Gold Market Radar (June 23, 2014)

For the week, spot gold closed at $1,314.85, up $37.96 per ounce, or 2.97 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 7.12 percent. The Trade Weighted U.S. Dollar Index fell 0.25 percent for the week.

Strengths

- Gold rose almost 3 percent this week after Fed Chairwoman Janet Yellen stated interest rates will remain low for an extended period of time, disregarding rising inflation as noise. Surveys show investors expected the Fed to hint it would raise interest rates faster than previously anticipated. As a result, the U.S. dollar weakened to its lowest level this month, and speculators, who had pushed the number of short contracts to a five-fold rise since March, were left scrambling to unwind their trades.

- Earlier in the week, gold naysayers were calling for the gold price to consolidate around the $1,280 range despite the escalating conflict in the Middle East that sent oil prices above $105 per barrel. Even in light of intensifying unrest in numerous places around the world, Fidelity’s head of asset allocation called for investors to sell gold and buy stocks at today’s “attractive valuations.” That strategy may work in a riskless world, but according to Mineweb contributor Lawrence Williams, the numerous conflict flashpoints around the world make this the best time to hold gold.

- The Shanghai free-trade zone international gold trading will be a reality by year-end, according to city government officials. More details leaked out this week to give investors a better idea of the impressive capabilities of the proposed exchange. Testing for interest rate liberalization and currency usage is currently ongoing, as the exchange seeks to allow foreign investors to trade in the market using offshore Chinese yuan accounts. Jiang Shu, senior analyst at Industrial Bank in Shanghai, stated the recent advances show the Chinese authorities are serious about yuan and gold trading reform.

Weaknesses

- A new report by SNL Metals & Mining, coming in at a modest 538 pages, concludes that the cost of building a mine has increased significantly over the last decade, from $560 per ounce of production capacity in 2004 to more than $2,300 last year. To make matters worse, SNL analysts argue that curtailment in capital spending since 2013 will take at least until 2015 to reverse the rising trend, as current forecasts show costs will rise to $2,400 per ounce this year.

- China National Gold, the only central enterprise in the Chinese gold industry, announced it is no longer in talks with Ivanhoe Mines on its African assets after talks began last year. Similarly, in Mali, gold production is set to fall 12 percent in the next three years as mine closures outpace new production, thus curbing revenue from the country’s main export. Randgold Resources recently announced its Morila mine is in the process of being closed, while IAMGOLD suspended operations at its Yatela mine last year.

- There was major disappointment among miners looking to mine the ocean floors as New Zealand rejected Trans Tasman Resources application for an undersea project. The country’s decision was being closely watched by other countries. The New Zealand EPA argued there were “uncertainties in the scope and significance of the potential adverse environmental effects” as reasons for rejecting the project.

Opportunities

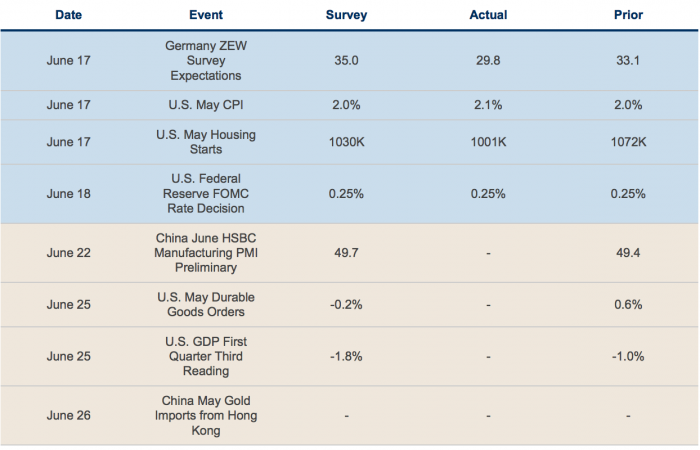

- Headline inflation rose robustly in May for the third consecutive month, bringing the annual change above 2 percent for only the second time since the end of the recession. U.S. Personal Consumption Expenditures, the most widely monitored inflation measure by Fed officials, leaped to 1.4 percent. National Bank research argued dismissal wouldn’t be easy this time around, but that’s exactly what Janet Yellen did in her press conference. On the same note, Canaccord raised gold to overweight following the CPI readings and the belief that the Fed is “cornered.” It concludes by saying investors should buy inflation-protection hedges.

- Bank of America recommends investors buy gold into the third quarter as the seasonality trade kicks in with Ramadan and Indian buying. Historically, the July-August period sees a demand boost from religious festivities, which Bank of America believes could push gold past $1,400 this year. In a related note, Mining Recruitment Group’s outlook suggests mining executives have turned bullish this year as a poll shows the percentage of bearish executives dropped from 64 percent to 14 percent from a year ago.

- First Quantum announced it entered into a definitive agreement to acquire Lumina Copper for approximately $470 million. Lumina is the owner of the Taca Taca copper deposit located in Salta Province in northwest Argentina. Lumina founder Ross Beaty highlighted the sale as a win for Argentina, whose economic team is set to stabilize the nation’s currency, negotiate debt settlements with holdouts and instill confidence in foreign investors. The transaction is inevitably bullish for other copper developers in the region and the mining sector in Argentina as a whole.

Threats

- South Africa’s platinum mining industry’s main labor union has tabled fresh new demands beyond the preliminary agreement struck with producers last week. The demands add more delay-pressure to an already long-running strike. Facts show that South Africa’s mining output has been declining in a linear pattern for the last 20 years. At this pace, argues Mineweb contributor Michael Schroeder, the last skip of gold bearing ore from the once giant Witwatersrand deposit will be hoisted in 2019, costing the country some 130,000 jobs.

- The five-year-long positive correlation between gold and oil came apart recently as the prospects of a global economic recovery boosted energy consumption and lowered gold’s appeal. The relationship tightened over the past two weeks as the Iraqi conflict took over headlines. Analysts continue to expect oil to trade higher on fears of a Middle Eastern supply disruption, which would mean lower gold prices if the negative correlation holds.

- A group of more than 40 Congressmen asked the U.S. Fish and Wildlife Service to delay the implementation of new rules and procedures that would be overly prohibitive for economic activity. The proposed changes to procedures could increase in millions of acres the areas designated as critical habitats, regardless of whether the protected species occupy these areas or not. These proposals have resulted from hundreds of closed-door settlements with litigious environmental groups.