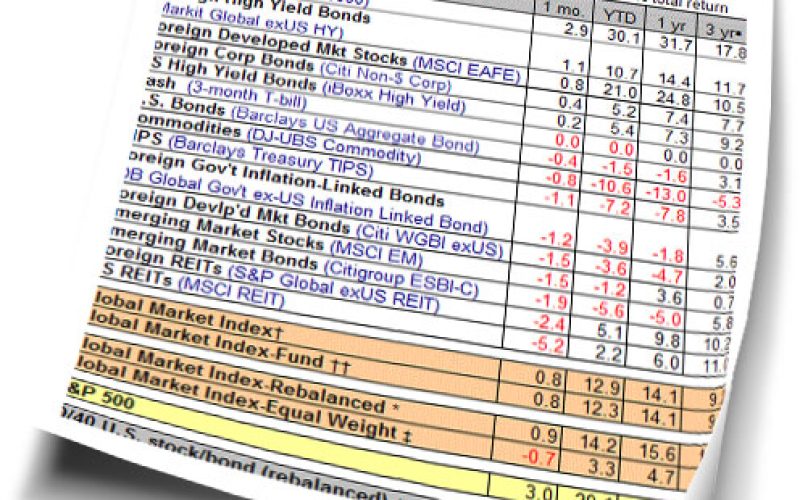

Red ink is splattered across November’s performance profile, presenting a contrast with the easy money gains in September and October. The leading exception: the US stock market, which advanced 2.9% in November on a total return basis. Meanwhile, last month's big loser among the major asset classes: US REITs, which shed a hefty 5.2% for the month just passed.

The negative skew for November’s returns overall kept last month’s advance for the Global Market Index (GMI) to a tepid 0.8%. The numbers still look encouraging on a year-to-date basis, however. Indeed, GMI is higher through the first 11 months of 2013 by a strong 12.9%, thanks in no small part to soaring stock markets in the developed world. The MSCI EAFE’s total return so far this year is an impressive 21% while the Russell 3000 in the US is ahead by more than 30%. If you exclude those two pieces of the global asset pie, the performance numbers for global multi-asset class strategies are considerably weaker. That’s a reminder that performance results for 2013 have been highly dependent on choices about weighting equities in the US and EAFE countries (i.e., Europe and Japan). In other words, if you underweighted one or both of those regions relative to Mr. Market’s asset allocation, your return results are probably on the light side so far this year vs. GMI.

Genius is a bull market, as the saying goes. For 2013, we might add that brilliant investing is also about two seemingly innocuous decisions about asset allocation.

Copyright © Capital Spectator