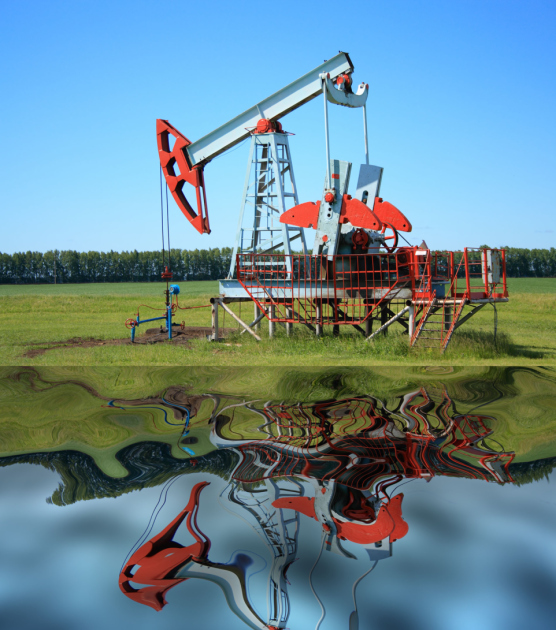

With oil prices down roughly 25% from their 2012 peak, many investors are asking about the future direction of crude.

With oil prices down roughly 25% from their 2012 peak, many investors are asking about the future direction of crude.

In my opinion, while fears of a hard landing in China and overall weakness in global growth are likely to keep prices down in the near term, crude should rebound in the longer term for three reasons:

1.) Marginal supply is increasingly coming from unconventional sources, such as the tar sands in Canada, where production costs are higher.

2.) Many of the largest oil producing countries – notably Saudi Arabia and Russia – now require a much higher price for crude in order to balance their budgets.

3.) OPEC currently has very little spare capacity. Today, OPEC space capacity is less than 4 million barrels a day, or about 11% of overall production, the lowest level since 2008. With spare capacity this tight, any supply disruptions are likely to push crude up sharply.

How should investors consider playing this? For most investors, it’s both unnecessary and unpractical to hold a direct position in crude oil. One more practical idea is to capture the potential benefits of higher oil prices through an overweight to energy stocks. Currently, US large cap energy companies are trading for roughly 1.5x book value, well below the market average and the sector’s historical values.

I particularly like global energy companies, which are even cheaper than US large cap energy companies and currently offer a healthy dividend yield. Investors can access these stocks through the iShares S&P Global Energy Sector Index Fund (NYSEARCA: IXC).

Russ Koesterich, CFA is the iShares Global Chief Investment Strategist and a regular contributor to the iShares Blog. You can find more of his posts here.

Source: Bloomberg

The author is long IXC.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Narrowly focused investments typically exhibit higher volatility. The energy sector is cyclical and highly dependent on commodities prices. Companies in this sector may face civil liability from accidents and a risk of loss from terrorism and natural disasters.