Looking At Copper’s Bear Market

by Tiho Brkan, The Short Side of Long

Peaking February 2011, Copper prices have been declining for years

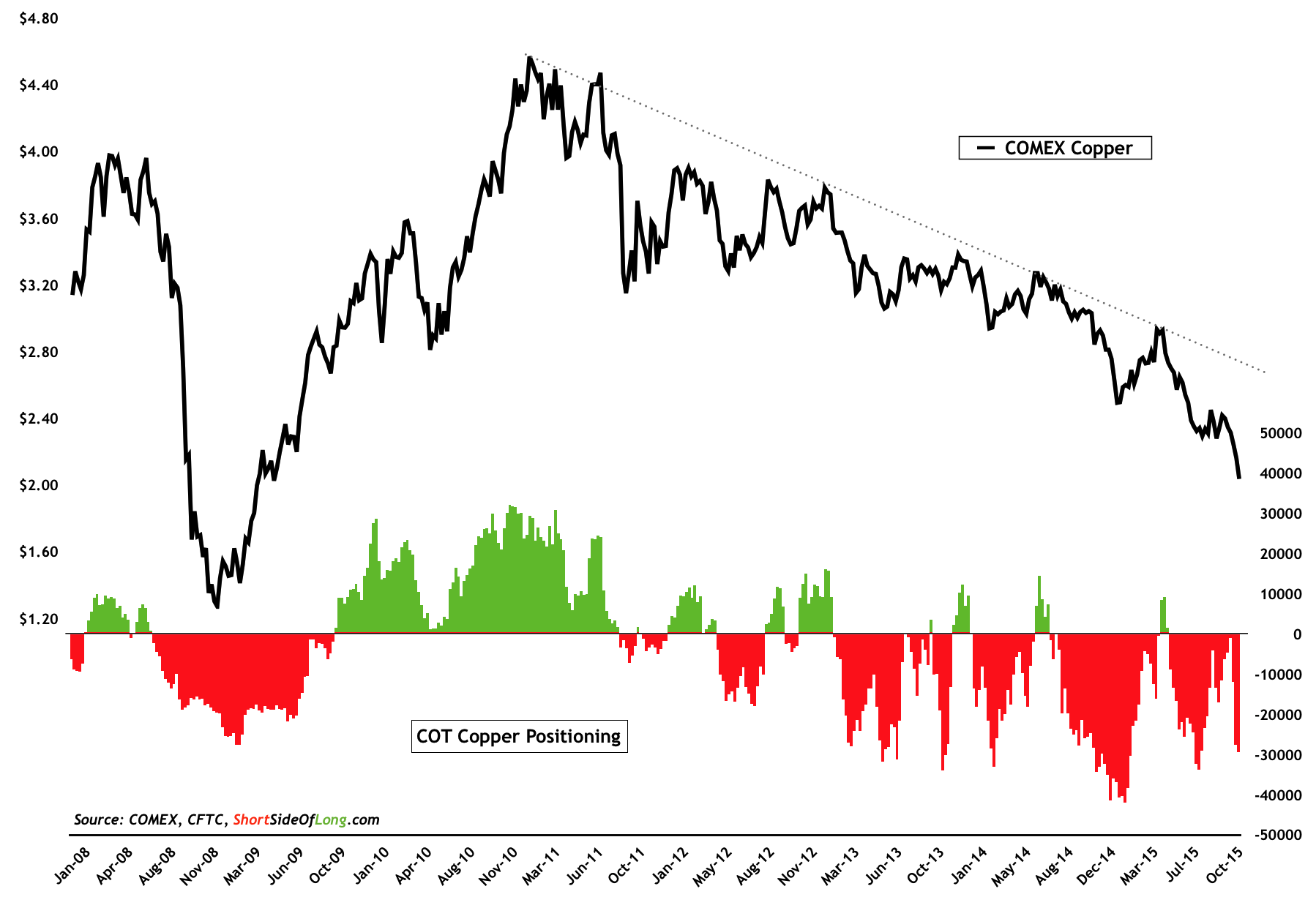

Copper prices are making six year lows and the bears are back. Peaking all the way back in February 2011, at a very high prices of $4.65 per pound, high grade Copper prices have now been declining half a decade without a strong rebound. According to the recent Commitment of Traders report published on Friday, hedge funds and other speculators are once again pressing short bets against the metal. They have been doing this quite consistently since early 2013. Furthermore, according to SentimenTrader, optimism index has declined below 20% for the first time in almost 15 years. One has to be reminded that its perfectly normal and very common for sentiment to be bearish during a downtrend, however it is at major selling climaxes that sentiment becomes overwhelmingly one-sided and the pendulum swings reversing the trend.

Will Copper be able to establish support on an important trend line?

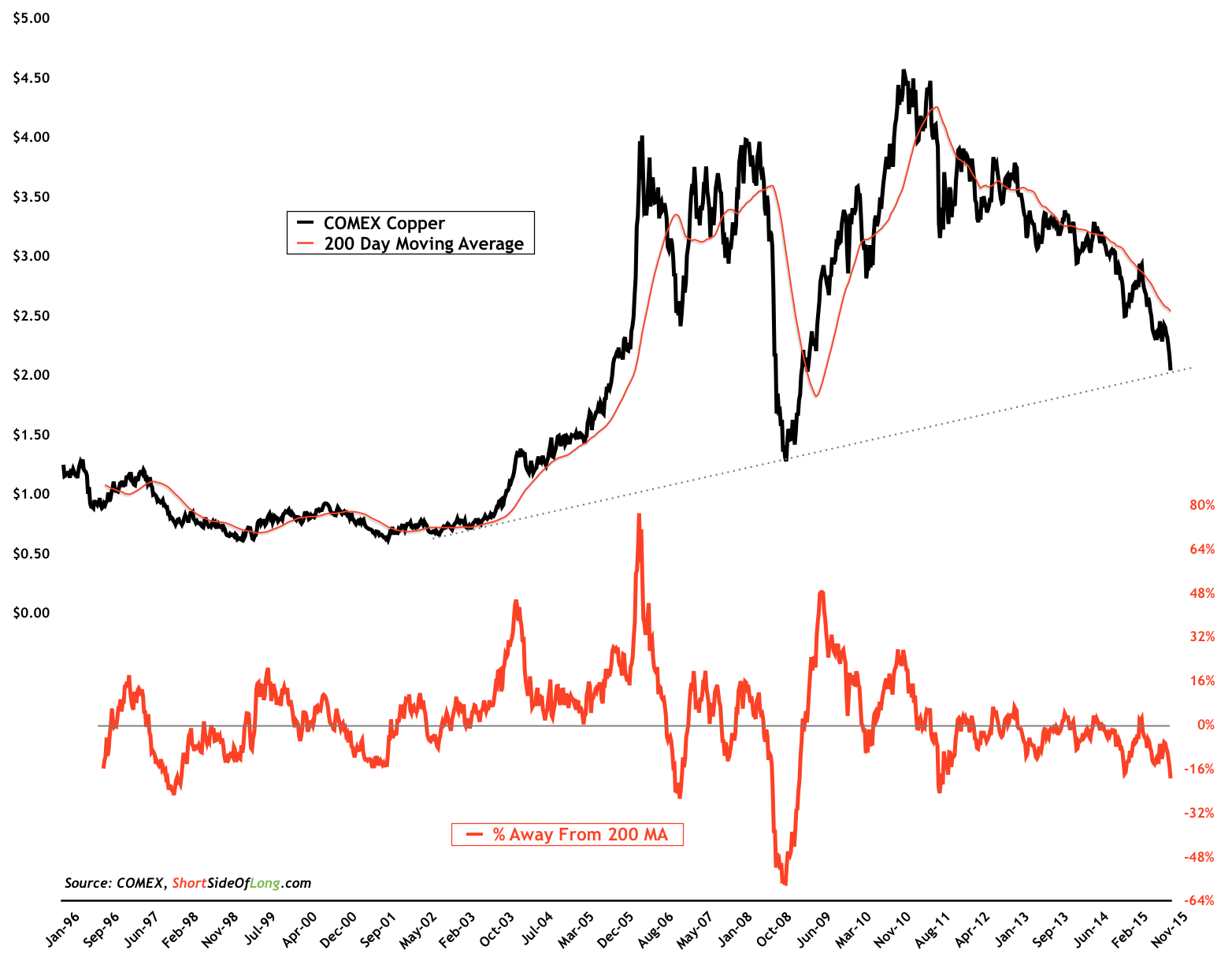

So are we witnessing a selling climax in the price of high grade Copper? It is difficult to say. Bulls could argue that the downtrend is now accelerating rather rapidly, which means investors are panicking and liquidating the metal together with the baby and the bathwater (as already confirmed by the sentiment discussed above). Moreover, bulls could also argue that the price has fallen on to an important decade long trend line, which could prove to be a strong support (see the chart above). On the other hand, bears would argue that overcapacity in the overall industrial metals space is set to continue. Add to that mix Fed’s intention to rise interest rates, which should strengthen the US Dollar in longer run, and its hard to see Copper, or for that matter, any metal rising on a sustainable basis.

Contrarians & smart money are betting on companies such as Freeport

Source: Financial Times (edited by Short Side of Long)

Source: Financial Times (edited by Short Side of Long)

Contrarians and smart money investors such as Carl Ichan, have taken bullish bets on companies such as Freeport McMoRan (NYSE: FCX) with a view on future Copper price rebounding and a total overhaul of companies capex, salary structure & cutting of high cost production. Freeport shares are approaching a major historical floor (buying zone) which should be a great entry point for the next bull market rally. Moreover, recent rise in trading volume, which hold similarities to the panic of 2008, indicates that retail investors (dumb money) are liquidating shares, while smart money (Mr Ichan) is accumulating at bargain prices. Personally, I am still sitting on the sidelines and watching, but I do have Freeport McMoRan shares in my watchlist.

Copyright © The Short Side of Long