Asset Allocation – Q4/14 Update

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

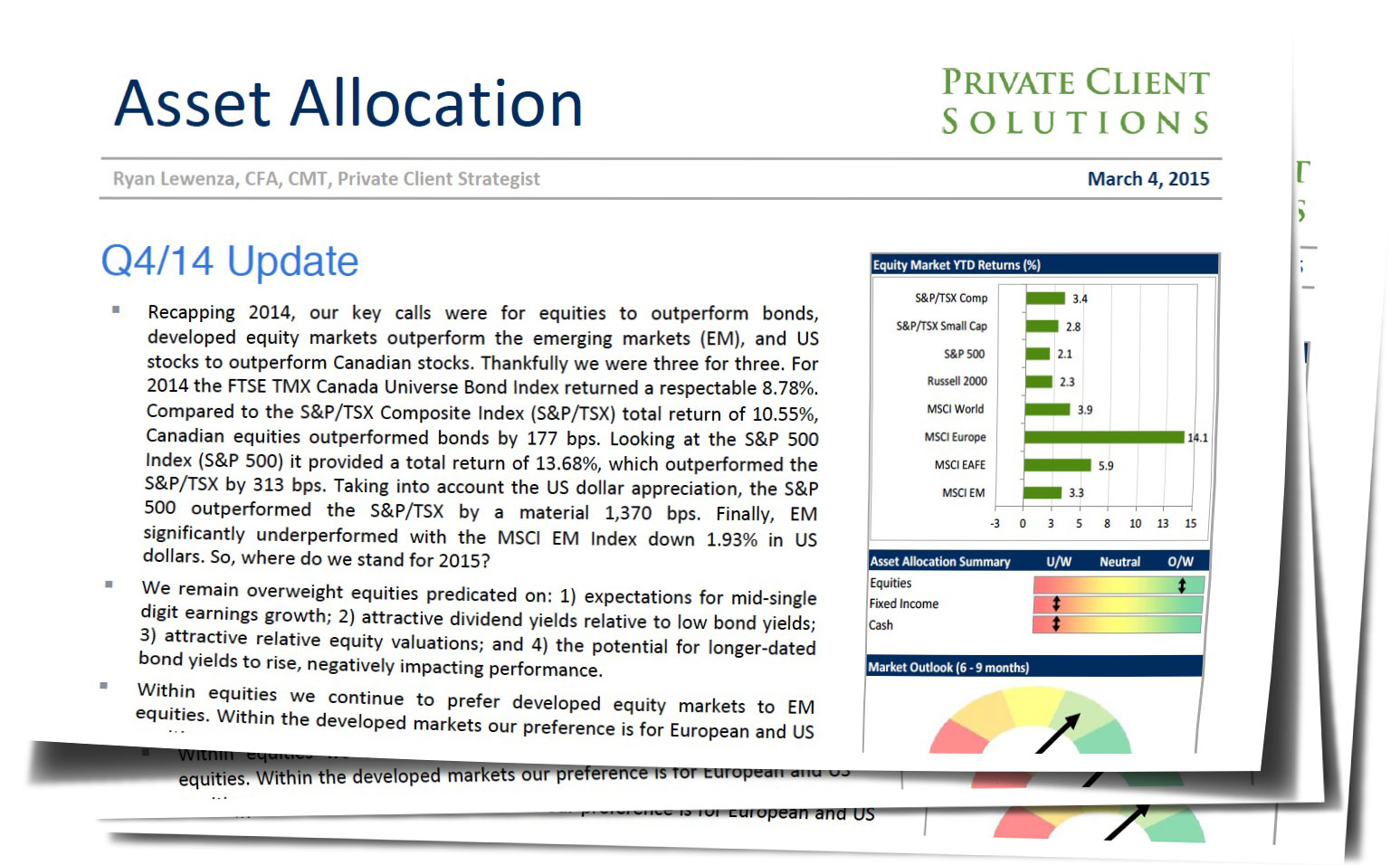

• Recapping 2014, our key calls were for equities to outperform bonds, developed equity markets outperform the emerging markets (EM), and US stocks to outperform Canadian stocks. Thankfully we were three for three. For 2014 the FTSE TMX Canada Universe Bond Index returned a respectable 8.78%. Compared to the S&P/TSX Composite Index (S&P/TSX) total return of 10.55%, Canadian equities outperformed bonds by 177 bps. Looking at the S&P 500 Index (S&P 500) it provided a total return of 13.68%, which outperformed the S&P/TSX by 313 bps. Taking into account the US dollar appreciation, the S&P 500 outperformed the S&P/TSX by a material 1,370 bps. Finally, EM significantly underperformed with the MSCI EM Index down 1.93% in US dollars. So, where do we stand for 2015?

• We remain overweight equities predicated on: 1) expectations for mid-single digit earnings growth; 2) attractive dividend yields relative to low bond yields; 3) attractive relative equity valuations; and 4) the potential for longer-dated bond yields to rise, negatively impacting performance.

• Within equities we continue to prefer developed equity markets to EM equities. Within the developed markets our preference is for European and US equities.

• Given this outlook we are making the following tactical changes to our equity split in our Investor Profiles:

o Moderate: Reduce Canadian equity weight by 5% (to 10%), while increasing US equity weight to 20% (from 15%).

o Growth: Reduce Canadian equity weight by 5% (to 15%) and US weight by 5% (to 35%), while increasing International by 10% (to 20%).

o Global Equity: Reduce US weight by 5% (to 40%) and increase International equity weight by 5% (to 25%).

• As a result of the very low yields in government bonds, their duration has increased significantly, making them very susceptible to a rise in rates. Looking at the Government of Canada (GoC) 10-year bond, if rates back up by just 1%, the price of the bond will decline by roughly $9 or 8%. We see the potential for the GoC 10-year yield to rise to 2% by end of year, which if realized, could result in a decline of roughly 5% through 2015. As such, we recommend an underweight in government bonds, seeing better value in other areas.

• Within fixed income we continue to recommend investors look to high-quality corporate bonds given the yield pick-up, strong balance sheets, and low current default rates.

Read/Download Ryan Lewenza's complete report below: