For this weeks edition of the SIA Equity Leaders Weekly, we are going to look at an important resistance level for the USDCAD and also look at the volatility in the long-term 30-year interest rate (TYX.I). Will the USD/CAD relationship continue to be in favor of the US after its historical move upwards in the last 6 months? Will long-term interest rates rechallenge all-time lows?

United States Dollar/Canadian Dollar (USDCAD)

Can the US Dollar go even higher and challenge highs from 2008 and 2009? It is approaching this important resistance level at $1.30-$1.31 after an uninterrupted column of X's move upwards since September of 2014 where it is up ~17%-18% so far. How significant of a move is this without a pull-back? It has only had one other move this large at the end of 2008 in the past 20 years. That is why these current resistance levels may provide strong levels of resistance for this currency relationship possibly leading to its first reversal in half a year at a 1% scale.

However, the USDCAD is still showing a strong near-term strength score of 10 out of 10 and hasn't shown any sign of a significant reversal or change yet. So even though there is strong resistance above for USDCAD and a small pull-back may be likely based on its historical upwards move, it could still trade range bound sideways between the first support level at $1.223 and resistance level of $1.2983 until a level is broken or the relative strength relationship changes.

Click on Image to Enlarge

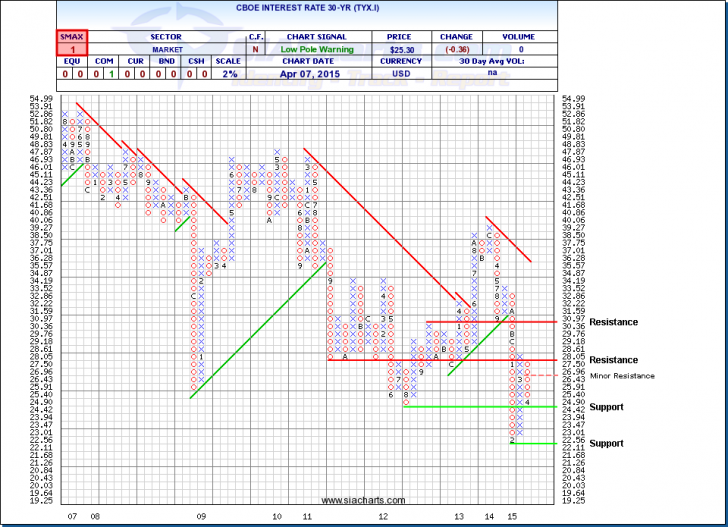

CBOE 30-Year Interest Rate (TYX.I)

Since we last looked at this chart back in January, the downward movement continued to a new all-time low at the support level now found at 2.211%. This was then followed by over a 10% move upwards on the speculation of interest rate hikes in the summer. This volatility has continued for the CBOE 30-Year Interest Rate as it has now moved back into a column of O's and down to the support level at 2.442%, which is the exact same place we were on January 13th when we last wrote about this position.

So has this volatility changed the outlook for TYX.I? The SMAX score is at 1 out of 10, showing short-term weakness across all asset classes. It now has a new low that it could trade down to again at 2.211% if this near-term weakness continues into long-term weakness. With interest rates falling again, long-term bonds are also looking to challenge their all-time highs from February. Although many speculated that interest rates would have to go up soon, the last Fed policy delay continues to frustrate speculators and hedgers. With U.S. employers in March adding the fewest workers since Dec. 2013, market data could continue to be "weak" enough to keep interest rates low for longer than most people thought and why a chart like the TYX.I is so important to monitor because it takes away the speculation and gives you an unbiased view of what the actual supply/demand relationship is for long-term interest rates.

Any questions or to learn more about these relationships, other Currencies, Fixed Income trends, or for other information, please call or email us at 1-877-668-1332 or siateam@siacharts.com

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.