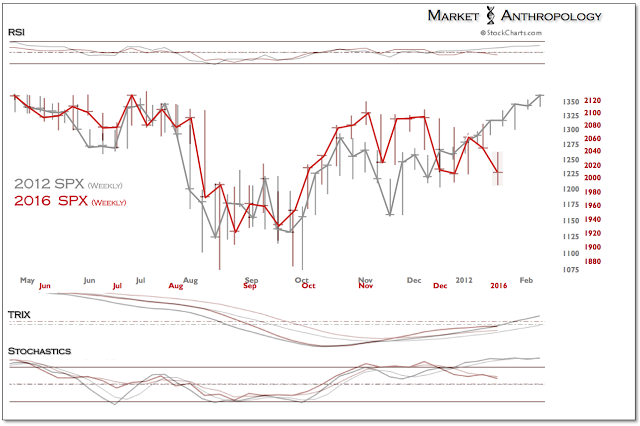

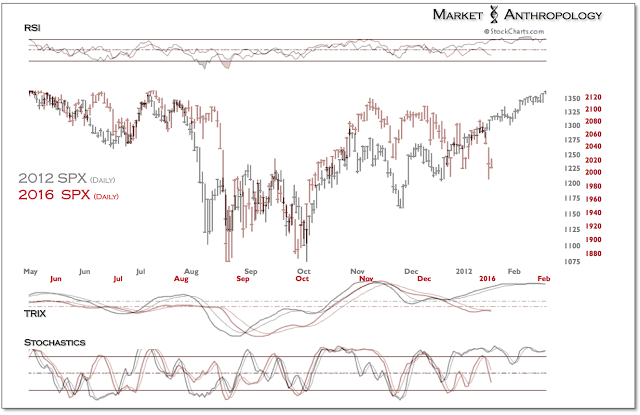

As trading commenced for the new year, Santa's fine offerings were shamelessly returned, as if to imply that cash was the preferred fairing - or at least sorely sought. With renewed collective resolution to panic at the whiff of uncertainties in China and a freshly opened wound in the Middle East, the S&P 500 opened down approximately 45 points Monday, eventually completing a full retracement intraday of the Santa rally that began in mid December.

As trading commenced for the new year, Santa's fine offerings were shamelessly returned, as if to imply that cash was the preferred fairing - or at least sorely sought. With renewed collective resolution to panic at the whiff of uncertainties in China and a freshly opened wound in the Middle East, the S&P 500 opened down approximately 45 points Monday, eventually completing a full retracement intraday of the Santa rally that began in mid December.

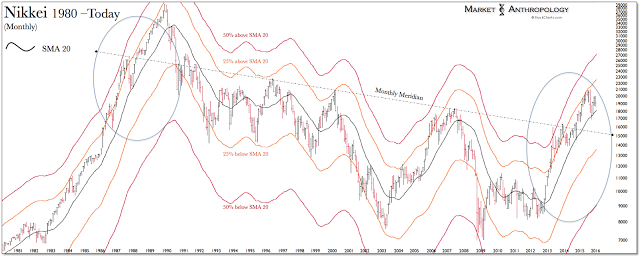

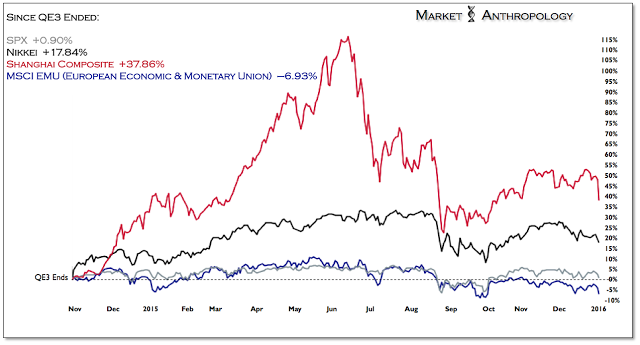

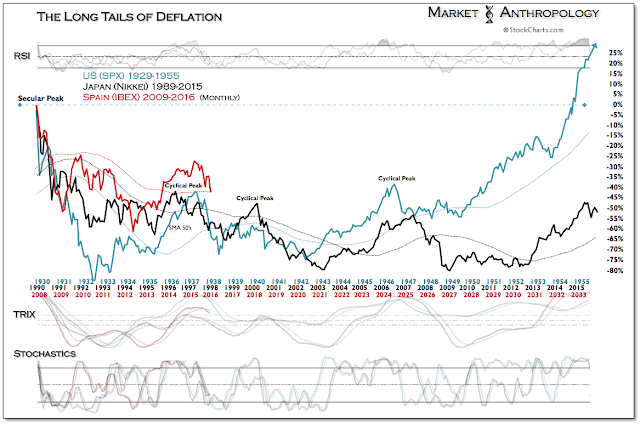

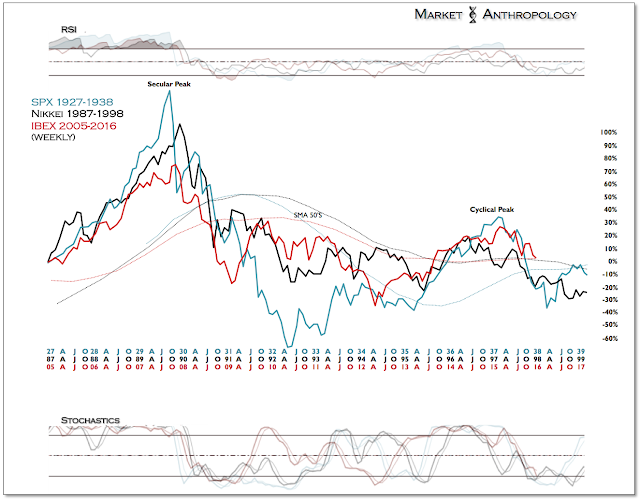

Stepping back, while we certainly take heed from the obvious concussion to world markets this week, we don't believe an all or nothing outcome awaits participants this year. Conversely, we expect a broadening dispersion of performance in equities worldwide, building on last year's underperformance by US stocks; spearheaded by the Nikkei's outperformance and the surprising truth that - gasp - the Shanghai Composite bested them all.

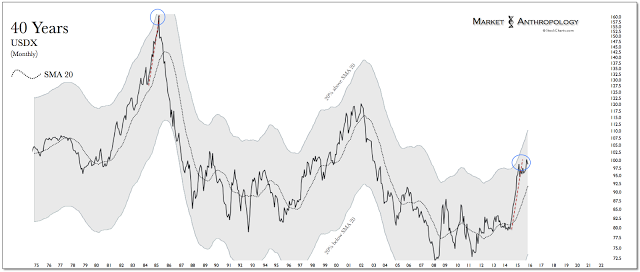

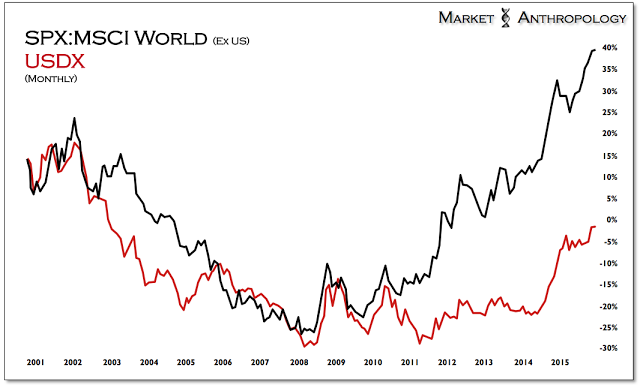

To a much greater extent, it's the nuance that shapes the bigger picture these days, which is an ongoing challenge for investors to read or foresee in the policy doldrums where a cockpit instrument panel is more than occasionally forsaken for a glance out an opaque window. That said, we maintain our convictions that the US dollar is poised to decline from the relative performance extreme it revisited again at the end of last year, which we'd speculate would only help widen the breadth of relative outperformance to US equities by global markets that have yet to turn the proverbial corner. Namely, in emerging markets that took the brunt from the collapse in the commodity markets and the strength of the US dollar over the past four to five years.

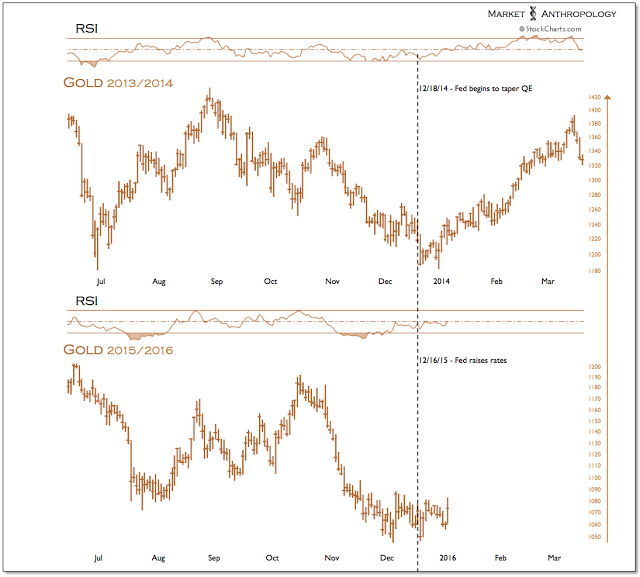

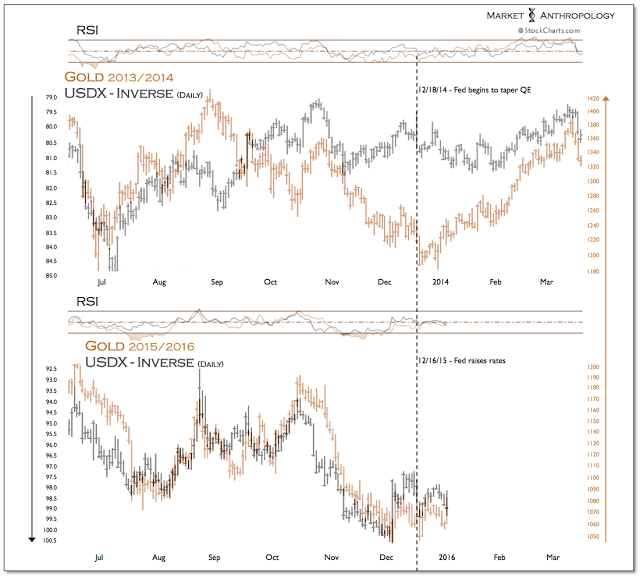

Taking its cue from the Fed last month and guiding our outlook for hard commodities, precious metals have another window to work higher over the first quarter. Similar to the early stages of normalizing QE, gold set a low the day after the Fed's initial taper in December 2013. Although precious metals and commodities did eventually succumb to another disinflationary front encouraged by the respective blowoff legs in the currency markets that began in the second quarter of 2014, the currency backdrop these days frames a much different picture.

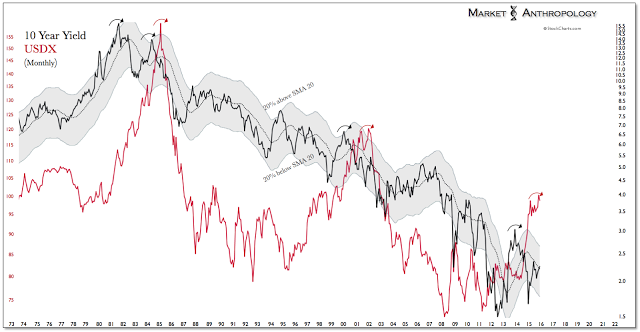

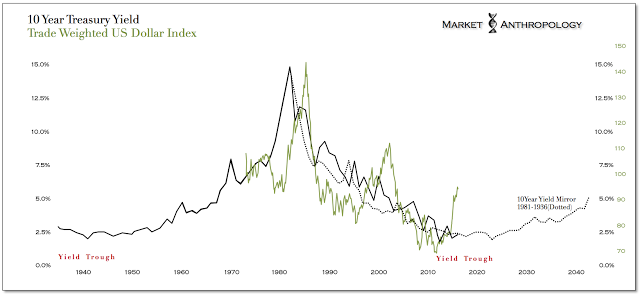

The dollar index, which gold has increasingly tracked over the past year is once again stretched and listing with popularity as the trade du jour for 2016. With net speculative positions back near all-time highs, conditions are once again ripe for disappointment. In previous notes we've compared the current set-up in the dollar as analogous with the consensus expectation of rising yields going into 2014, which was propelled by a strong sell the rumor (i.e. taper tantrum) and eventual buy the news reaction (inverse dynamic in Treasuries) that played out during the Fed's first phase of normalizing policy through posture than gradual practice. With the exceedingly modest pace and reach of potential rate hikes by the Fed over the foreseeable future, we speculate the strength in the dollar built and buttressed over the past 18 months will bleed lower in 2016.

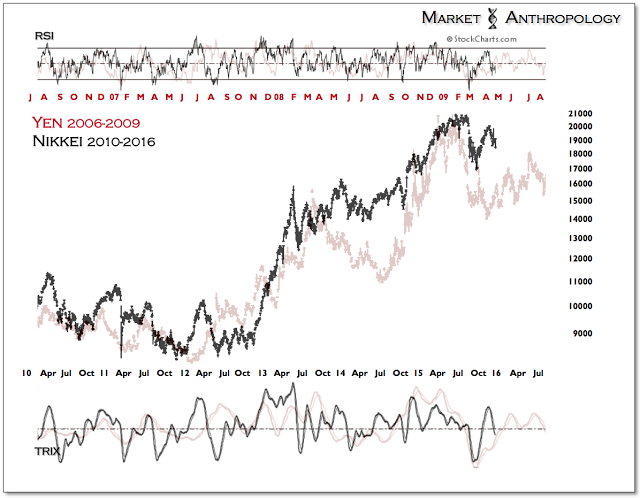

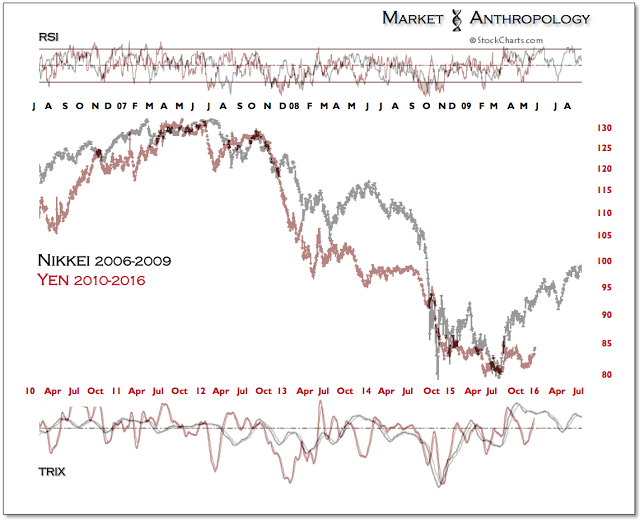

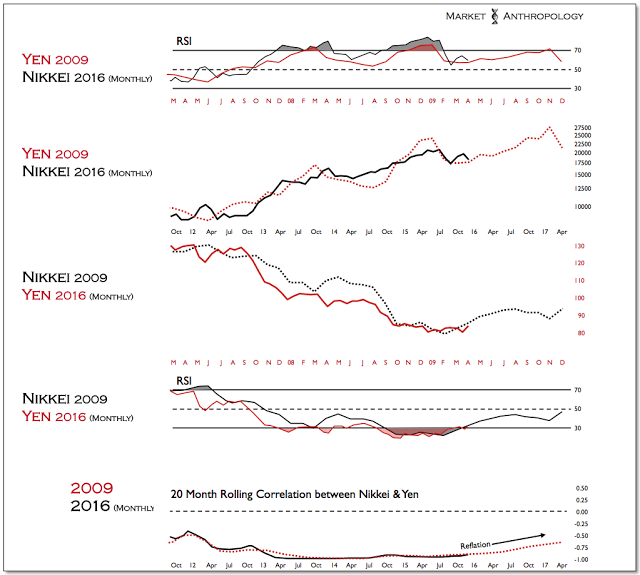

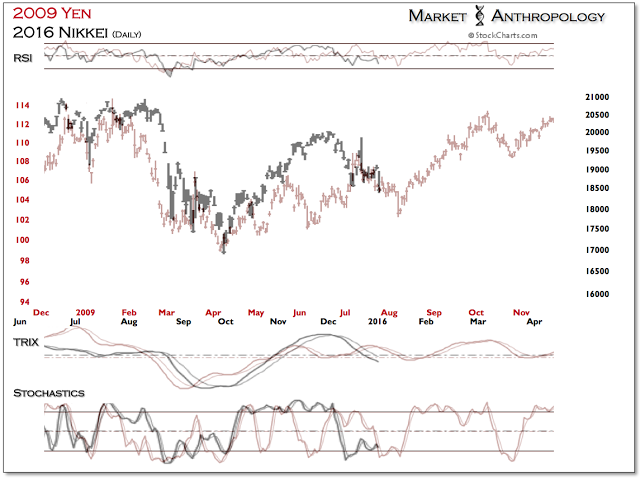

The yen, which we have appreciated as an increasingly asymmetric hedge to equity positions - specifically in Japan, is beginning to move out of the broad base it carved over the past year. As described in previous notes, the yen and Nikkei are working away from the negative correlation extreme that has been in place over the past three years since Abenomics was first floated in the fall of 2012. We are looking for the correlation extreme between the Nikkei and yen to continue to thaw, in a manner similar to the reversal in Q2 2009. The difference of course being, that the trends today between these assets are inverse to that time. Mimicking the dynamics in 2009, they should continue to mirror performance moves, while also gradually trending higher.

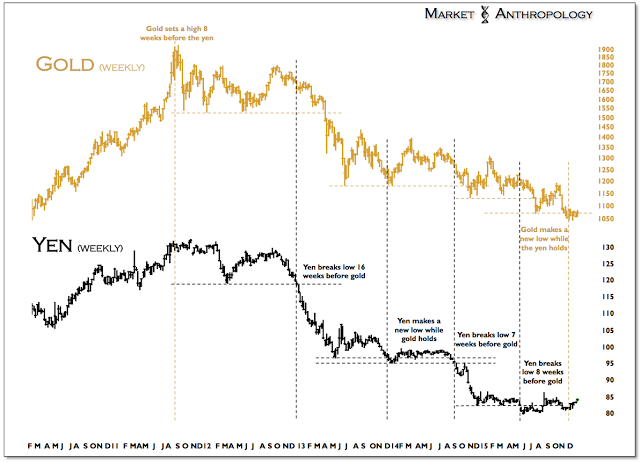

Both gold and the yen have trended closely together since the equity markets peaked in October 2007 and the financial crisis unfolded over the next two years. While gold set its closing high eight weeks before the yen in 2011, it has followed the downside breaks in the yen over the past 4 years with varying lags of several weeks - the most recent breakdown in the yen last May occurring 8 weeks before gold.

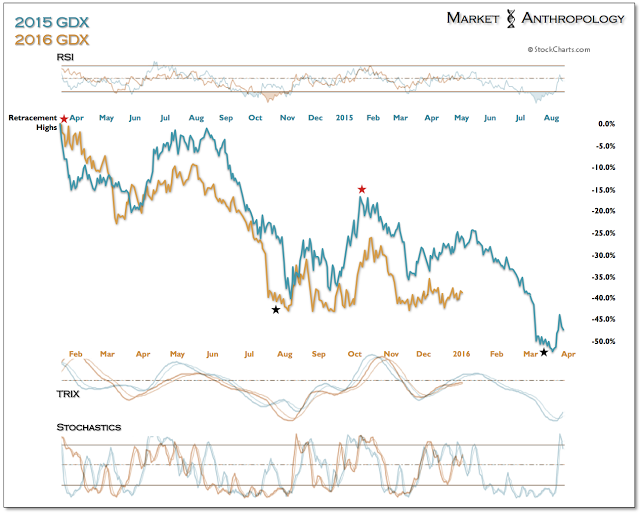

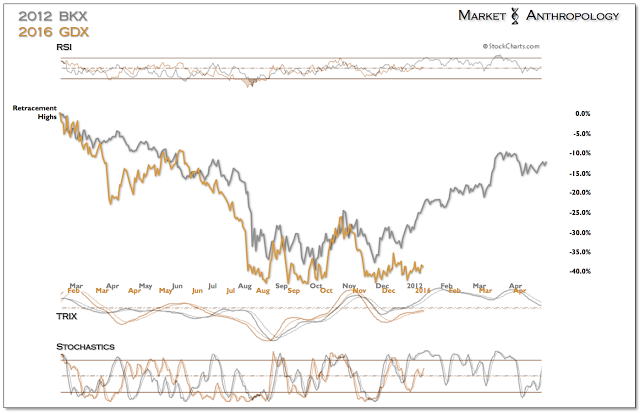

Mirroring the leading downside move in the fall of 2012, the yen has recently begun to break out of the base it had built over the past year. As such, we will be looking for gold to follow suit, which dovetails to our suspicions that the miners have a window to break the replicating downside pattern they have been stuck in over the past several years.