by Cullen Roche, Pragmatic Capitalism

Jason Zweig has a great piece in the WSJ highlighting the decline in costs over the years and how the winners have been retail investors. But I want to look into this idea more closely because yes, while it’s true that retail investors have benefited from the low cost environment, it also looks as though their behavior is becoming worse.

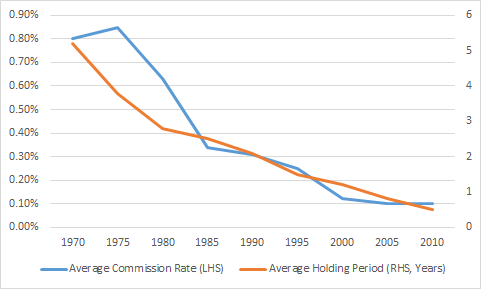

If we look at a chart of historical commission rates vs the average holding period on stocks we see a direct correlation. This makes sense since turnover becomes less expensive per transaction.

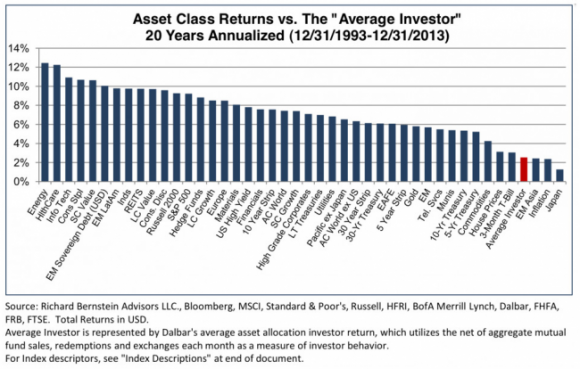

But I wonder if investors aren’t paying for these cost cuts in other ways. For instance, a recent study by Richard Bernstein showed that the average investor generated a measly 2.1% return over the period from 1993-2013:

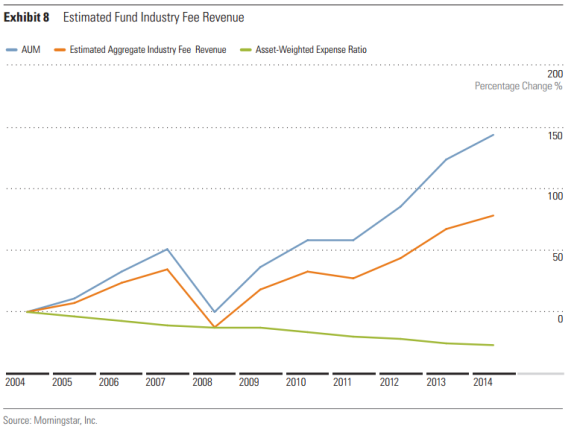

The reality is that, while fees have come way down the aggregate fee revenue to the financial services industry has increased quite substantially:

This is largely due to the fact that assets have been shifted from stock based commission accounts into fund based flat fee AND commission accounts. But the decline in commissions has actually increased activity. In fact, the decline in ETF costs has also coincided with increased activity. After all, the most actively traded shares on any given day are ETFs. So, the rise of low costs hasn’t necessarily helped the retail investor. In fact, one could argue that it has hurt quite substantially. And the reason for that is simple – retail investors tend to be incredibly undisciplined. Retail investors tend to trade too much, suffer from all the classical behavioral biases, incur high fees, short-term capital gains, etc. So yes, the investment world has become more democratized, but it hasn’t necessarily helped improve the performance of the retail investor.

Copyright © Cullen Roche, Pragmatic Capitalism