by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

Q1/15 Update

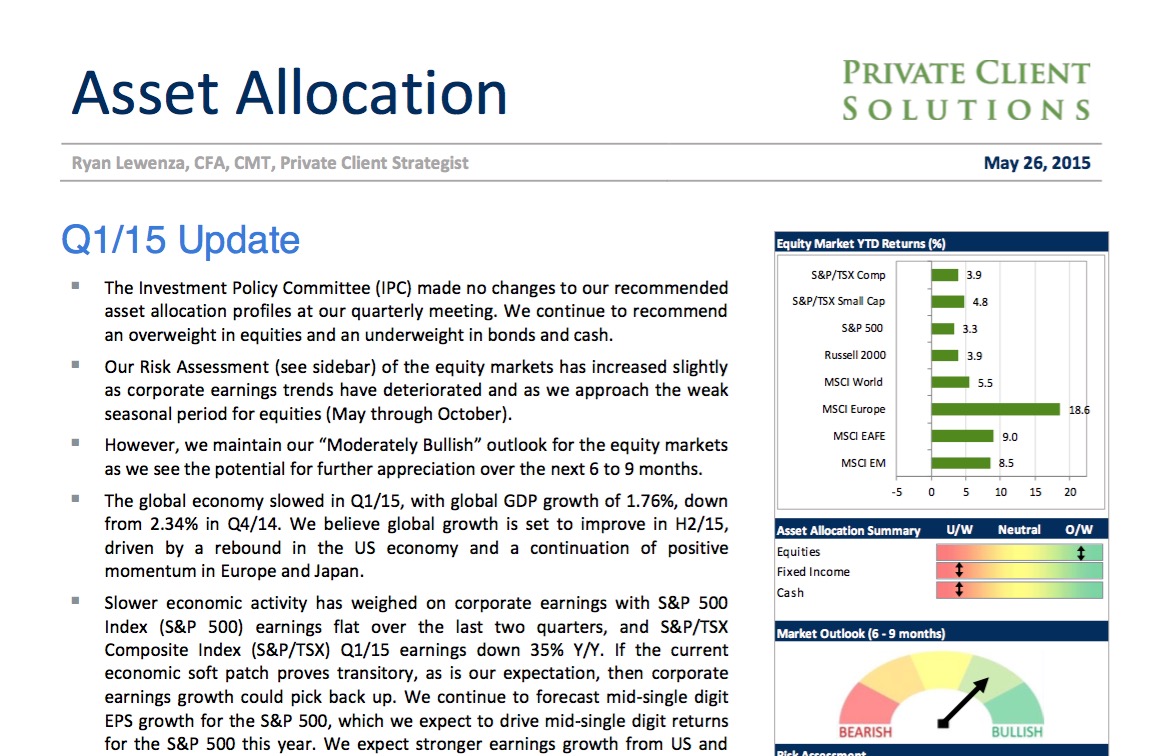

• The Investment Policy Committee (IPC) made no changes to our recommended asset allocation profiles at our quarterly meeting. We continue to recommend an overweight in equities and an underweight in bonds and cash.

• Our Risk Assessment (see sidebar) of the equity markets has increased slightly as corporate earnings trends have deteriorated and as we approach the weak seasonal period for equities (May through October).

• However, we maintain our “Moderately Bullish” outlook for the equity markets as we see the potential for further appreciation over the next 6 to 9 months.

• The global economy slowed in Q1/15, with global GDP growth of 1.76%, down from 2.34% in Q4/14. We believe global growth is set to improve in H2/15, driven by a rebound in the US economy and a continuation of positive momentum in Europe and Japan.

• Slower economic activity has weighed on corporate earnings with S&P 500 Index (S&P 500) earnings flat over the last two quarters, and S&P/TSX Composite Index (S&P/TSX) Q1/15 earnings down 35% Y/Y. If the current economic soft patch proves transitory, as is our expectation, then corporate earnings growth could pick back up. We continue to forecast mid-single digit EPS growth for the S&P 500, which we expect to drive mid-single digit returns for the S&P 500 this year. We expect stronger earnings growth from US and European stocks relative to Canada, which is one factor in our call to overweight these regions.

• Recently, global bond yields have surged higher with Germany and US 10-year government bond yields up 53 and 35 bps, respectively since mid-April. We have been calling for higher bond yields this year based on our expectations for stronger global growth and the US Federal Reserve (Fed) hiking rates sometime this year. Our call for higher bond yields is one important factor behind our recommendation to underweight bonds in portfolios.

• From a technical perspective the outlook for equities remains constructive. The S&P 500 and S&P/TSX continue to trade in long-term uptrends and above their 40-week moving averages (MA). Market breadth is broadly supportive with the NYSE Advance/Decline line making new highs, confirming the news highs for US equities.

• In summary, the macro conditions of “not too hot, not too cold” are very supportive for equities in that low inflation will allow global central banks to maintain accommodative policies, while improving economic growth should result in stronger corporate earnings and in turn, higher stock prices.

Read/Download the complete report below, or here:

Copyright © Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James