Ridiculous as our market volatility might seem to an intelligent Martian, it is our reality and everyone loves to trot out the “quote” attributed to Keynes (but never documented): “The market can stay irrational longer than the investor can stay solvent.” For us agents, he might better have said “The market can stay irrational longer than the client can stay patient.”

- Jeremy Grantham

Here without further comment is an opening excerpt from Grantham's latest letter. You can read/download the whole letter in the slidedeck below.

Jeremy Grantham - Letter to Investors Q1 2012

My Sister’s Pension Assets and Agency Problems

(The Tension between Protecting Your Job or Your Clients’ Money)

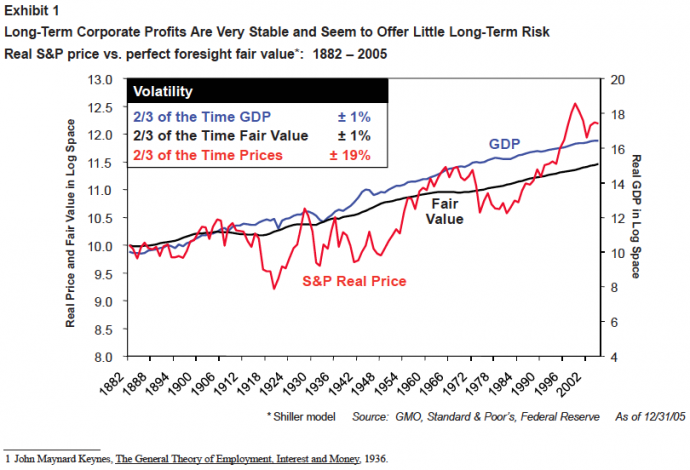

The central truth of the investment business is that investment behavior is driven by career risk. In the professional investment business we are all agents, managing other peoples’ money. The prime directive, as Keynes1 knew so well, is first and last to keep your job. To do this, he explained that you must never, ever be wrong on your own. To prevent this calamity, professional investors pay ruthless attention to what other investors in general are doing. The great majority “go with the flow,” either completely or partially. This creates herding, or momentum, which drives prices far above or far below fair price. There are many other inefficiencies in market pricing, but this is by far the largest. It explains the discrepancy between a remarkably volatile stock market and a remarkably stable GDP growth, together with an equally stable growth in “fair value” for the stock market. This difference is massive – two-thirds of the time annual GDP growth and annual change in the fair value of the market is within plus or minus a tiny 1% of its long-term trend as shown in Exhibit 1. The market’s actual price – brought to us by the workings of wild and wooly individuals – is within plus or minus 19% two-thirds of the time. Thus, the market moves 19 times more than is justified by the underlying engines!

This incredible demonstration of the behavioral dominating the rational and the “efficient” was first noticed by Robert Shiller over 20 years ago and was countered by some of the most tortured logic that the rational expectations crowd could offer, which is a very high hurdle indeed. Shiller’s “fair value” for this purpose used clairvoyance. He “knew” the future flight path of all future dividends, from each starting position of 1917, 1961, and all the way forward. The resulting theoretical value was always stable (it barely twitched even in the Great Depression), but this data was widely ignored as irrelevant. And ignoring it may be the correct response on the part of most market players, for ignoring the volatile up-and-down market moves and attempting to focus on the slower burning long-term reality is simply too dangerous in career terms. Missing a big move, however unjustified it may be by fundamentals, is to take a very high risk of being fired. Career risk and the resulting herding it creates are likely to always dominate investing. The short term will always be exaggerated, and the fact that a corporation’s future value stretches far into the future will be ignored. As GMO’s Ben Inker has written,2 two-thirds of all corporate value lies out beyond 20 years. Yet the market often trades as if all value lies within the next 5 years, and sometimes 5 months.

Ridiculous as our market volatility might seem to an intelligent Martian, it is our reality and everyone loves to trot out the “quote” attributed to Keynes (but never documented): “The market can stay irrational longer than the investor can stay solvent.” For us agents, he might better have said “The market can stay irrational longer than the client can stay patient.” Over the years, our estimate of “standard client patience time,” to coin a phrase, has been 3.0 years in normal conditions. Patience can be up to a year shorter than that in extreme cases where relationships and the timing of their start-ups have proven to be unfortunate. For example, 2.5 years of bad performance after 5 good ones is usually tolerable, but 2.5 bad years from start-up, even though your previous 5 good years are well-known but helped someone else, is absolutely not the same thing! With good luck on starting time, good personal relationships, and decent relative performance, a client’s patience can be a year longer than 3.0 years, or even 2 years longer in exceptional cases. I like to say that good client management is about earning your firm an incremental year of patience. The extra year is very important with any investment product, but in asset allocation, where mistakes are obvious, it is absolutely huge and usually enough.

What Keynes definitely did say in the famous chapter 12 of his General Theory is that “the long-term investor, he who most promotes the public interest … will in practice come in for the most criticism whenever investment funds are managed by committees or boards.” He, the long-term investor, will be perceived as “eccentric, unconventional and rash in the eyes of average opinion … and if in the short run he is unsuccessful, which is very likely, he will not receive much mercy.” (Emphasis added.) Reviewing our experiences of being early in several extreme outlying events makes Keynes’s actual quote look painfully accurate in that “mercy” sometimes was as limited as it was at a bad day at the Coliseum, with a sea of thumbs down. But his attribution, in contrast, has proven too severe: we appear to have survived.